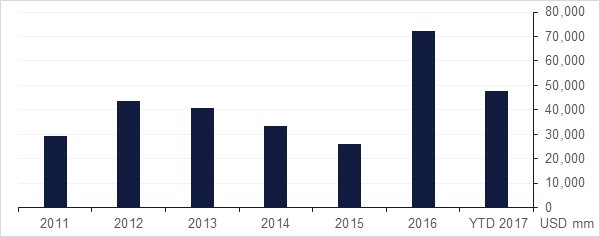

After record new GCC bond issuance in the first half of 2017, primary market seems to have grinded to a halt in the third quarter. In H1 2017, governments of the six GCC nations issued an unprecedented amount of bonds to cover budget deficits caused by low oil prices. Large deals such as the $9 billion sukuk from Saudi Arabia, $8 billion bond from Kuwait and $5 billion debt raising by the Oman government lead the total issuance to reach a record $43 billion in the first half this year compared with $36 billion in the year before.

Source: Emirates NBD Research

Source: Emirates NBD Research

The demand for USD bonds remains high in the region, driven by relatively still low interest rates, the hunt for higher yields and demand for duration by the insurance/pension companies. Improving liquidity in the banking sector also supported bid tone. This made the GCC Bonds deliver solid performance with YTD return on Barclays GCC bond index at 5.5%. This rally is further being lifted by the recent change in the US rate hike expectations driven by increasing geopolitical tensions. However despite good demand and solid performance of existing bonds, new issue supply has been negligible in the recent months.

There is no evidence of funding pattern shifting from bonds to loans as the total syndicated loans in the region has also declined in the last quarter. The reason for low issuance are:

In consideration of a bigger decline in GDP growth in the region than expected early in the year, we expect total new supply of bonds for the whole year to finish at circa $65 billion.

Click here to see the full publication