.jpg?h=457&w=800&la=en&hash=1B6B185336BC6FA3CC8CAF0DDBCA845F)

After years of concerns relating to the LIBOR’s vulnerability to manipulation, the UK Financial Conduct Authority has decided that it will no longer collect LIBOR quotes from participating banks beyond 2021. Consequently, the most commonly used reference rate in global financial markets, the 3m USD LIBOR, along with other LIBOR tenures will be phased out by the end of 2021.

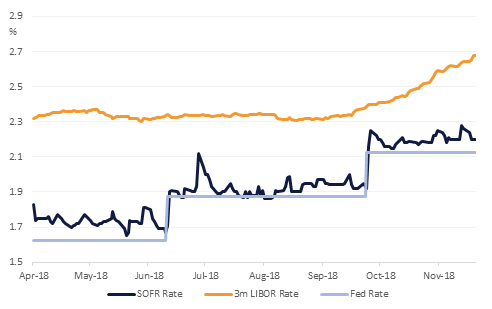

Following months of due diligence, in June 2017, the Alternative Reference Rate Committee (ARRC) selected the Secured Overnight Financing Rate (SOFR) for USD derivatives and other financial contracts as its preferred alternative to the USD LIBOR. Beginning April 3,2018, SOFR is now published each business day by the Federal Reserve Bank of New York in cooperation with the U.S. Treasury Department’s Office of Financial Research.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research