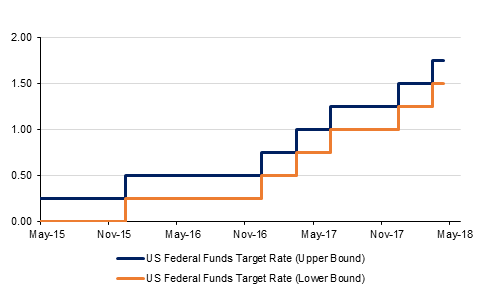

In a unanimous vote the FOMC left U.S. rates unchanged within a 1.50% to 1.75% band. The May statement noted that overall inflation had ‘moved close’ to its 2% target, which was a slightly more positive than the previous statement about it being ‘expected to move up in coming months’. The statement acknowledged the slowdown in consumption growth in the first quarter, but reiterated the FOMC’s view that this weakness is likely to be transitory. The decision and statement will do nothing to alter expectations of a further 25bp rate hike in June. Meanwhile the U.S. ADP reported private payrolls increased 204k in April after the 228k gain in March (revised from 241k). This tees up the official U.S. employment report tomorrow and suggests that the March non-farm payroll weakness of 103k will be temporary.

Preliminary estimates have shown that growth in the Eurozone slowed to 0.4% q/q in Q1 2018, compared with 0.7% in Q4 2017, slowing annual growth from 2.8% to 2.5%. This slowdown is likely to be temporary and caused by unseasonable weather and worker strikes, indicating that growth should rebound in the next quarter. None the less, the data is likely to invite caution from policy makers at the European Central Bank and could weigh on the Euro in the short term.

Elsewhere in the Eurozone, data from Eurostat showed that unemployment rate remained at a near decade low of 8.5% in March, despite the unemployment rate falling to 3.4% in Germany, from 3.5%, and to 8.8% in France, from 8.9%.

Finally, the Eurozone aggregate Markit Manufacturing PMI was revised upwards in April to 56.2 compared with the preliminary reading of 56.0. Despite the upwards revision, this still represents a slowdown from the previous month’s reading of 56.6. This represents a fourth month of slowdowns as a firmer Euro, trade risks and rising prices are weighing on demand.

Treasuries closed higher as the statement from the Federal Reserve was perceived to be slightly dovish to neutral against expectations of a more hawkish outlook. While the Fed did acknowledge that inflation was moving closer to its target of 2%, it highlighted the ‘symmetric’ nature of their target. This was read by markets as the Fed willing to allow inflation to overshoot its target in the short-term. Yields on the 2y UST and 5y UST dropped 2bps each to 2.48% and 2.79% respectively and the 10y UST yield remained flat 2.96%.

Regional bonds closed sharply lower with the YTW on the Bloomberg Barclays GCC Credit and High Yield index adding +5bp to 4.57% and credit spreads widened 6 bps to 182 bps.

Following declines during the Asia session to below 1.36, GBPUSD recovered in the Europe session as investors locked in profits before the FOMC policy announcement. However, the price remains below the 61.8% one year Fibonacci retracement (1.3694), the 200 day moving average (1.3536) is likely to be in scope for bears, with a break below this support level likely to indicate further declines. A weekly close below the supporting baseline from the weekly uptrend that has been in effect since March 2017 is now looking more likely. Should this occur, further downwards pressure may be inevitable.

Developed market equities closed mixed with the S&P 500 index dropping -0.7% and the Euro Stoxx 50 index adding +0.6%. Mixed corporate earnings and macroeconomic data weighed on investor sentiment. With the Fed maintaining status quo, there was minimal impact on equities following the meeting.

Most regional equity indices drifted lower with the Tadawul losing -0.7% and the DFM dropping -0.9%. Banking sector stocks continued to drag the Tadawul lower with Al Rajhi losing -0.6% and Samba dropping -2.8%. Emaar Properties and Emaar-related stocks remained a drag on the DFM index.

Crude futures managed to eke out some gains overnight despite a large jump in US crude inventories. Brent futures closed up 0.3% at USD 73.36/b while WTI added more than 1% to close at USD 67.93/b. Total crude stocks in the US rose by over 6.2m bbl last week while production continues to push higher. Saudi Arabia’s energy minister gave a statement saying that OPEC and its partners would be prepared to adjust plans if necessary at the end of the year. This is perhaps the first indication from Saudi Arabia in recent months that prices have finally hit a level with which they are comfortable and some increase in production may be need to avoid squeezing markets too tightly.

Click here to Download Full article