The FOMC holds its first meeting of the year this week with widespread expectation that there will be no change in rates. Markets are currently assigning roughly a 3% chance of a 25bps cut when the committee concludes on January 31. Focus will fall instead on how the FOMC describes the economy and whether it will push back against market expectations for any imminent easing later on in H1 2024. At its December meeting the Fed noted that “economic activity has slowed from its strong pace in the third quarter” but since then initial estimates of Q4 GDP have been released and showed the US economy expanding by 3.3% on an annualized basis, more than markets had been expecting. Personal spending data for December, both in nominal and inflation adjusted terms, also came in better than expected.

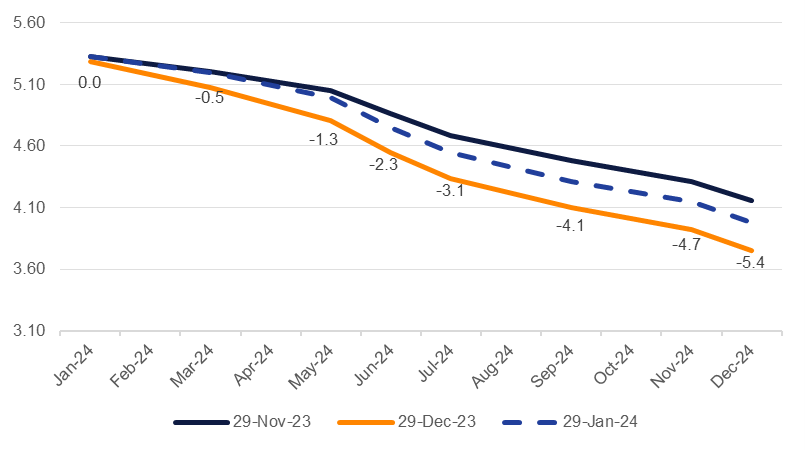

With the robust performance of the US economy in Q4 we would expect the Fed to notionally at least push back against expectations of imminent rate cuts. Prior to the Fed’s blackout period regional presidents had been dampening down market aspirations for rates to be cut as early as March. Over the course of the last two months, options-based pricing for the March FOMC has fallen from a peak probability at the end of 2023 of almost 90% chance of a 25bps cut to less than 50% now.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Activity and consumption data from the US doesn’t seem to be calling out for easing in policy rates. ISM data for January will be released this week with the services sector forecast to improve while consensus expectation for manufacturing is for another month of contraction. Labour market data also doesn’t seem to support an argument for easier monetary policy. The December nonfarm payrolls surprised to the upside with a print of 216k and initial jobless claims in January so far have come in better than expected for three of the past four weeks. Market estimates are for a print of 180k on the nonfarm payrolls for January with a modest uptick in the unemployment rate to 3.8%.

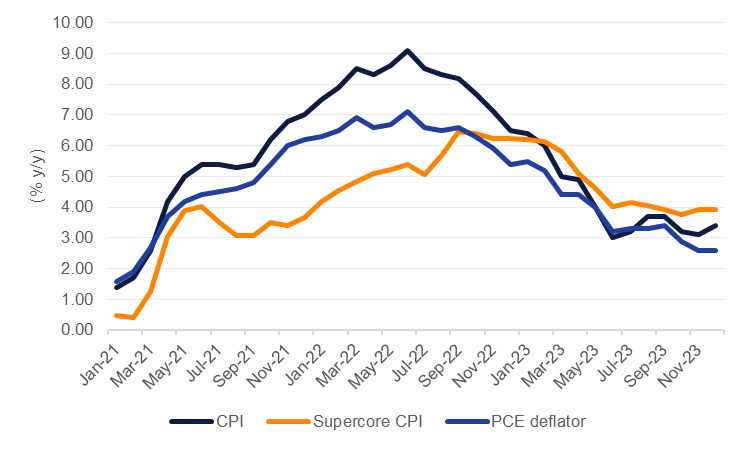

Inflation though is the paramount challenge for the Fed and the trajectory on prices has been steadily disinflationary since the headline CPI hit a peak of more than 9% in mid-2022. Goods prices ex-food and energy have been running at near 0% since September 2023 and on a six-month annualized basis, the core PCE deflator has run at less than 2% for the November-December prints. What then is staying the Fed’s hand on cutting rates now or as soon as the March FOMC?

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

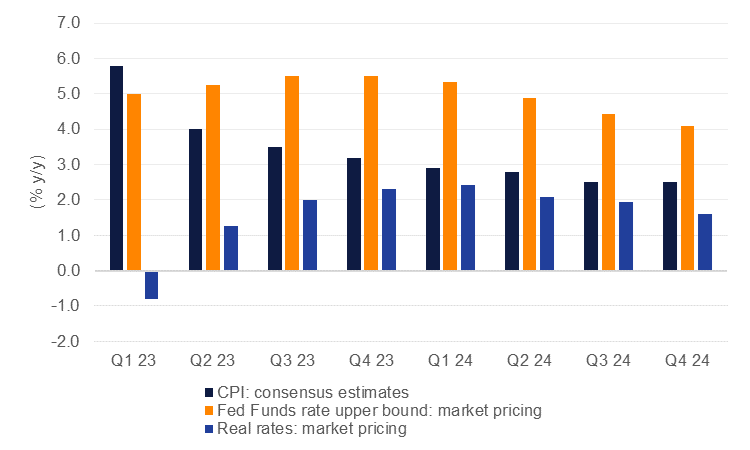

The Fed revised its inflation targeting strategy in August 2020 with the aim of average inflation in the PCE index of 2%. That shouldn’t prescribe the Fed to immediately cut rates when PCE inflation moves below 2% but only if it is sustainably around that target level. The focus on the FOMC this week should be on how the Fed describes the risks around its inflation outlook. If there remains any inclination that inflation could reaccelerate, particularly given the apparent robust health of the US economy or catalyzed by exogenous factors like energy prices or disruptions to global shipping, the Fed will likely remain cautious. Cuts, in our view, will be motivated by a desire to drop real rates—which are running at historically tight levels—rather than provide support to an otherwise healthy economy.

Source: Bloomberg. Note: consensus estimates for inflation and market pricing for rates.

Source: Bloomberg. Note: consensus estimates for inflation and market pricing for rates.

Our base case stands for three cuts, starting from the June FOMC and proceeding sequentially on a quarterly basis. Upside risks to that base case would stem from a clearer disinflationary path developing in the next several months which could allow the Fed to start to cut rates from the May FOMC, adding in one additional cut to our base case.