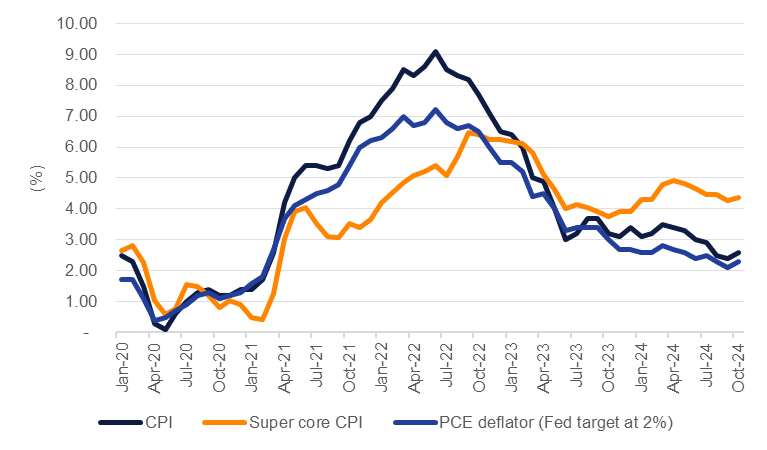

PCE inflation in the US rose by 2.3% y/y in October and was higher by 0.2% m/m. Core PCE inflation, which the Federal Reserve often refers to as a more comprehensive measure of inflation in the economy, rose to 2.8% y/y in October, up from 2.7% a month earlier and was 0.3% higher m/m. PCE inflation has been following the same disinflationary path as headline CPI, moving from a peak of 7.2% midway through 2022 to close to the Fed’s target level of 2%. However, the disinflationary path in both the PCE measure and headline CPI looks to be decelerating in recent prints as core services prices continue to show stubbornly sticky levels of inflation.

The minutes of the November FOMC that were released earlier this month showed that policymakers advocated a gradual shift lower in policy rates and the data that has come out from the US economy in recent weeks would seem to endorse that view. CPI inflation bounced higher in the most recent print for October, up to 2.6% y/y from 2.4% a month earlier, while producer price inflation spent a brief month in deflation in September before climbing to growth of 0.7% y/y in October.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

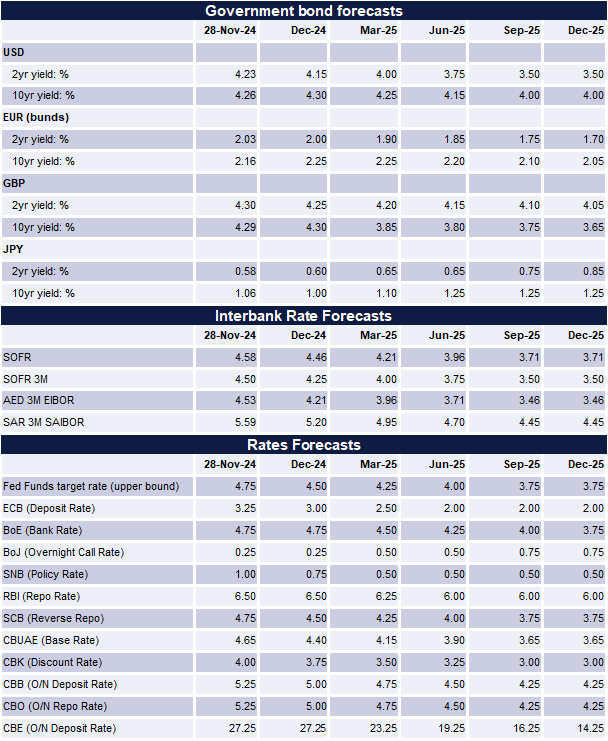

The final FOMC meeting for the year takes place on December 18 and the Fed will get several more data points to observe before making a call on whether to cut rates again. Nonfarm payrolls for November will be released on December 6 where levels are expected to normalize to growth of 200k after strikes and hurricanes impacted the October print with just 12k jobs added. On December 11-12 CPI and PPI inflation will be released with consumer prices likely in focus to see if the disinflation trajectory has stalled out more.

