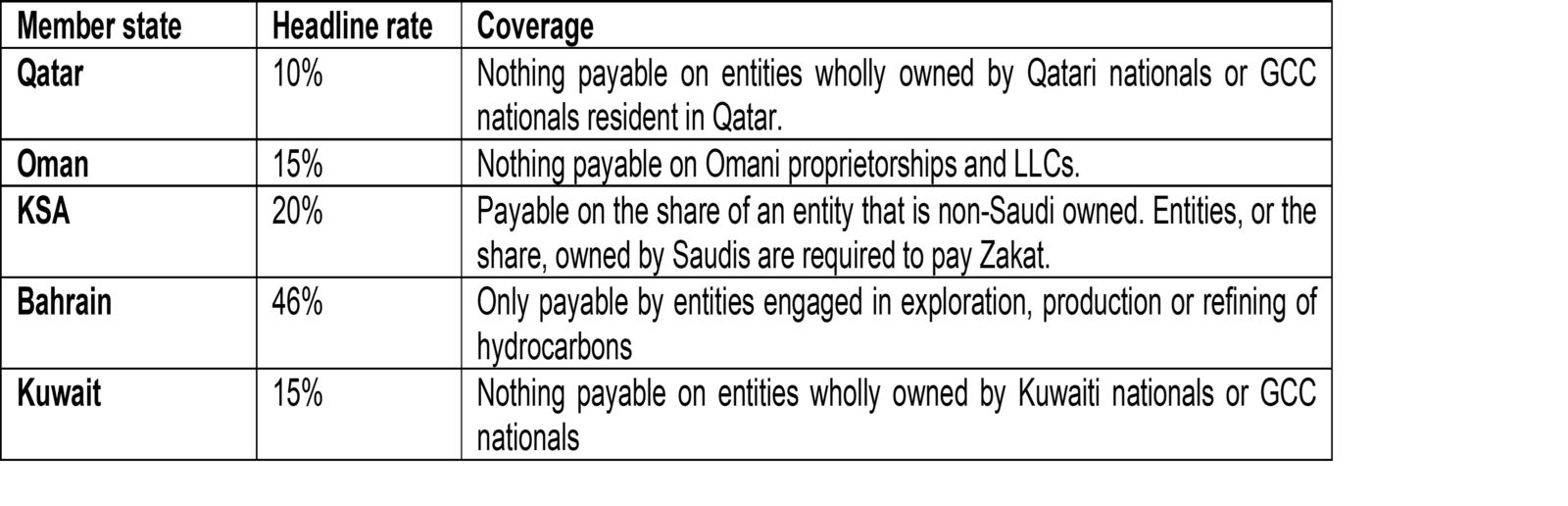

Defence spending was resilient across the GCC for yet another year in 2016 with Saudi Arabia and the UAE reporting the largest defence budgets with USD 63.7bn and USD 22.8bn, respectively. Overall, GCC countries spent USD 105.4bn in 2016 down by roughly -20.0% y/y due to the fall in oil prices in 2015. We expect GCC military spending to have increased in 2017 as oil recovers and GCC military commitments continue. The focus of the GCC is channeled to domestic production matched by a number of policies for attracting local investment to the sector. Domestic defense design and production however will take time. Matching GCC domestic policies to support diversification in the defense sector with investors and technologies will require partnerships between the public and private sectors.

Source: Bloomberg, SIPRI, Emirates NBD Research

Source: Bloomberg, SIPRI, Emirates NBD Research

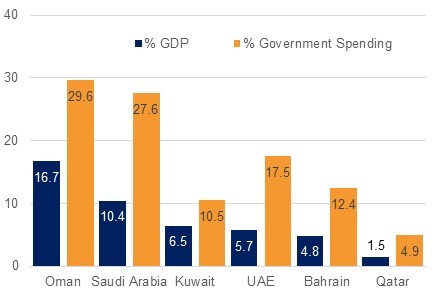

Saudi Arabia’s military spending is expected to increase further in the next few years considering the rising commitments in active military engagement in the region. UAE’s military expenditure reached a record high in 2016 with an active procurement pipeline being continued through 2017 with large orders for aircraft and weaponry. Oman’s military budget is the highest in terms of GDP and government spending making up for a considerate part of its economic capacity with USD 9.1bn, followed by Kuwait (USD 6.6bn), Qatar (USD 1.9bn), and Bahrain (USD 1.4bn), according to latest data from Stockholm International Peace and Research Institute (SIPRI).

