The US Federal Reserve adopted a much more dovish tone at its first FOMC meeting of the year. The Fed left rates unchanged at 2.25%-2.50% but toned down their description of the performance of the US economy. More pertinently for the future trajectory of interest rates, the Fed said it would be ‘patient’ and also cut its reference to ‘further gradual increases’. The dovish tone from the Fed helped spur a positive move in risk assets and sank yields on 10yr USTs to below 2.7%. Markets will increasingly price in no move from the Fed later this year and may even begin to grow more assertive at the margins for a rate cut as early as 2020. Private sector data out of the US showed another positive report from the jobs market for January. The ADP private payrolls survey rose by 213k in January following on from the very strong 263k added in December. The NFP report due out tomorrow also projects a decline from December’s large gains while wage growth is expected to hold steady at around 3.2% y/y.

The latest round of US-China trade talks has begun in Washington. The two sides are working to reach an agreement on trade before a March 2nd deadline would see tariffs on goods traded between the two countries increase again. Both sides remain far apart on issues surrounding implementation and supervision of reforms to the trading relationship, particularly around Chinese support for national companies. However, pressure will be growing in China to ensure a deal is reached. The official manufacturing PMI data for January showed a second month of contraction in the critical sector. The manufacturing PMI hit 49.5 after falling to 49.4 in December.

The Turkish central bank released its Q1 2019 inflation report yesterday, in which it revised down its end-2019 inflation forecast from 15.2% last quarter to 14.6%, while the end-2020 outlook was changed down from 9.3% to 8.2% - though this remains well over the target rate of 5.0%. Highlighted factors behind the revisions included a stronger lira, weak demand, and lower oil prices. The TCMB continued to strike a cautious note, pointing out residual upside risks to price growth, and the subsequent presentation was further reassuring to markets as Governor Murat Cetinkaya reaffirmed the commitment to tight monetary policy made in the past several MPC communiqués.

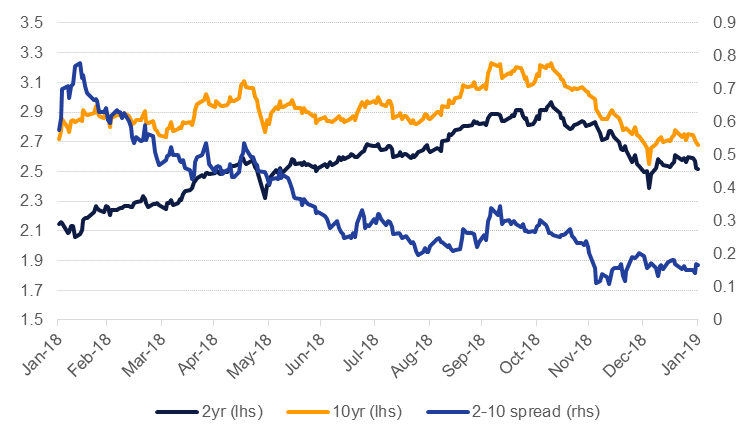

USTs build up on previous gains with yields falling in response to the Fed’s plan to remain patient with future rate hikes. Yields on 2yr, 5yr and 10yr USTs closed at 2.51% (-6bps), 2.48% (-7bps) and 2.68% (-3bps) respectively with 2yr10yr spread rising to 17bps.

Despite falling benchmark yields and marginal increase in oil prices, GCC bonds remained largely unchanged. Yield on Bloomberg Barclays GCC bond index closed range-bound at 4.50% as credit spreads widened 4bps to 193bps. That said, credit default swap market in GCC had a more constructive day with spreads remaining largely unchanged with only notable movement being 1bp tightening in 5yr CDS level on Abu Dhabi to 63bps.

USD was on the backfoot overnight after the Fed adopted a dovish stance during its January FOMC meeting. Against the EUR and GBP, the dollar slipped by 0.4% while JPY saw more muted gains. Commodity currencies all strengthened against the USD thanks to a gain in oil prices along with the Fed’s commentary.

EM currencies gained nearly across the board on the dollar overnight with TRY back to 5.22, helped along by more realistic and committed language from the TCMB on its inflation objectives. CNY also gained although markets will be closely watching the outcome of today’s US-China trade talks.

US equity markets surged on the Fed’s more dovish assessment of the trajectory for rates. The S&P 500 gained 1.55% while the Dow ended the day even higher. Better than expected earnings from Facebook and an upgrade to Boeing’s profit outlook helped push markets higher.

Local markets underperformed. The DFM fell 1.1% while the ADX was down 0.56% and the Tadawul was flat.

Crude oil prices gained overnight as the weekly EIA data tilted to a short-term bullish bias. WTI closed up 1.7% at USD 54.2/3b while Brent futures added 0.5% to close at USD 61.65/b. Geopolitical risks around Venezuela are also increasing which will help to keep a bid under crude in the near term. However, the shortage of heavy crude caused by US sanctions on Venezuela may be relieved to a degree as the Canadian province of Alberta will ease back its restrictions on production in February and March, earlier than had been expected.

US crude stocks in the US rose by 919k bbl last week while there were draws in gasoline, distillates and propane inventories. Total inventories fell for the first time this year by 4.8m bbl. Production held steady at 11.9m b/d, up 2m b/d year on year while US crude exports are holding around 2m b/d.

The Brent curve has begun to steepen into backwardation more consistently even as the 1-2 month spread struggles to get much past USD 0.2/b. The June-December spread are at USD 0.46/b, its widest level since November last year.