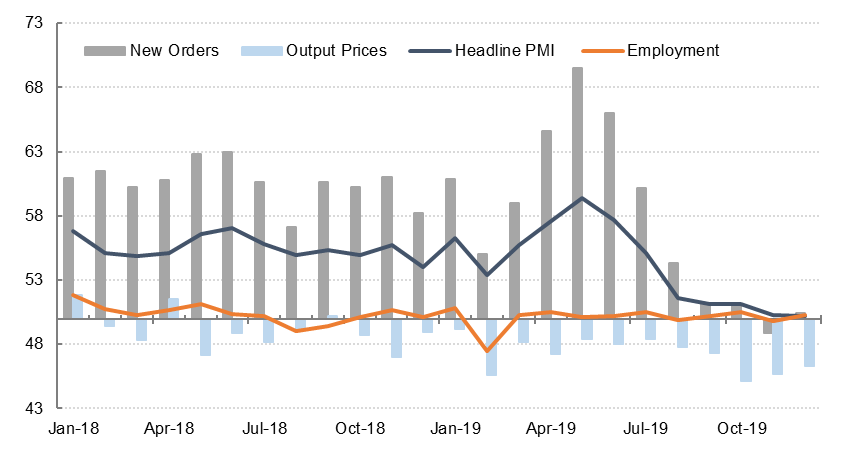

Saudi Arabia’s PMI declined to 56.9 in December from 58.3 in November, the lowest reading in five months. A marginal decline in new export orders contributed to slower growth in overall new orders, although the data suggests it is domestic demand that is driving output and new work in the kingdom. The employment index declined to 50.5 in December, indicating very little private sector job growth. Price pressures remain muted, with almost no change in overall input costs last month.

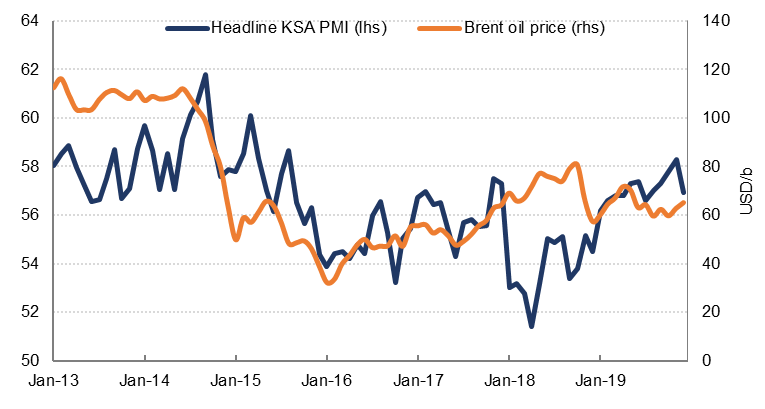

The average PMI reading for Saudi Arabia last year was 57.1, the highest reading since 2015. This is consistent with official GDP data which shows the non-oil sector expanding at the fastest rate in five years in Q3 2019. Expansionary fiscal policy which has been in place since 2017 has in our view been the main driver of accelerating growth over the last year, although structural reforms have likely been a key contributor as well.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

In the UAE, the headline index was fractionally lower in December at 50.2. Growth momentum appears to have slowed since August, with the Q4 average PMI reading at 50.5, the lowest Q3 2009. While new export orders recovered in December after declining in November, both output and new work readings remained below the series average.

For the year as a whole, the average PMI reading was 54.1, still in growth territory but indicating a slower rate of non-oil sector growth than in the last two years. The employment index averaged just 50.1 in 2019, the lowest reading in nearly decade, effectively signalling no job growth in the UAE’s private sector on average last year. Selling prices declined for the fifth consecutive year in 2019, and the extent of price discounting last year was the steepest on record, as firms competed for work. Firms remain very optimistic about the coming 12 months though, as Expo 2020 is expected to boost output across most sectors.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The Egyptian non-oil private continued to contract in December, albeit at a moderately slower pace as compared to the previous month. The index rose from 47.9 to 48.2, still short of the neutral 50.0 level which delineates expansion and contraction. This is the fifth consecutive sub-50.0 reading. While Egypt’s macroeconomic fundamentals have strengthened markedly over the three years since it began its economic reform programme, the private sector has been a notable laggard in this recovery, with growth driven primarily by public investment and external rebalancing.

While we still expect a recovery in the private sector, bolstered by a slowdown in reforms as objectives are completed (the private sector has arguably borne the brunt of these), slower inflation (at multi-year lows) and easing monetary policy, it is now long overdue, and the PMI gives no great indication of an imminent boost. Jobs were cut for the second month in a row in December, and both new orders and new export orders also declined on the previous month. The government is aware of the need to stimulate activity, and in December it announced an initiative which will see loans to smaller factories at lower rates in a bid to achieve this.