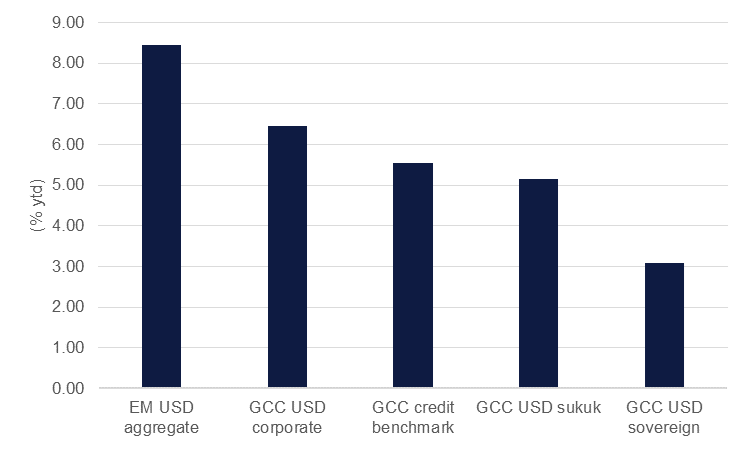

GCC credit is riding out a decent end to 2023 in line with a broader move higher in emerging market bonds. The Bloomberg GCC benchmark index, including investment grade and high-yield bonds, is up 5.53% year-to-date as of December 20th. The performance was largely down to corporates, up by about 6.5% ytd, while GCC sovereigns lagged somewhat, gaining a bit more than 3% on the year. Overall regional credit followed rather than led wider emerging market bonds with Bloomberg’s EM USD index adding about 8.5% since the start of the year.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

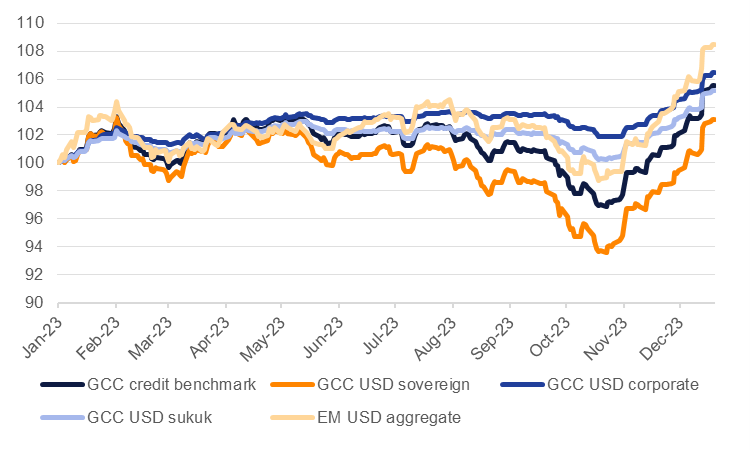

Most of the gains across the EM space have been concentrated in the final months of the year. Emerging market bonds in general had been drifting for much of 2023 as the global context was unfavourable. High benchmark interest rates, a strong US dollar, declining global trade and an uncertain macro trajectory for China all dragged on emerging markets this year but now some of those dynamics are set to reverse.

