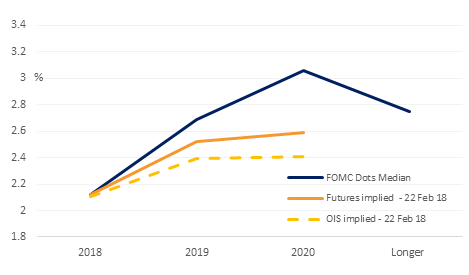

As per the January FOMC meeting minutes, majority of FOMC participants felt that a stronger outlook for economic growth raised the likelihood that further gradual policy firming would be appropriate. The addition of "further" in the accompanying policy statement has been perceived to be a more ‘hawkish’ stance, particularly because those officials now think the impact of the recent tax cuts could be bigger than previously believed. Moreover, the FOMC meeting comments pre-date the recent congressional agreement to boost spending, which means that the overall mix of fiscal stimulus could be significantly bigger over the next 18 months than was assumed at last month's FOMC meeting. Market implied probability of rate hikes in 2018 still remains at 3 hikes this year but has now increased from one to one and half for 2019. In terms of data, Existing Home Sales in January came in weaker than expected at annualised 5.38 million homes from 5.57 in the previous month. However, this seems to be because of lower inventory as home prices increased by 5.8% y/y.

Preliminary estimates of Eurozone PMI reflected weakening in composite PMI to 57.5 in February from 58.8 in January, partly reflecting the impact of stronger currency. However companies continue to hire and economic growth in the region is expected to have been over 2% in the last quarter.

In the UK, unemployment level in 4Q17 increased to 4.4% from 4.3% previously.. Though unemployment increased, the overall employment rate rose to 75.2%, close to a record, as fewer workers were economically inactive. On the positive side, average weekly earnings increased by 2.5% y/y, similar to the previous quarter.

The final version of the TPP (Transpacific Partners) trade deal was released yesterday. The deal is being led by Japan and excludes the United States of America. It is scheduled to be signed on 8th March in Chile and expected to boost activity in the economies of its 11 participating nations.

In the region, Bahrain’s finance minister yesterday confirmed that they are working with the parliament for introduction of VAT and aim to have everything set up by the end of 2018.

US Treasuries closed lower as they failed to hold onto gains following release of minutes from Federal Reserve’s last meeting. While the minutes highlighted the risk that inflation would continue to fall short of Fed’s expectations, investors paid more attention to ‘continued gradual removal of monetary policy accommodation’ in light of data released post last Fed-meeting. Yields on the 2y USTs, 5y USTs and 10y USTs finished at 2.26% (+5bps), 2.68% (+4 bps) and 2.95% (+7 bps).

Regional bond markets were largely unchanged as investors remained cautious ahead of the release of minutes from last Fed meeting. The YTW on the Bloomberg Barclays GCC Credit and High Yield index closed unchanged at 4.14% while credit spreads tightened by 3 bps to 150 bps.

The remainder of Wednesday saw AUD add to its losses from the Asia session, AUDUSD losing a total of 1.0% to close at 0.78042. Currently trading at 0.77987, yesterday’s break below the 50 day moving average of 0.7867 and 61.8% one year Fibonacci retracement being firm, we see the next level of support at 0.7775, near the 100 day and 200 day moving averages of 0.7773 and 0.7777 respectively.

This morning, JPY is outperforming and has gained against the other G-10 currencies. The JPY has advances for the first time in 5 days amid safe haven bids as Asia equity markets perform poorly this morning. As we go to print, USDJPY trades 0.43% lower at 107.31.

This afternoon, investors will be looking towards the UK where preliminary data for is expected to show that the economy expanded 1.5% y/y in Q4 2017. Should the data meet expectations or surprise to the downside, we could see GBPUSD falling further towards 1.38, adding to 0.81% losses realized so far this week.

Developed markets closed mixed as US stocks closed lower following concerns over a faster pace of tightening by the Federal Reserve. The S&P 500 index dropped -0.6% while the Euro Stoxx 600 index added +0.1%.

For regional equities, it was more of the same i.e, lower volumes and lack of broad based moves. The DFM index added +0.5% on the back of +3.2% rally in Emaar Properties. The stock benefitted from reports that the government is looking to tweak off-plan sales rules wherein a developer needs to complete 50% construction before they can start selling.

Oil markets remain under pressure, largely down to movements in the dollar rather than fundamentals. Brent futures edged up just 0.26% yesterday but have given up nearly 1% in trading early this morning to push below USD 65/b while WTI lost 0.36% overnight and is down more than 1% today. FOMC minutes showed a Fed confident in its rate rising mission, helping the dollar gain ground and acting as a brake on commodities.

The API reported a small decline in overall crude stocks last week as a result of interruptions to supply from Canada as a pipeline was undergoing repair. Official EIA data will be published later today, later than usual thanks to a public holiday to start the week in the US.