Markets reversed early losses yesterday helped by the Federal Reserve which announced it will begin buying corporate bonds later today. The Fed has previously indicated that this would be in its tool kit, but had yet to start doing it having limited itself to ETF purchases. The Fed is creating a diversified index of corporate bonds and will include US company bonds that meet a minimum rating and maximum maturity criteria. Fed Chair Powell will testify to Congress later today and will likely repeat the dovish message about the economy delivered after the FOMC meeting last week.

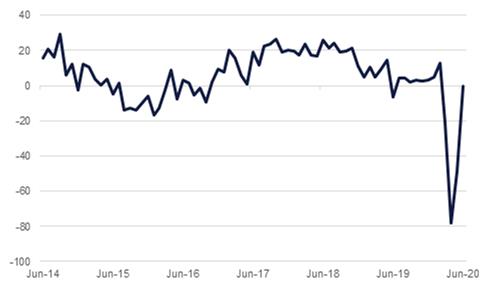

The news from the Fed along with better expected US economic data served to offset the negative impact on markets of weekend reports of renewed coronavirus cases in China where Beijing reported a new cluster of cases. The New York Fed’s Empire State manufacturing index jumped from -48.5 points in May to -0.2 in June, much better than expected. These followed a -78.2 record low seen in April. Gains were broad based, with the employment component improving to -3.5 from May's -6.1 and new orders surging to -0.6 from -42.4. The workweek increased to -12.0 from -21.6, while prices paid climbed to 16.9 from 4.1. There was also encouraging news from Europe where the EU and UK agreed to intensify talks over a trade deal following a high level video conference held yesterday, something given more urgency by the recent UK decision not to extend transitional trading arrangements beyond this year.

Consumer prices rose by 0.1% m/m in Dubai last month, driven largely by higher transport costs. However, this was offset by lower housing and food prices. On an annual basis, prices were down -3.5% y/y in May, the steepest rate of deflation since March 2019. Food prices were 5.5% higher than a year ago, but housing, clothing & footwear, transport and recreation & culture were all down sharply. With excess capacity and soft demand, we expect inflation for the whole UAE to average -1.5% in 2020.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

It was a choppy session of trading for USTs. Early session gains were pared following announcement by the Fed that it will begin buying individual corporate bonds under its secondary market corporate credit facility. Yields on the 2y UST and 10y UST ended the day at 0.19% (flat) and 0.72% (+2 bps) respectively.

Regional bonds came under pressure at the start of the new week. YTW on Bloomberg Barclays GCC Credit and High Yield index rose +5 bps to 3.26% and credit spreads widened 5 bps w-o-w to 262 bps.

The dollar failed to consolidate on the gains it experienced at the end of last week. The DXY index, a measure of the dollar against a basket of major currencies, traded mostly sideways for the day, only for it to fall in the evening and continue to fall this morning to trade at 96.480. This comes off the back of an announcement by the Fed saying that they will begin buying individual U.S. corporate bonds. USDJPY struggled for a firm direction on Monday but had made some modest gains this morning to trade at 107.55.

The euro rallied amid the dollar's weakness in the evening, increasing over 0.70% to 1.1340 as market mood improves. Sterling trades at 1.2665, buoyed by fresh Brexit optimism after U.K. Prime Minister Boris Johnson said that there is a good chance of a deal being made. Similar to the euro, the AUD and NZD both rallied in the evening off the back of the slump in the dollar. Both currencies slipped towards the end of last week, but saw a resurgence in the evening that has continued this morning to trade at 0.6960 and 0.6500 respectively.

Developed market equities closed mixed as the decision of the Federal Reserve to start buying corporate bonds from today provided a boost to investor sentiment. The S&P and the Euro Stoxx 600 index ended the day +0.8% and -0.3% respectively.

Regional equities also traded mixed. The DFM index lost -1.9% while the KWSEPM index rebounded +1.2%.There was very little in terms of corporate news flow.

Oil markets showed some wide oscillations to start the trading week but both Brent and WTI futures managed to close higher yesterday. Brent settled overnight at USD 39.72/b, up 2.56% while WTI was up 2.37% at USD 37.12/b. Both are heading lower in early trade this morning, however, down by around 1% each.

Iraq has reportedly asked international oil companies operating in the country to limit production in line with Iraq’s OPEC+ production cut targets while also requesting importers to defer loadings of crude to bring exports down. Elsewhere, the EIA estimates that production from shale basins will drop by 93k b/d m/m in July to 7.63mb /d as exploration and production companies slash spending and take rigs out of operation. Drilling productivity is estimated to increase as far fewer rigs are still allowing for production of more than 7m b/d.