Higher oil prices and significant progress with Covid-19 vaccine rollouts support our view that the outlook for the GCC economies this year is brighter, notwithstanding little improvement in the January PMI readings. However, budget deficits are likely to remain substantial, limiting the scope for additional fiscal stimulus to support a recovery and resulting in more debt issuance from the region this year.

January PMI readings in the GCC were largely unchanged from December, albeit at a relatively high level for Saudi Arabia. In the UAE, there was no change from December on the headline reading as the sharp rise in new coronavirus cases in January likely weighed on output and new work. On a positive note, employment did not contract for the first time in over a year.

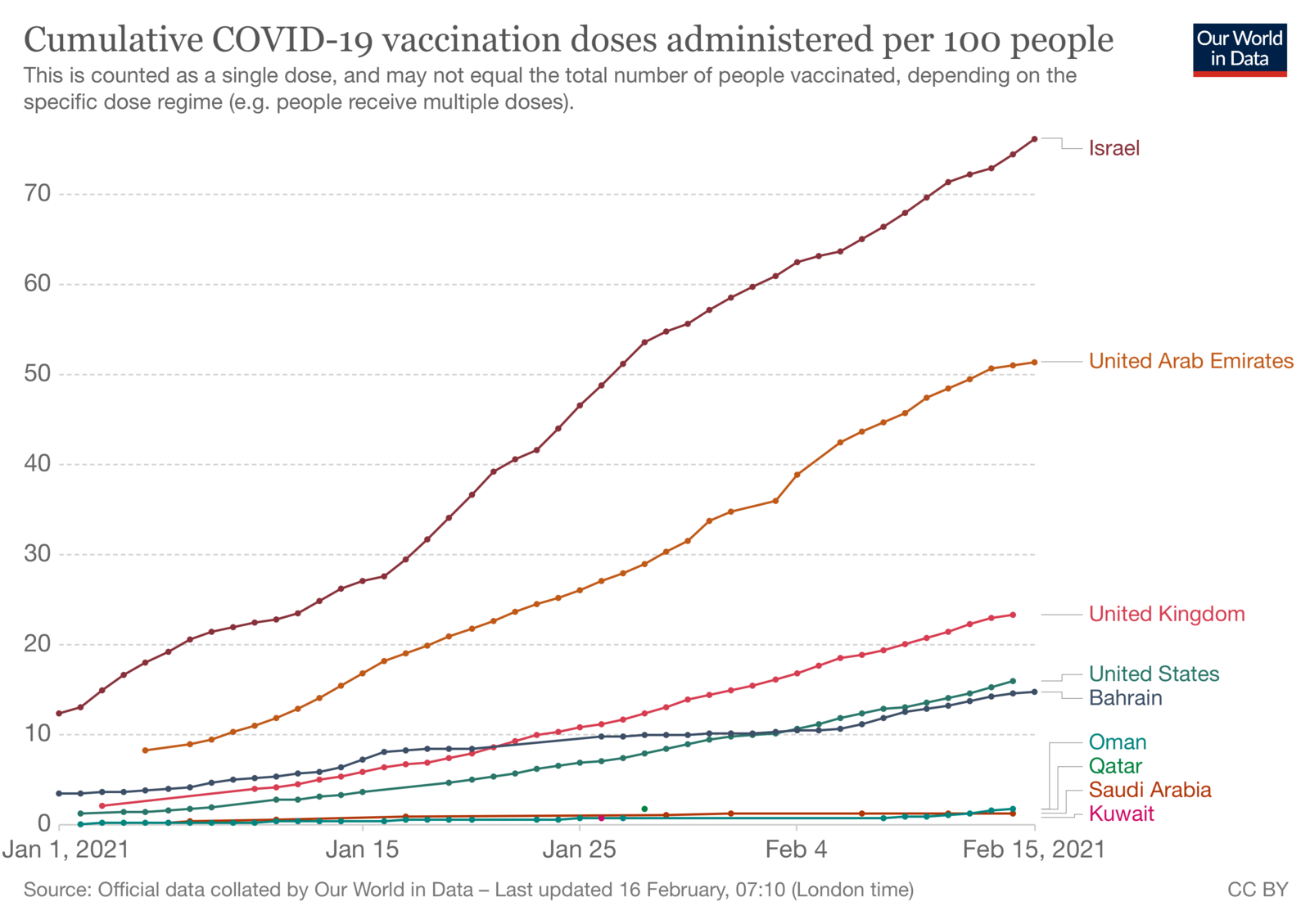

The UAE has now administered more than 50 Covid-19 vaccine doses per 100 people, second only to Israel, according to data compiled by Our World in Data. Bahrain is in fifth place globally at almost 15 doses per 100 people, just behind the US. In our view, a fast vaccine rollout should facilitate a speedier return to “normal” activity in the UAE and allow the economy to remain open to visitors. This is particularly relevant for Dubai, with Expo 2020 due to start in October. Passenger traffic through Dubai International airport fell by 70% in 2020, and while air travel globally is not expected to reach pre-pandemic levels for several years, we do expect tourism to recover as travel restrictions are eased later in the year, once vaccines have been rolled out sufficiently.

