The minutes of the July FOMC highlighted the concern that most Fed officials have about the persistent low levels of inflation affecting the US economy although they did describe the spate of low prices as transitory and reflecting one-off factors. The Fed's preferred measure of price growth remains stubbornly short of the target of 2% despite the tightening labour market which should be pushing up wages and prices. The Fed officials also discussed when they would begin to pare down the agency's balance sheet, with the market expecting an announcement as early as next month. The markets received the minutes as largely dovish with both Treasury yields and the DXY index falling.

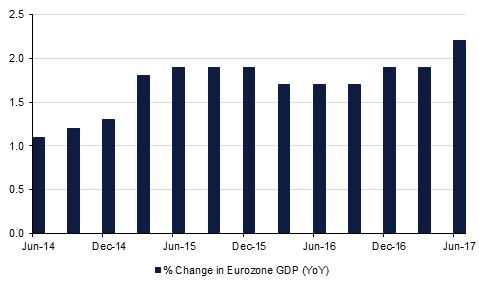

Preliminary data showed the aggregate Eurozone GDP expanding 2.2% y/y in Q2 2017, an upwards revision from the primary reading of 2.1% y/y. With this being an improvement on Q1’s figure of 1.9%, it confirms that economic recovery in the Eurozone continues. Indeed, timelier surveys released suggest that this recovery has continued into the start of the third quarter and reinforces market expectations for tapering from the European Central Bank.

The UK labour market showed further evidence of tightening after data from the International Labour Organization showed a fall in the unemployment rate and an increase in wages in June. The weighted three month unemployment rate fell from 4.5% in May to 4.4% in June while during the same period, average weekly earnings rose from 1.8% to 2.1%. Despite this uptick in wage pressures, they remain tepid in comparison to inflation and thus are unlikely to influence the Bank of England into raising interest rates sooner.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

|

| Time | Cons |

| Time | Cons |

| UK Retail Sales Ex Auto Fuel m/m | 12.30 | 4.5% | US Initial Jobless Claims | 16.30 | 240k |

| Eurozone CPI y/y | 13.00 | 1.3% | US Industrial Production m/m | 17:15 | 0.3% |

Source: Bloomberg.

Treasuries rose across the curve following minutes from the last Federal Reserve meeting. The minutes were considered slightly dovish amid considerable focus on the lack of inflation in the economy. Yields on the 2y USTs dropped 2 bps and 5 bps on the 10y USTs.

GCC bonds benefitted from the drop in benchmark yields. Yield on the Bloomberg Barclays GCC Credit and High Yield Index dropped 1 bps even as credit spreads widened by 3 bps.

In terms of single names, EA Partners bonds suffered following the bankruptcy lawsuit filed by Air Berlin. Fitch downgraded the bonds to CCC- following the news. The EAPART 20s dropped 4 points to close at USD 89.0 while EAPRT 21s dropped 6 points to close at USD 87.7.

The Saudi Finance Ministry informed that they will selling the second tranche of the SAR sukuk in week starting 20 August 2017.

Saudi Electricity signed a 5y USD 1.75bn syndicated loan co-financed by several banks. The outstanding bonds of the company closed marginally higher with SECO 24s closing at USD 105.30 (+0.21).

USD underperformed yesterday following the release of the FOMC minutes (see macro) and continues to add to losses this morning, softening against the other major currencies. Since the 16th of August, the Dollar Index has declined 0.48% to trade at 93.40, maintaining the downward trend that has been in effect since the 3rd of January 2017 and we could see further declines towards the 200 week moving average of 92.458.

This morning’s strongest performing G-10 currency is JPY which remains bid after better than expected trade data. The Japanese trade surplus for July was reported as ¥418.8bn, beating expectations for a surplus of ¥327.1bn. As we go to print, USDJPY currently trades 0.3% lower at 109.86. The movement of the last two days has taken the cross back below it 50 week moving average of 100.73 and leaves the risk of a second consecutive close below this level a distinct possibility. Should this situation arise, there will be short term risks to further declines.

Developed market equities closed higher as geopolitical tensions subsided and minutes from the Federal Reserve threw up no major surprises even though there were concerns expressed on the inflation front. The S&P 500 index and the Euro Stoxx 600 index added +0.1% and +0.7% respectively.

The Qatar Exchange (-1.2%) was a notable exception in what was a relatively positive day for regional equities. There was no standout single stock performer but largely bottom fishing in stocks which have declined in the past week.

Oil prices fell on the back of mixed data from the EIA. Brent futures closed 1% lower and WTI gave up more than 1.6%. The EIA reported a large draw of 8.95m bbl in overall crude inventories, well above market expectations. However, refinery demand and utilisation slipped along with flat gasoline stockpiles. US production also expanded to 9.5m b/d.

Despite the drop at the front of the curve, Brent remains in a narrow backwardation for the first two months but is largely flat along the rest of the forward curve. The WTI curve is a little steeper but both remain far flatter than they were 1 month ago.