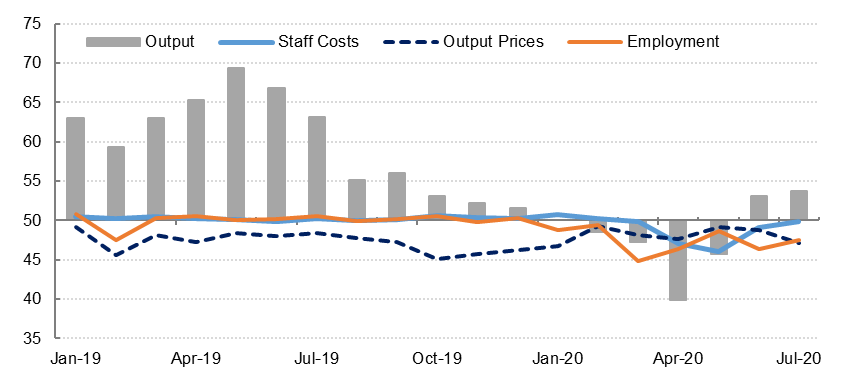

The UAE headline PMI rose further to 50.8 in July, the second consecutive month of improvement in business conditions in the non-oil private sector. However, the rate of recovery was marginal following relatively sharp contractions in March through May. Both output and new work increased in July, and the growth in new work appeared to be driven by recovering domestic demand as new export orders declined in July.

However, employment in the private sector declined again last month despite higher output as firms continued to prioritise cost reductions. Selling prices declined at the fastest rate since January – even as input costs rose slightly - as firms again competed for business. Supply chain conditions continued to improve as travel restrictions eased further. Firms remained optimistic on average about their future output, but the degree of optimism was slightly weaker than in June.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

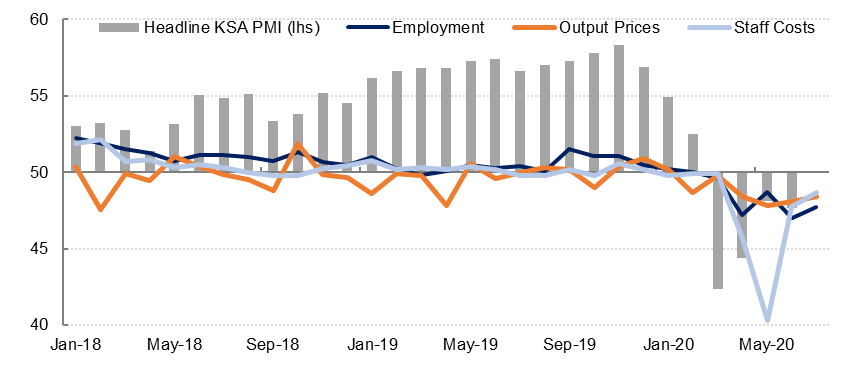

Saudi Arabia’s headline PMI rose to 50.0 in July from 47.7 in June, the highest reading since March, indicating a stabilization in the non-oil private sector after four months of contraction. Output and new work declined only slightly last month as restrictions on movement and business activity were further eased. However, private sector employment declined for the fifth month in a row as firms reduced headcount in an effort to lower costs. Staff costs also declined again in July, signaling further salary cuts in the private sector.

Stocks of inventories rose even as purchasing activity was largely unchanged, likely as output remained relatively soft. Supplier delivery times continued to lengthen in July, although delays appeared to be less frequent than in the prior three months as restrictions on movement eased. Saudi Arabia announced yesterday that it would ease restrictions on trucks carrying goods from other GCC states, which should help to improve supplier delivery times in the coming months.

Input costs were broadly stable in July but firms continued to lower output prices for the sixth month in a row. Business optimism recovered in July to the highest level since February, although it remains subdued relative to the series history.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

It is important to recognise that the PMIs are indicating changes in business conditions on a month-to-month basis. The survey data suggests that the UAE’s non-oil private sector has stabilized and is gradually recovering following the coronavirus-driven contraction in March through May, but output likely remains below pre-lockdown levels.

In Saudi Arabia output is still slightly in contraction territory, although even here the data suggests that the worst is over and activity should start to recover in the coming months. Even as activity continues to normalize, firms will likely continue to grapple with lower-than-normal revenues for some time, and cost containment is likely to remain a priority against this backdrop.