The FOMC holds its first meeting of the year this week amid an uncertain policy agenda from US President Donald Trump and substantial volatility in equity markets.

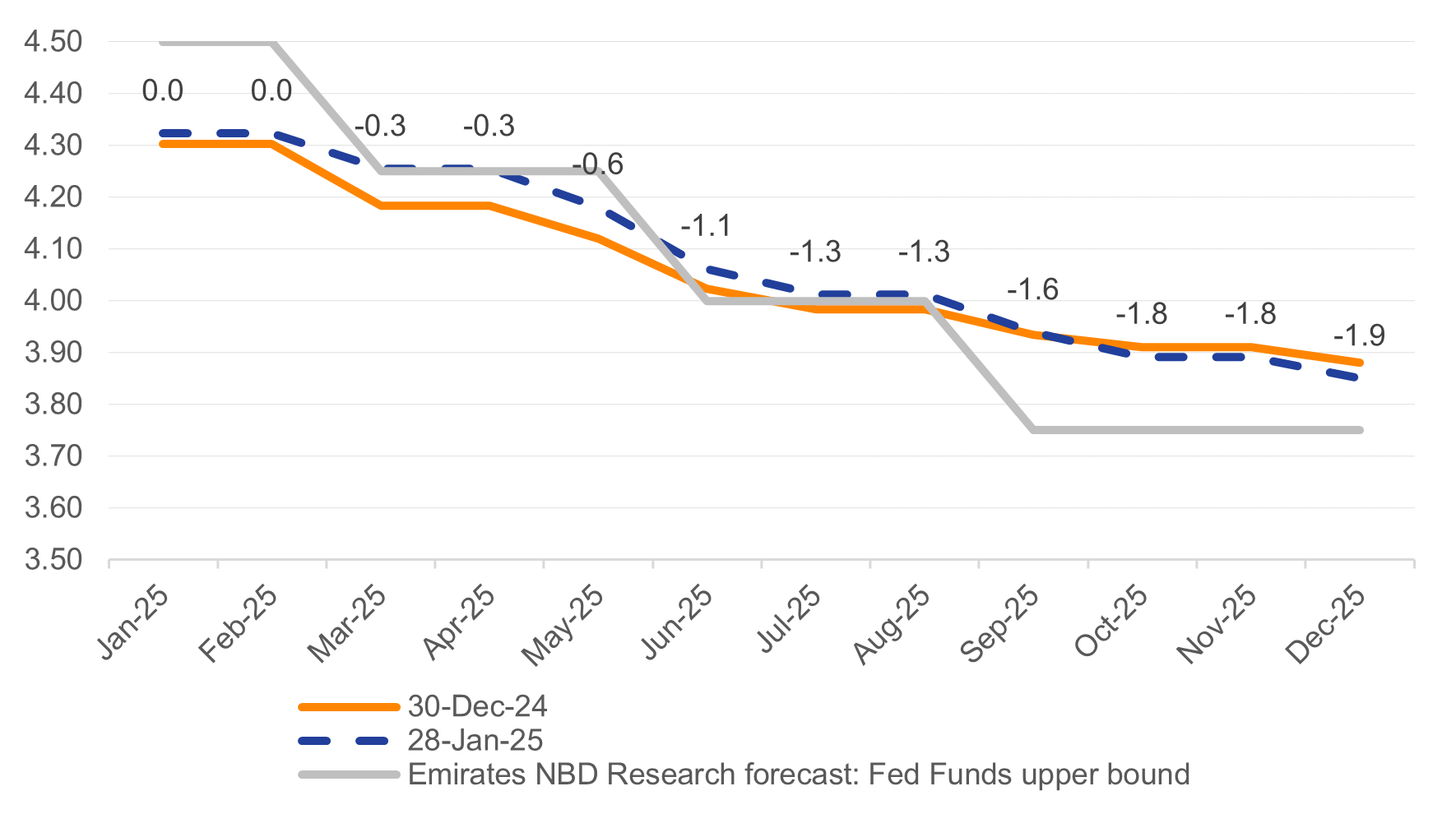

The Federal Reserve cut rates by 100bps in 2024, weighted toward the final months of the year. Inflation has moderated in the US even as activity in the economy has remained solid and the labour market continues to show signs of strength. At the December 2024 FOMC meeting, the Fed said the risks to hitting its “employment and inflation goals are roughly in balance.” At that meeting, however, the Fed adjusted to a more hawkish tone for 2025, cutting the projection for the Fed Funds rate in its December Summary of Economic Projections (SEP) to just 50bps of total cuts, from 100bps in its September SEP.

