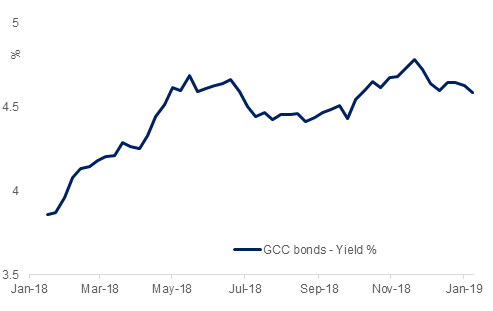

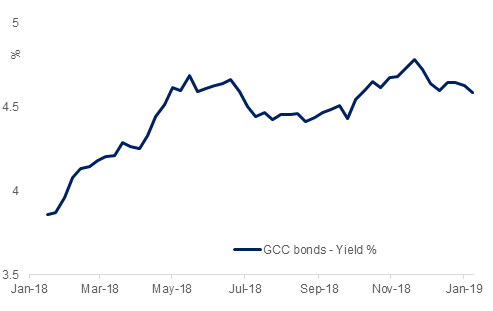

Last year was challenging for most asset classes and GCC bonds were no exception. Rising US interest rates and receding dollar liquidity drained investor appetite for emerging market assets and affected the bid for USD denominated bonds from the GCC region negatively. That said, with average yield above 4.5%, coupon collection helped GCC bonds to avoid losses. Total return on Barclays Bloomberg GCC bond index was a mild gain of 0.18%. This compares favourably with loss of -2.5% on the wider EM USD bond index and 0.2% loss on the US aggregate bond index.

Looking ahead, we expect US rate hikes to slow or pause in 2019. Assuming that oil prices remain in the $60-$80 /b range, total return on GCC bonds is expected to remain positive in 2019 albeit in a very low single digit percentage.

The factors affecting performance of GCC bonds in 2019 will be:

- Rising US Interest Rates: As per the current dot plot, the US Federal Reserve expects two more rate hikes in 2019 which in turn will possibly see the benchmark UST yield curve shifting upward, causing bond prices to fall. Though market is pricing no more rate hikes in 2019, we think the possibility of inflation picking up and the Fed managing to do one or two more rate hikes is reasonably high. Slower rate hikes or no more rate hike in this cycle at all will obviously be constructive for GCC bonds.

- Range-bound oil prices: We expect Brent crude to average around $65/b this year albeit with high level of volatility. Short lived movements in oil prices are unlikely to affect GCC bonds materially provided the fluctuations are within the range of $60/b - $80/b.

- Inclusion in the JP Morgan EMBI Index: The bid from international investors ensuing from JP Morgan’s decision to begin including GCC sovereign and quasi sovereign bonds into its emerging market index is expected to provide a beneficial backdrop for GCC bonds, particularly in the first half of this year.

- Large new issue pipeline; We expect between $60 billion to $80 billion of new issues from GCC issuers, contributed by a) sovereigns that will continue to tap capital markets to fund their budget deficits; b) banks that will boost their capital buffers in response to adoption of Basel III; c) corporates that will likely need to borrow more in response to improving economic growth; and d) $26 billion of upcoming redemptions that will need to be refinanced.

- Relatively high credit ratings and low default rates: Despite multiple downgrades of multiple entities over the last three years, GCC sovereigns continue to be better rated than peers in the emerging market universe which makes them attractive on relative value bais.

Blomberg Barclays GCC bond - yield %

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Click here to Download Full article