Source: Our World in Data

Source: Our World in Data

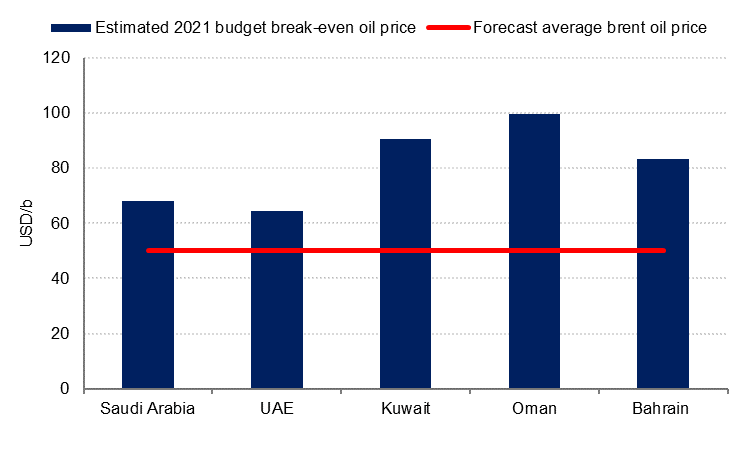

Brent oil has averaged USD 57/b since the start of this year, above our annual average forecast of USD 50/b, driven by increased optimism about global growth prospects and a severe cold weather snap in the US Midwest which has led to a temporary reduction in crude oil production there. However, even at USD57/b the oil price remains well below the break-even price for GCC budgets in 2021. We estimate the UAE’s breakeven oil price at around USD 65/b this year, the lowest in the region (excluding Qatar). Saudi Arabia’s break-even oil price will be lower this year at just under USD 70/b, as budget spending is set to decline by more than 7% y/y, while Bahrain, Oman and Kuwait would need oil prices between USD 80-100/b to balance their budgets.

Source: Emirates NBD Research

Source: Emirates NBD Research

Last year, we estimate the weighted average budget deficit across the region reached -11% of GDP, the widest since 2015. To finance the budget shortfalls, GCC sovereigns issued almost USD 60bn in bonds and sukuk last year and USD 63bn in loans, according to data compiled by Bloomberg. These figures exclude bond and sukuk issuance by GREs, sovereign wealth funds and corporates in the region – total bond and sukuk issuance from GCC issuers last year exceeded USD 126bn, up 24% from 2019. In addition, several GCC countries stepped up domestic debt issuance in local currency to help finance last year’s budget deficits, including Saudi Arabia.

This year we expect budget deficits to narrow in most GCC countries on higher oil prices, and as production recovers in H2 2021. However, the total budget shortfall across the region is still likely to exceed USD 100bn in our view. There is also almost USD 40bn of government debt (both domestic and international) falling due this year, according to Bloomberg estimates.

Not all deficit financing will be via debt issuance however – typically GCC oil producers draw on accumulated fiscal reserves and/or privatization proceeds to finance part of the deficit – and not all of the debt financing will be via international bond issuance. Nevertheless, GCC sovereigns have been quick to take advantage of the low-yield environment and tap capital markets this year. Oman, Bahrain and Saudi Arabia have already issued sovereign bonds totaling USD 10.25bn since the start of the year and total GCC bond and sukuk issuance (including corporates and GREs) has reached USD 25.3bn, according to Bloomberg estimates. We expect GCC sovereigns to tap bond markets again over the course of the year.

With the focus on reducing budget deficits, there is little prospect of additional direct fiscal stimulus by governments in the region to boost growth this year. Instead, the priority will likely remain maintaining sufficient liquidity in the financial system and accelerating the rollout of Covid-19 vaccines to aid a return to more “normal” economic activity, while relying on improving external conditions to support a regional economic recovery. Structural reforms will continue to be needed to attract investment and retain human capital, even in the face of little or no job growth.