The US FOMC meeting left interest rates unchanged overnight as expected at 1.75-2.0%. However, there was a slight upgrade to the language of the Fed’s statement, with the Fed noting the economy has been rising at a ‘strong rate’ – stronger language than the ‘solid rate’ mentioned in the June statement. The Fed reiterated that ‘the Committee expects further gradual increases in the target range for the federal funds rate’ keeping a September hike in play, with another move likely in December too dependent on the data.

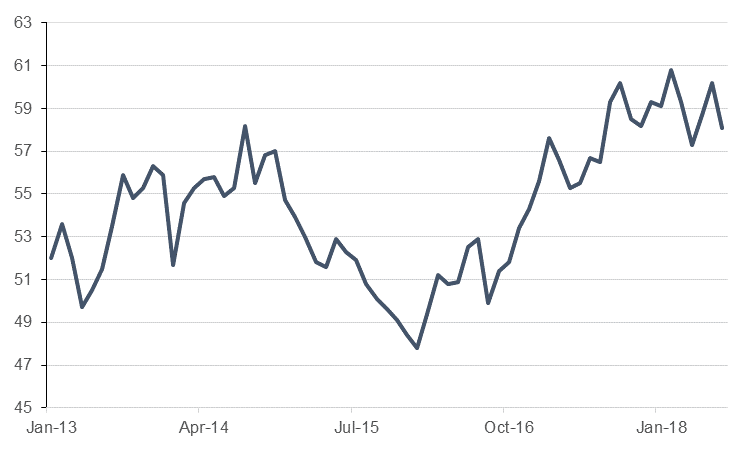

US data released overnight showed the ISM manufacturing index slip to 58.1 in July, from 60.2 in June, while the ADP employment survey rose 219k in July, versus 181k June, auguring well for the official non-farm payrolls release tomorrow. In terms of other data released yesterday the Markit Eurozone manufacturing PMI was confirmed at 55.1 in July, showing an expansion from 54.9 in June. In the UK however manufacturing slowed with the manufacturing PMI there falling to a three-month low of 54.0 in July, from 54.3 the previous month.

The focus today will be on UK Bank of England’s Monetary Policy Committee’s interest rate decision and accompanying August Inflation Report. With the recent activity and survey data suggesting that economic activity has recovered in Q2 as the MPC expected, this should give the MPC the opportunity to continue normalising policy by taking the bank rate up to 0.75%. But given the weakness of wage and inflation data the vote could be narrow, with cautionary comments also accompanying the decision and dampening the effect on markets,

Meanwhile the Reserve Bank of India (RBI) raised its policy rate again yesterday against a backdrop of rising core inflation. The repo rate went up by 25bp to 6.50% with the RBI retaining a neutral bias. Five members voted for the hike while one member voted for a no change. The successive hikes in interest rates suggest that the RBI can now afford to observe the effects of these moves and hold policy steady in the coming months.

FX

The USD was steady following the Fed’s unchanged interest rates decision overnight, seeing little overall movement although emerging market currencies were softer especially in Asia following reports that the Trump administration is considering increasing its proposed tariff on USD200bn of Chinese goods to 25% from 10% proposed previously. The TRY also sank to historic lows above 5.0 overnight following sanctions being imposed by the US on two Turkish government ministers.

This morning, Asian equity markets are having mixed performances and the Nikkei is currently trading 0.69% higher while the while the Shanghai composite is 0.32% lower.

Commodities

Brent futures fell 2.5% to close at USD72.39/b overnight, while WTI lost 1.6% to close at USD67.66/b. Brent’s close was the lowest since mid-July, while WTI had not seen these levels since June. Stories of ample supply have driven the market; yesterday’s EIA data release showed a surprise inventory build of 3.8mn b last week – analysts had anticipated a drawdown of 200,000 b – and Bloomberg has reported this morning that Saudi Arabia pumped 10.65mn b/d in July. These have helped dispel supply fears owing to North Sea shutdowns and the rerouting of Saudi Arabian vessels from the Bab el-Mandeb.