The emerging GCC defence market and the ‘USD 30bn opportunity’ in terms of domestic defence production over the next decade is mainly driven by Saudi Arabia’s economic diversification plans. According to vision 2030, Saudi Arabia plans to localize at least 50% of its defence spending by 2030 (currently at 2%) by developing a number of defence related sectors such as industrial equipment, communication, and information technology. In 2016, soon after the department of local manufacturing support was established, Saudi Arabia has launched a few support industries (spare parts, basic ammunition, armored vehicles) while aiming to advance to more complex equipment such as military aircrafts, etc.

Source: SIPRI, Emirates NBD Research

Source: SIPRI, Emirates NBD Research

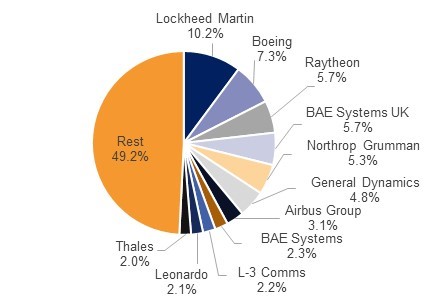

The impact of transferring knowledge and technology from defence expenditure is importnat in terms of industrial compensation arrangements, often referred to as offset programs. The scope of these programs is to provide the conditions that large item purchases from foreign suppliers can create additional benefits to the economy, including the creation of domestic job opportunities. As UAE was the second largest military spender in the MENA region after Saudi Arabia , accounting for 13.4% of total spending in 2016, we expect offset programs to continue having significant impact to the economy. Overall, total arms sales recorded USD 402bn in 2016 with 7 US companies being among the top 10 suppliers with a combined arms sales value of USD 152bn for the same period, as the graph below shows.

Source: SIPRI, Emirates NBD Research

Source: SIPRI, Emirates NBD Research

UAE’s strategy of creating jobs for its nationals and increase domestic ownership through investment vehicles, creating many opportunities within the security sector, is the driver for the country’s offset programs. Moreover, UAE’s aspiration in building defence capabilities is taking shape through Abu Dhabi’s Economic Vision 2030 and is strongly linked to investment in aerospace. The country’s diversified investments in aerospace are gaining momentum with a number of companies dedicated to maintentance, repair, and overhaul (MRO) of military planes. By expanding MRO capabilities in the aerospace industry, UAE has created the base for the production of unmanned aerial vehicles (UAVs). Abu Dhabi Autonomous Systems Investments (ADASI) and Adcom Systems are two of the leading UAV companies presently operating in the country.

Moreover, UAE is planning to enhance its maintenance and repair services designed to support military and civil air force equipment and parts, defence electronics and other equipment. So far UAE has designed and manufactured light weapons, military support vehicles, and armored personnel carriers. Namely, Mahindra Emirates Vehicle Armoring based in Ras Al Khaimah and NIMR Automotive based in Abu Dhabi have established significant capacity into this segment. It should be noted that NIMR’s military vehicles, although rebranded designs from the South African firm Denel, are being currently exported to Algeria while there are talks with Turkey and Egypt to soon import NIMR armored vehicles. In general, however modest, exports of domestically produced military equipment indicate the significant improvement of the country’s defence industry.

Last but not least, the maritime sector is undoubtedly the most advanced segment of UAE’s defence industry. Acting as a major contractor and systems integrator, Abu Dhabi Ship Building (ADSB) is the driving force of ship building in the UAE. Supported by Abu Dhabi Systems Integration (ADSI) - a subsidiary of ADSB, and Italian SELEX Sistemi Integrati, ADSB is focused on electronic and weapons systems design and development. Moreover, Gulf Logistics and Naval Support (GLNS), a joint venture between ADSB and BAE’s Maritime Systems subsidiary BVT Surface Fleet also provides support services for maritime systems, including logistics and training.