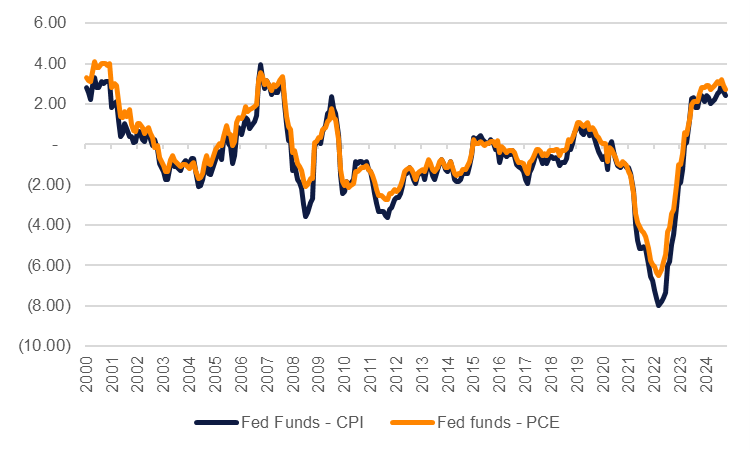

Our baseline view has been that the Fed will cut again in December by 25bps as it wants to move policy to a stance that is “less restrictive” and it will do so at a gradual pace. Based on CPI inflation, real rates in the US are still elevated and have only marginally ticked lower following the Fed’s rate cuts since September.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Market expectations for the December FOMC have oscillated since the election of Donald Trump earlier this month as markets anticipate a higher inflation path in 2025. But none of those will have an impact on data in the run-up to the December FOMC. We maintain our view that the Fed will cut by 25bps in December as they will be responsive to data that, while bumpy, is still heading in the right direction. As of the end of November, markets are assigning about a 2/3rds chance of another 25bps cut in December, higher than the 50-50 chance priced in only as recently as last week.

Trump policy priorities taking shape

Many of the policies that President-elect Trump had advocated during the campaign—tariffs, lower taxes, deregulation, restrictions on immigration—are on the surface prone to causing inflation. However, the degree to which those policies are enacted will matter much more for the inflation outlook than just their consideration as policies in the next administration. The tone of the new administration is now taking shape with a mix of more market-oriented officials in key positions like Treasury and more politically motivated policymakers in other departments. That would imply that on economic policies at least some of the policies announced during the campaign may be moderated or enacted by degree, rather than in full. Markets were shaken this week by President-elect Trump’s announcement of 25% tariffs on Canada and Mexico but his plan to increase tariffs on China by an additional 10% falls well short of the 60% tariff on all imports from China that he proposed during the campaign.

Rates will be on a higher path in 2025

For the rest of 2025 our expectations of another five 25bps cuts (125bps total of easing) looks too accommodative for an economy that has maintained good growth momentum and is seeing slow, but positive, progress on disinflation. Market consensus is for the US economy to cool to growth of 2.1% with inflation decelerating close to target levels. We expect that the Fed will continue to respond to that data rather than anticipate the effect of Trump policies whose impact would likely only be observable into the later months of 2025. We are now revising our view to three 25bps cuts next year, spaced out toward the end of Q1, Q2 and Q3 before the Fed takes an extended pause.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

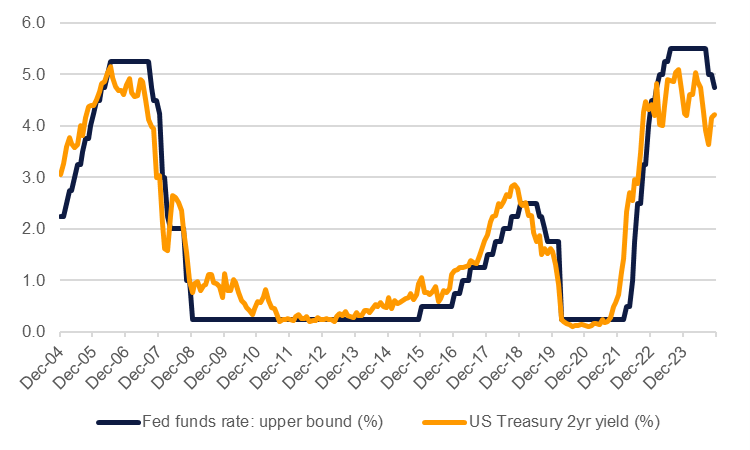

Treasury markets have begun to price in a higher path for Fed rates, although the scale of the move looks exaggerated. Since the start of September the 2yr UST yield has risen by 35bps while the Fed has cut rates by 75bps. Yields at the front end should follow the Fed Funds in 2025 provided there is clear and consistent policymaking in the new US administration. By contrast, an apparent lack of anxiety on the fiscal position of the government from the new administration will likely keep the term premium wider for the 10yr Treasury, contributing to a steeper curve next year.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.