Stronger than expected economic data out of the US continued to defy fears of the negative impact of the stronger dollar or the trade wars on the US economy, thereby boosting the case for continued rate hikes in the US. UST Yield curve shifted upward with yields on 2yr, 5yr, 10yr and 30yr UST closing the week at 2.70% (+8bps w/w), 2.82% (+8bps, w/w) and 2.94% (+8bps, w/w) and 3.10% (+8bps, w/w) respectively. Yields on sovereign bonds rose across the Atlantic in sympathy with the USTs with 10yr Bund and Gilt yields closing the week higher at 0.39% (+6bps, w/w) and 1.46% (+5bps, w/w) respectively.

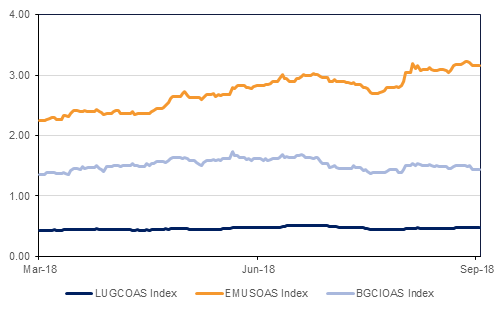

Though risk appetite in the developed world remained intact with CDS levels on US IG and Euro Main remaining stable at around 60bps and 64bps respectively, credit spreads on emerging market bonds maintained their widening bias against the backdrop of strengthening dollar and falling EM currencies. Option adjusted spreads on Barclays EM bond index have risen more than 50% in the recent months to 315bps from 212bps at the beginning of February, somewhat mirroring the circa 15% decline in the JP Morgan EM currency index. In contrast, credit spreads on US Agg index have remained range-bound over the last six months at around 42bps.

Despite the wide spread sell off in EM assets, GCC bonds are benefiting from rising oil prices, improving economic conditions and thinning new issue pipeline. Credit spreads on Barclays GCC bond index tightened 4bps over the week to 168bps, however, rising benchmark yield saw average yield on Barclays GCC bond index to close higher at 4.46% (+3bps, w/w).

On a generalized basis, the rising oil prices are boosting credit profiles of GCC sovereigns and GREs and this in turn is helping to reduce credit rating downgrades. However, owing to possibly higher borrowings by the Dubai government to fund EXPO 2020 related expenses, credit ratings on some of the Dubai Inc entities have come under pressure. S&P last week downgraded the ratings on DEWA and DIFC by one notch to BBB and BBB- respectively, citing the government’s weakening ability to provide support if need be. That said, their respective bonds reflected muted reaction to the rating change. Yield on DEWAAE 20s has remained range bound at 3.42% and that on DIFCAE 24s rose only marginally to 4.1%.

Elsewhere, Moody’s has withdrawn its B1 rating on Ezdan due to lack of sufficient information.

Click here to Download Full article