The risk of more trade disputes escalated over the weekend as the G7 meeting of leaders ended in disorder after US president Donald Trump refused to endorse the summit’s communique. President Trump alleged that Justin Trudeau, Canada’s prime minister, had been ‘dishonest’ in his statements when the PM said he would follow through with imposing retaliatory tariffs on US goods following trade barriers imposed on aluminium and steel flowing into the US. While trade was not the only item on the agenda of the G7 meeting, the increasingly hostile rhetoric between the US and its allies means the disputes overshadowed the rest of the summit. The prospect for a successful renegotiation of NAFTA or a new trade arrangement between the EU and US look remote in the current climate and all ahead of potential tariffs imposed on Chinese goods as early as this week.

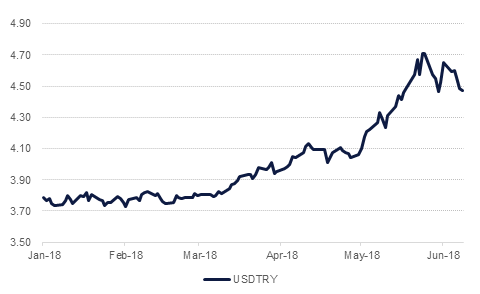

Turkey’s central bank raised rates much sharper than expected on Thursday, raising the one-week repo rate by 125 bps in its attempts to try and stifle inflation that is already elevated and also to try and stem the rout of the lira. The CBRT has now raised rates by 425bps or 4.25% points since late May as the central bank tries to assure markets it has the authority to determine monetary policy. In response to the hike in rates the lira appreciated sharply, moving back below the USDTRY level of 4.5 and settled the week stronger. Turkey goes to an election later this month that could empower president Erdogan further and again raise concerns about the independence of the central bank and its ability to use policy tools to set Turkey’s economy on a more solid footing.

There is a lot to look out for this week, starting with Donald Trump’s meeting with Kim Jong Un in Singapore and the House of Commons vote on the “Brexit Bill” tomorrow. This is followed by FOMC, ECB and BoJ meetings over the rest of the week. In addition, there is a raft of economic data due this week including inflation in the US and Eurozone, industrial production data for the UK, Eurozone and US, UK retail sales, as well as the ZEW survey in Germany and employment data in Europe.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

Treasuries ended the week marginally lower. For better part of last week, USTs took their cues from moves in European bonds. Yields on the 2y UST, 5y UST and 10y UST closed at 2.49% (+2 bps w-o-w), 2.78% (+4 bps w-o-w) and 2.94% (+4 bps w-o-w) respectively. The Fed is scheduled to meet later this week where they are widely expected to raise interest rates by 25 bps.

Regional bonds drifted marginally lower with YTW on the Bloomberg Barclays GCC Credit and High Yield index rising +2 bps w-o-w to 4.63% and credit spreads remaining flat at 190 bps.

S&P affirmed Abu Dhabi’s rating at AA with stable outlook. The rating agency said that the rating action reflects its expectation that economic growth will gradually pick up and that the country’s fiscal position will remain strong over the next two years.

Last week, the dollar posted its first decline in four weeks with the Dollar Index falling 0.64% to close at 93.54 on Friday. Despite these declines, the technical outlook for the greenback remains bullish while the weekly close remains above the 50% one year Fibonacci retracement (93.06). We expect resistance to exert itself at the 61.8% one year Fibonacci retracement (94.20) followed by stronger resistance at the 200 week moving average (94.91), a level which halted advances during the previous week.

Regional equities started the week on a mixed note. The DFM index added +0.4% while the Tadawul lost -0.8%. National Medical Care closed limit up after Hassana agreed to swap its 35% stake in the company for NMC Saudi Arabia. Dubai Islamic Bank added +1.2% after the company informed that its rights issue was three times oversubscribed.

Oil prices settled the week slightly lower, down 0.1% for WTI at USD 65.74/b and 0.4% for Brent at USD 76.46/b. Investors continue to close long positions in futures and options, taking the long/short ratio back below 7 for both WTI and Brent compared with more than 20 only a few weeks ago. In the US, the drilling rig count expanded by one rig, the third week in a row of gains.

Click here to Download Full article