Source: Bloomberg, Emirates NBD Research. Note: rebased to Jan 2 2023

Source: Bloomberg, Emirates NBD Research. Note: rebased to Jan 2 2023

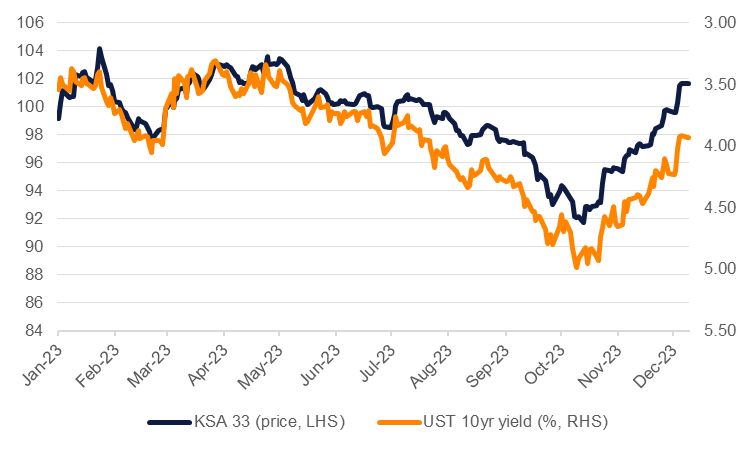

For 2024, macro conditions for GCC credit look more favourable. We expect the Federal Reserve to begin cutting interest rates mid-way through 2024, helping to lift bonds in general. If the Fed is successful in engineering a soft-landing—milder growth, a modest increase in unemployment and slowing inflation—then demand for risk assets like EM credit should be healthy. For the GCC, pegged currencies to the US dollar means that sovereign credit should track performance in benchmark treasuries and help to eliminate some of the FX volatility related risks that could impact EM peers.

Source: Bloomberg, Emirates NBD Research. Note: UST index inverted

Source: Bloomberg, Emirates NBD Research. Note: UST index inverted

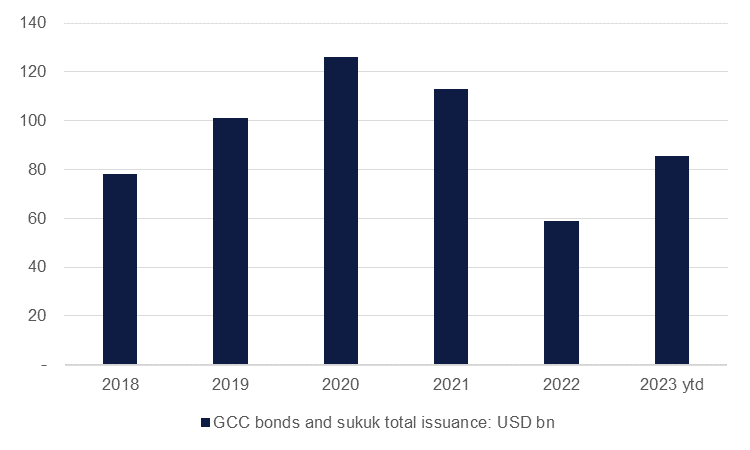

We expect that supply will also expand in 2024 as flat oil prices year-on-year will mean wider budget deficits or more modest fiscal surpluses across the GCC sovereign space. Non-oil economies across the region are set to have another decent performance in 2024, largely thanks to government spending which is likely to mean greater issuance next year.

Bloomberg, Emirates NBD Research

Bloomberg, Emirates NBD Research

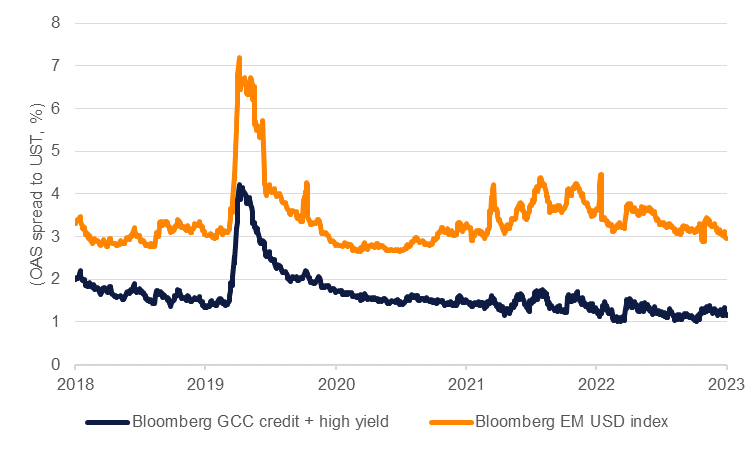

One risk that could hold GCC credit back is if investors perceive the asset class as too expensive. GCC credit spreads are tighter than the broader EM universe with an overall higher credit rating in the region compared with EM peers. Volatility in oil prices may help to widen spreads somewhat for the GCC though that will likely affect EMs in general as well given a high preponderance of hydrocarbon exporters across the space.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.