Dubai on on Friday cut its emirate-wide 24-hour lockdown back to a 10:00 pm to 6:00 am curfew. The emirate allowed dine-in cafes and restaurants to resume business with a maximum capacity of 30% and shopping malls to be reopened partially and under strict guidelines. Mosques, cinemas and playgrounds remain closed. On Sunday Dubai also lifted the lockdown on the densely populated commercial districts Al Ras and Naif, as both areas have been tightly sealed off, after they recorded no new cases of COVID 19 in the last two days. In the region, Saudi Arabia also began easing curfews across the country on Sunday, while keeping in place a 24-hour lockdown in Mecca and its neighborhoods. The Kingdom allowed certain activities to operate, including shopping malls, wholesale and retail shops from Wednesday until May 13. However, hair salons and cinemas will remain closed and social gatherings of more than five people are forbidden. The kingdom extended a suspension on international and domestic flights until further notice.

Saudi Arabia’s tourism sector could see a 35-45% drop this year, as the kingdom undertakes measures to fight the coronavirus pandemic, according to statements by the kingdom’s tourism minister on Friday. As recently as September last year Saudi opened the door to foreign tourists by launching a new visa regime for visitors from 49 countries. The Kingdom closed its doors to Umrah pilgrims and tourists from 25 countries in late February before completely shutting off its borders in March. A key event on the horizon will be the weeklong Haj ritual in July, where 2.5 million visitors flock to the country; however, officials are urging travels to wait until there is clarity on control over the virus.

According to statements Sunday by Egyptian finance minister Mohamed Maait, and IMF managing director, Kristalina Georgieva, Egypt is set to enter discussions with the IMF with regards to securing a new, monetary, deal from the Fund. Having completed its previous, comprehensive, three-year IMF reform programme in late 2019, Egypt was originally looking to secure a non-financial agreement with the IMF to serve as a policy anchor, with the success of the previous arrangement having diminished the need for external financial support. However, the massive impact of the Covid-19 pandemic on the Egyptian economy has reversed this, as evidenced by the sharp deterioration in Egypt’s external position, vis-à-vis the rapid decline in FX reserves last month. The IMF expects the request for assistance through its Rapid Financing Instrument and a Stand-By Arrangement in the next several weeks.

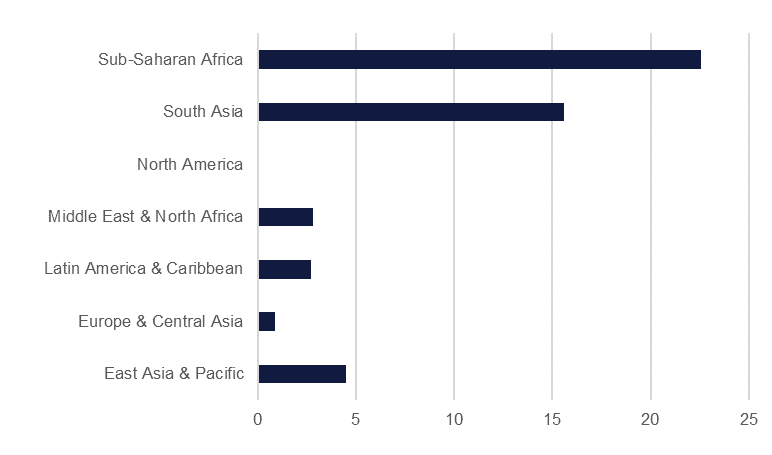

Senior World Bank officials warned on Friday in a blog on the bank’s website that developing economies may see a deeper recession than projected if consumption and investment do not rebound swiftly after the coronavirus pandemic. The officials pointed to a 2% drop in economic output in developing countries, the first contraction in these economies since 1960 and a sharp reversal from average growth of 4.6% over the last 60 years. The bank warned of a “considerable worse” scenario where output could drop as much as 3%, if investment faltered further and if just one of the bank’s key assumptions fails to materialize.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed mixed last week as some risk aversion sentiment crept back in the market. The curve flattened with yields on the 2y UST and 10y UST ending the week 0.22% (+2 bps w-o-w) and 0.60% (-4 bps w-o-w).

High yield securities came under pressure for the first time in three weeks on the back of complete dislocation in energy markets. The Bloomberg Barclays Global High Yield index returned -1.9% last week.

Regional bonds were able to weather the drop in oil prices. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -4 bps w-o-w to 4.25% and credit spreads remained flat at 367 bps.

S&P affirmed the rating of the Emirate of Sharjah and the Emirate of Ras Al Khaimah but lowered the outlook to negative from stable.

There was little in the way of dramatic movement for most major currencies last week. The DXY index saw the dollar experience some choppy activity but was overall bullish, increasing by 0.45% to finish the week at 100.233.The gauge advanced on fading risk appetite after European leaders struggled to force through a deal regarding a longer term rebuilding program despite Angela Merkel pledging to back a huge stimulus package for the EU. The JPY was volatile but still managed to close just below last week's closing price at 107.51.

Sterling saw the biggest change, dropping over 1% to 1.2365. UK Prime Minister Boris Johnson has announced he will return to office on Monday which is likely to improve sentiment and lift the pound. Otherwise the currency has been on the back foot for the week amid uncertainty about the UK's lack of a clear exit strategy from the virus, as well as worrying economic figures. The Euro was similarly bearish despite some progress being showed by France and Italy in slowing the coronavirus spread. The currency reached a new low for April on Friday, dropping to 1.0734 but still ended the week just 0.13% lower than its closing price at 1.0825. Meanwhile the AUD and NZD changed by 0.42% and -0.29% respectively.

Regional equities closed higher as some restrictions were eased in parts of the region. The DFM index and the Tadawul gained +3.5% each. Gains were broad based with all sectors participating in the rally.

Following the roller coaster to start the week, oil prices ended the week lower with Brent futures falling almost 24% to settle at USD 21.44/b while WTI closed its roller coaster week at USD 16.94/b, down 7.3%. Both contracts are now down around 70% since the start of the year: Brent by 67% and WTI by 72%.

If the market hadn’t been preoccupied with WTI’s descent into negative territory then the extremely wide time spreads, particularly at the front of both the Brent and WTI curves would have garnered most of the attention. Brent’s 1-2 month time spreads last week were among the widest ever dating back to 1990 and reflect the absence of storage availability nearly anywhere in the world. December spreads for both Brent and WTI have lost all of their recent gains and both closed in a contango of around USD 5-5.50/b.