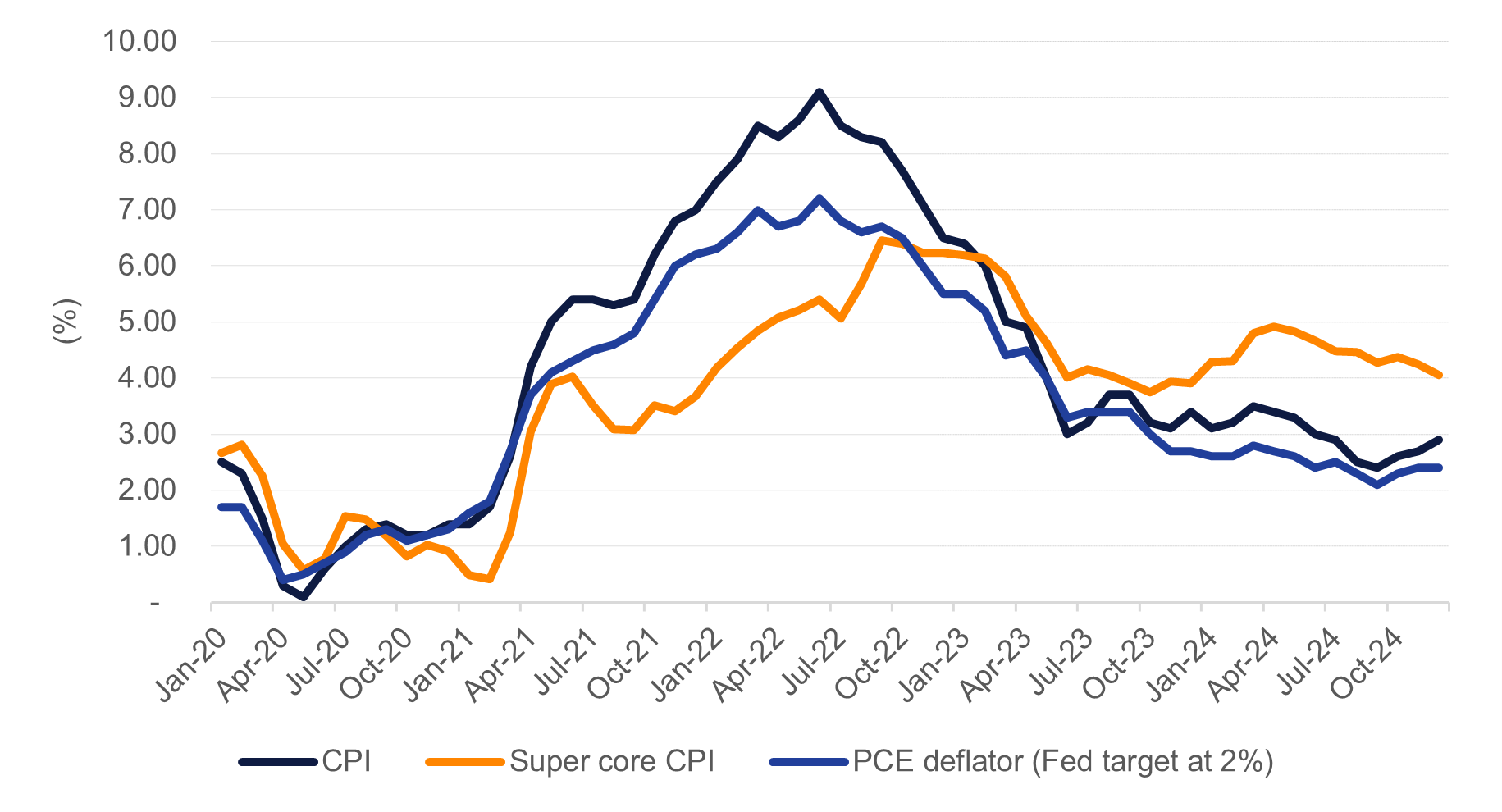

Fed Chair Jerome Powell also noted that progress on inflation had been “sideways” as the path of disinflation leveled off from a peak CPI print of 9.2% midway through 2022 to around 3% as of the end of 2024. PCE inflation, the Fed’s target measure, has also flattened out around 2.5%, still some ways above its 2% target.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

The Fed will now have to balance its assessment of current economic conditions, which are showing some signs of moderating but are still positive, against the potential inflationary effects of the new US administration’s policies. A clear stance on whether and to what scale the new Trump administration will impose tariffs has yet to be articulated. Newly confirmed Treasury Secretary Scott Bessent seemed to favour an initial 2.5% universal tariff that gradually increases while President Trump appears to want a much higher initial level, applied in a punitive measure against specific trading partners (both Canada and Mexico have been singled out for tariffs to be applied as early as February 1). Other measures from the new administration that could fuel inflation include a tighter labour market as migrant workers are removed from the labour force or are outright deported.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

President Trump has said that he will push energy prices lower—either by encouraging domestic production of oil and gas or by insisting on higher volume/lower prices from OPEC producers—which will allow inflation, and thus interest rates to drop “immediately.”

We still expect the Fed to focus on conditions in the US economy that are observable—current levels of employment and inflation—rather than try to set policy in anticipation of the potential effects of the administration’s policies. Nevertheless, there will likely be a maintenance of the hawkish edge to Fed commentary.

The Fed will also need to assess the sell-off in equity markets that has occurred in late January in response to the release of a new Chinese-developed AI model that is less technologically burdensome than some of the US-developed competitors. There have been sharp sell-offs in the value of firms feeding into the AI space but we do not see a direct macroeconomic pass-through. In fact, a disruption of incumbent firms in the AI sector and potential lower costs for technology could be a positive for wider adoption. We do not expect the sell-off in tech stocks to have a material bearing on the Fed’s decision this week.

We still expect that the Fed will lower rates this year and are holding to our forecast of three 25bps cuts, taking place once per quarter from Q1-Q3 2025. With 75bps of cuts and projected disinflation path for this year real rates—whether adjusted by CPI or PCE—in the US will still be above estimates of the real neutral interest rate.