- In November 2017, GCC equity markets declined for a third consecutive month with the MSCI GCC Countries index losing -1.1%. This was primarily on account of crackdown on corruption in Saudi Arabia and renewed geopolitical tension. Ironically, the Tadawul was one of the very few indices to end the month in positive territory with gains of +1.1%. The DFM index dropped

-5.9% while the Qatar Exchange lost -5.5%. - The DFM index saw outflows of c. AED 380mn from foreign investors. Dubai Investments saw the biggest inflow of AED 169mn as the stock was included in the MSCI EM index.

- The Qatar Exchange saw inflows for a second consecutive month. Foreign investors bought stocks worth QAR 36.4mn. The market heavyweight Qatar National Bank was the biggest beneficiary with inflows of USD 33.4mn.

- The Tadawul saw the biggest monthly outflows this year in November 2017. Foreign investors sold stocks worth SAR 1.5bn amid crackdown on corruption by the government and renewed political tension in the region. However, the broad index ended the month higher following support from government-related mutual funds.

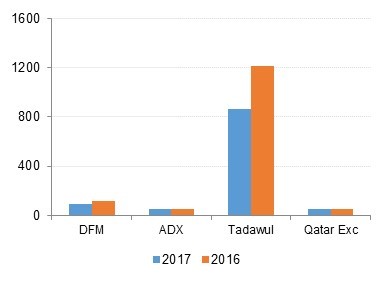

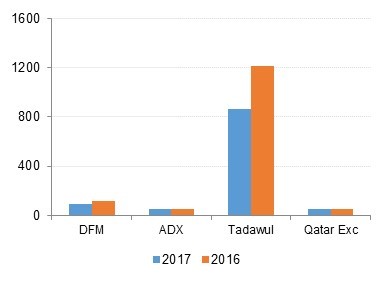

- On a y/y basis, volumes have declined across the major GCC equity indices. The value traded on the DFM index and the Tadawul dropped -23.0% y/y and -29% y/y respectively. However, on a m/m basis volumes increased on the Tadawul (+18% m/m) and the Qatar Exchange (+27.0% m/m) but declined on the DFM index (-16.0% m/m)

Average Daily Value Traded (USD mn)

Source: Emirates NBD Research

Source: Emirates NBD Research

Click here to see the full publication

Source: Emirates NBD Research

Source: Emirates NBD Research