.jpg?h=457&w=800&la=en&hash=AF425F103361855CAB3100AD29A334CF)

If the first few days of September are anything to go by the roller coaster that has been underway throughout 2019 shows no signs of abating. Data that has been released so far this month has shown the world economy continuing to struggle through the summer, with the global manufacturing PMI remaining in contraction territory at 49.5, up only marginally from July’s 49.3, the lowest levels in almost a decade. In the Eurozone the overall manufacturing PMI reading stood at 47.0 in August 2019, with all key economies with the exception of France remaining well in contraction territory. Furthermore German industrial production also unexpectedly contracted by -0.6% m/m in July. The Markit manufacturing PMI reading for the UK also dropped from 48.0 in July to 47.4 in August, while in the U.S. the ISM manufacturing index fell to 49.1 from 51.2. July. Meanwhile U.S. August employment data was weaker than expected, showing a rise in non-payrolls of 130k, even though the breakdown was a bit more reassuring, with the unemployment rate steady at 3.7% for a third straight month and average hourly earnings ticking up to 0.4% m/m from 0.3%.

Against this backdrop, markets appear to have settled on the need for more monetary easing, with the ECB expected to get the ball rolling later this week. The Fed is more than likely to follow suit later this month, even though the U.S. data is less discouraging overall and Chairman Powell downplayed the risks of a recession in a speech at the end of last week. This may have been an attempt to assuage criticism that the Fed is ‘enabling’ President Trump by cutting interest rates to bolster growth that is being negatively impacted by Trump’s trade policies, but it will probably still not get in the way of the Fed cutting rates at least twice more this year starting this month.

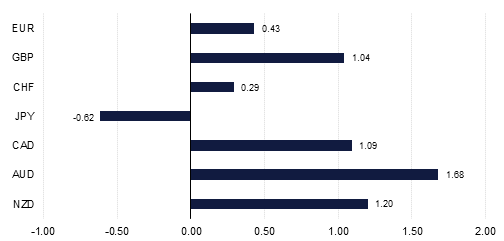

The U.S.-China trade dispute started last week negatively as both sides went ahead with their latest tariff increases, only to end the week more hopefully as China announced that its trade officials will travel to the US early next month for talks. As risk appetite improved the USD sold-off slightly, assisted by a sharp reversal in Brexit sentiment as well which pushed up GBP. After last week started with news that suggested a ‘no deal’ Brexit was likely, it ended it with a completely different perspective, with PM Johnson being increasingly boxed in by pressures in Parliament to seek a Brexit extension beyond the end of October. It is almost impossible to predict the next twist in this saga, but it seems likely that there could be many more making GBP volatility still the likeliest outcome.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg