As the US Congress continues to dither over a USD 2 trillion fiscal package the Federal Reserve stepped up to the plate yesterday by delivering a massive new stimulus, providing open-ended asset purchases (QE) and credit directly to corporates for the first time ever. US markets were initially relatively unmoved by the measures overnight, however, as economic projections are being sharply lowered, with investors moving from pricing in a recession to contemplating the risks of a depression.

Indeed the OECD warned yesterday that the economic fallout from the pandemic could last for years, while a prominent Fed official talked about the possibility of the unemployment rate reaching 30% in Q2. Congress’s stalemate is not helping matters either. Their proposed deal would including allocations for small-business loans, direct cash payments to households, enhanced unemployment benefits and a USD 4 trillion lending facility supported by the Federal Reserve. However, there are disagreements over some of the details including the amount of money being allocated to large companies. Markets can remember similar delays in Congress over the TARP (Troubled Asset Relief Program) during the last financial crisis, which saw equities drop before a deal was finally reached.

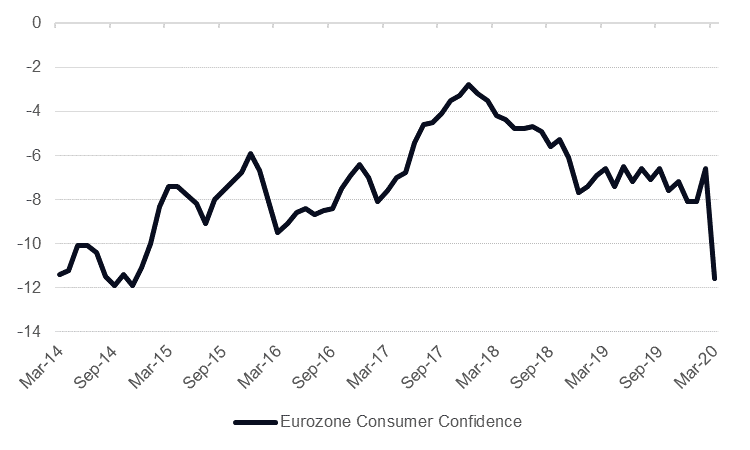

The EU is also seeking ways of providing a comprehensive fiscal stimulus package, which is just as well as economic data is starting to show some of the challenges facing them. Eurozone consumer confidence fell sharply in March to -11.6, its lowest level since late 2014, and this before most of the recent restrictions were implemented. Germany presented a fiscal package worth nearly 5% of GDP yesterday, while some ECB officials are signaling their backing for the possible use of the European Stability Mechanism - a fund established during the last financial crisis with a EUR500bn capacity, or just over 4% of Eurozone GDP. Another option being mentioned is the possibility of launching a Eurobond as a way to finance an EU-wide fiscal package, which would mark a significant step towards harmonizing fiscal policy.

GCC countries have intensified their efforts to curb the spread of the coronavirus, with Saudi Arabia imposing a nationwide curfew from 7pm to 6am yesterday for the next three weeks. The UAE has closed malls and restaurants and halted all passenger and transit flights for two weeks. Ratings agency Fitch now expects GCC governments in the GCC to draw down sovereign wealth fund reserves and issue USD 42bn in external debt to finance the expected widening in budget deficits. Fitch also estimated that sovereign wealth fund asset values have declined by more than USD 200bn this year as financial returns have turned negative.

The Lebanese ministry of finance has confirmed that it will no longer be paying maturing eurobonds, after having defaulted for the first time on a USD 1.2bn issuance which matured earlier this month. The country was already under severe financial strain even before the coronavirus pandemic which has put a stop to all tourism, an important source of dollars. A meeting with investors is scheduled for later this week.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

It was a choppy session of trading for treasuries as announcement from the Federal Reserve was offset by inability of the US Senate to pass the stimulus bill. The Federal Reserve, on its part, said it will buy unlimited quantities of USTs and asset backed securities and will set up programs to support credit flow to businesses. Yields on the 2y UST and 10y UST ended the day at 0.31% (flat) and 0.78% (-6 bps) respectively.

Regional bonds continue to suffer from general risk-off sentiment and sustained decline in oil prices. The YTW on Bloomberg Barclays GCC Credit and High Yield index jumped 18 bps to breach the 5% level while credit spreads widened further to end the day at 433 bps.

The Federal Reserve's announcement about expanded lending facilities, including unlimited bond purchases, caused EURUSD rally to highs of 1.0827 overnight after closing on Friday at 1.0695. It was a shortlived recovery however as it was met with resistance at this level and soon declined to around 1.0745 before recovering back to 1.08 this morning.

GPBUSD has also firmed a little this morning following the announcement of a lockdown in the UK last evening helping it to recover from yesterday’s low’s around 1.15 to above 1.16 currently. The USD also lost ground against the JPY after encountering resistance at the 111.59 level and it now hovers around the 110.30 level, while the AUD also improved following the Fed’s announcement, with bonds in both Japan and Australia rallying on the Fed news.

Notwithstanding a fresh booster shot from the Fed, developed market equities closed lower as the stimulus bill in the US Senate failed for a second time. The S&P 500 index dropped -2.9% while the Euro Stoxx 600 index declined -4.4%.

Regional markets remained under pressure as governments ramped up restrictions on economic activity. The DFM index and the Tadawul dropped -3.8% and -2.9% respectively. Egyptian equities were an exception with the EGX 30 index adding +3.0% following announcement from the government that it has allocated EGP 20bn to support the equity market.

Oil prices have managed to stabilize over the last few days, bolstered by the Fed’s “do everything” approach to easing funding strains and new rounds of QE. Brent futures settled up slightly overnight but have popped by more than 4.5% this morning to trade at USD 28.26/b while WTI is holding just shy of USD 25/b, up 5.7% in early trade today.

Prices may also be receiving a bid from anticipation that the US—or Texas in particular—may somehow “join” OPEC in restraining production. We aren’t holding our breath to see that emerge. The US oil industry is hugely dynamic and market conditions such as these allow for the necessary destruction of firms lower down on the efficiency curve, freeing up their assets to be taken on by leaner, more effective players. Moroever, OPEC has already tried to cooperate with Russia, a relatively diversified economy compared with most OPEC member nations, and that has ended in failure. The Texan economy’s largest sector is services—70% of private sector output according to the Dallas Fed—insulating to the fluctuation in commodity prices.