Our recently revised oil price forecast (see Oil outlook 2025: dimming) has implications for the GCC through a variety of channels, not least the budget balances of the bloc’s member states. We now forecast that Brent futures will average USD 73.0/b over 2025, down 8.8% from the expected USD 80.0/b average for 2024 as oil markets look set for another year of soft demand. We had previously forecast that prices in 2025 would remain at a similar level to this year. As a result, we have revisited our budget forecasts for the GCC to reflect this, with oil revenues revised downwards. For the time being, these new fiscal projections are assuming that oil production levels are unchanged from our earlier projections, although there is a strong possibility that production comes in higher than we currently envisage, especially considering press reports that OPEC+ members would seek to preserve market share rather than target prices. The magnitude of any increase in production would of course have a further bearing on the price outlook.

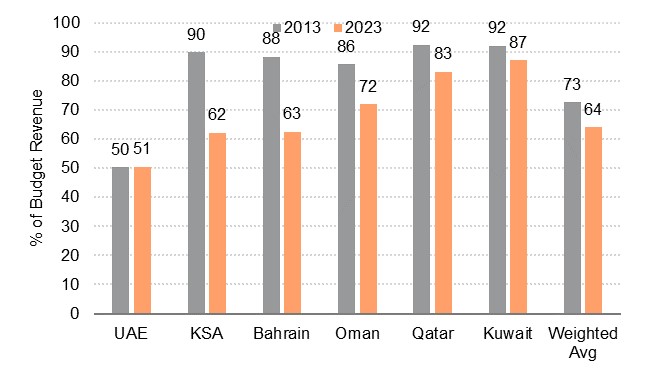

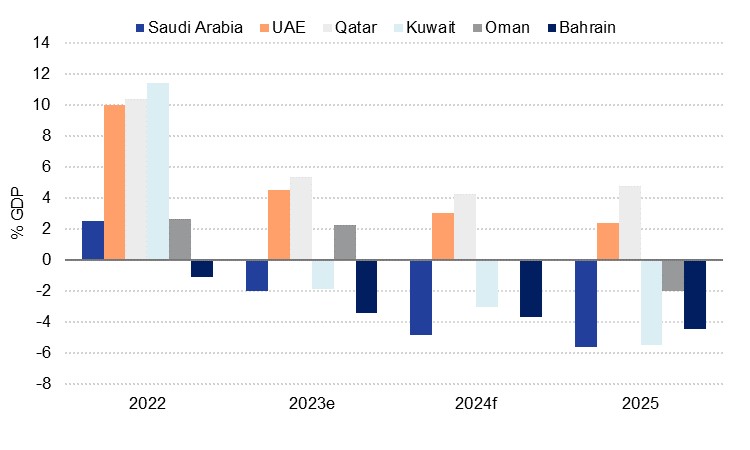

We now forecast that the GCC’s weighted regional average budget balance will be in deficit equivalent to 2.2% of GDP in 2025, compared with the previous expectation of a much shallower shortfall of less than 1%. This markdown is spread between the member states unevenly, however, with those countries where diversification of revenues has been a slower process seeing sharper deteriorations in their budget outlooks. As a proportion of total revenues, hydrocarbons have fallen from 72.7% for the bloc in 2013 to 64.0% in 2023, but this progress has been uneven.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The country by far still the most reliant on oil revenues to finance its government spending is Kuwait, where income from hydrocarbons still accounted for 87.1% of total government revenues in 2023. As a result, it is also the country that has seen the sharpest widening in our outlook for the budget balance next year, and we now forecast a shortfall equivalent to 5.5% of GDP, 3.5ppts larger than our previous forecast of a 2.0% deficit. Kuwait has been a laggard in diversifying its income stream, with VAT still not introduced some seven years after the GCC agreement to do so.

For Oman, hydrocarbons made up 71.9% of revenue last year, and we have gone from forecasting a budget surplus of 0.4% to a 2.0% deficit, a change of 2.4ppts. Oman is somewhat shielded by the fall in the crude price by strong growth in natural gas and condensates production, while the government has been taking greater steps towards income diversification, with VAT introduced in 2021, and a limited personal income tax potentially coming soon as well. Greater progress on state divestment, with a new five-year strategy introduced earlier in September, could also make a meaningful difference to the budget.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The UAE has the most diversified income stream in the GCC, and as a result the impact of our oil price revision is most muted. We now forecast a budget surplus equivalent of 2.4% of GDP next year, less than 1ppt lower than our previous projection. This still allows ample room for the government to pursue its investment strategy, with the value of public sector projects in execution in the UAE standing at AED 348bn at the end of September.

Saudi Arabia receives a little less than two thirds of its revenue via oil sales, and with the budget already expected to be in deficit for the next several years as the country pursues its ambitious reform agenda, the downgrade to prices will push the deficit wider in 2025. We had previously forecast a shortfall equivalent to 4.1% of GDP in 2025, and now see that coming in at 5.6%. Non-oil revenues recorded robust growth of 11.1% in 2023 and we anticipate that they will continue to expand at a robust pace, but not swiftly enough to offset the decline in oil prices given we forecast a breakeven price of USD 101.0/b for KSA next year.

While there have been a number of headlines in recent months around the rolling back of the scope and scale of some of the Vision 2030 projects, and timelines pushed out, there is still a huge volume of activity that Saudi Arabia is committed to, not least because of timelines related to the various events it is due to hold, including the Asian Winter Games and Expo 2030 to be held in Riyadh. As such we do not expect a major change in spending plans in the kingdom. KSA has been issuing debt through 2024, including USD 12bn in bonds in January, and a series of sukuks thereafter. Share sales from ARAMCO also raised a further USD 11.2bn for the government, all of which together cover a significant proportion of this year’s projected deficit of USD 52.6bn. Next year we forecast the nominal shortfall at USD 62.0bn, meaning that Saudi Arabia will likely remain active in bond and sukuk issuance.