The Federal Reserve kept policy unchanged at the June FOMC meeting, holding the Fed Funds rate at 5.5% on the upper bound. The only notable change to its statement being that there was “modest further progress” toward hitting the Fed’s inflation target, compared with a “lack of further progress” that they signalled at the May FOMC.

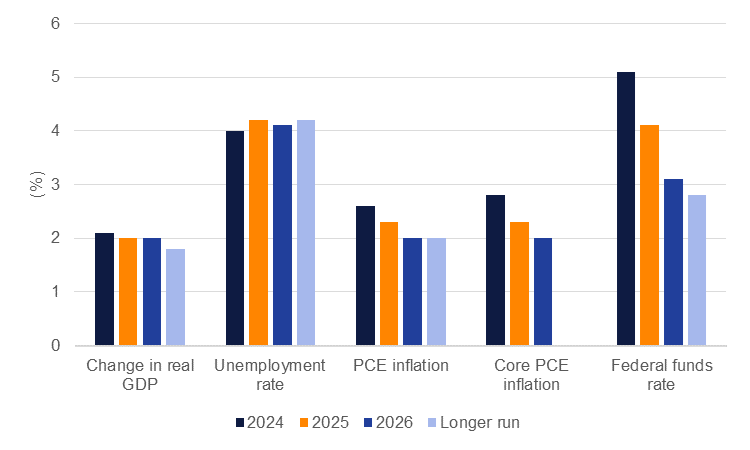

The Fed also released a new summary of economic projections (SEP) with the forecast for GDP growth in 2024 unchanged at 2.1% along with the unemployment rate at 4%, unchanged from their March projections. The Fed did revise higher their expectation for PCE inflation to 2.6% this year and to 2.3% in 2025. According to the new SEP, PCE inflation will only hit the Fed’s target level by 2026.

Source: Federal Reserve.

Source: Federal Reserve.

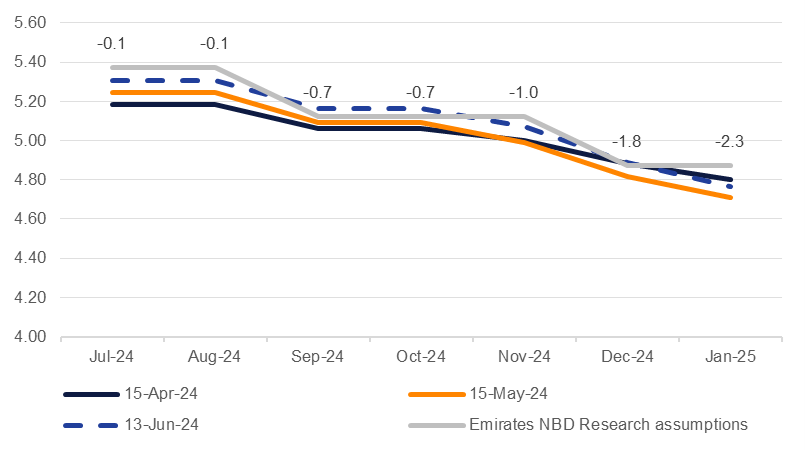

The dots plot was also revised with the median forecast among Fed officials now for just one 25bps cut in 2024, compared with three in the March SEP. While four policymakers opted for no rate cuts this year (up from two in the March plot), the split between committee members who thought rates were likely to be 25bps or 50bps lower by the end of 2024 was fairly tight, with 7 and 8 members respectively. For 2025, the median projection for the Fed funds rate was revised higher to 4.125%, up from 3.875% in March.

In his press conference following the decision Fed chair Jerome Powell said that the “most recent inflation readings have been more favourable” but that they still “need to see more good data to bolster our confidence” that inflation is heading toward target levels. He also noted that the labour market looked as though it had returned to conditions it had ahead of the Covid-19 pandemic and was in “better balance.” He also tried to temper some of the hawkishness in the dots plot by noting that while the median projection for rate cuts has dropped this year, the additional rate cuts have “just moved later” into 2025.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

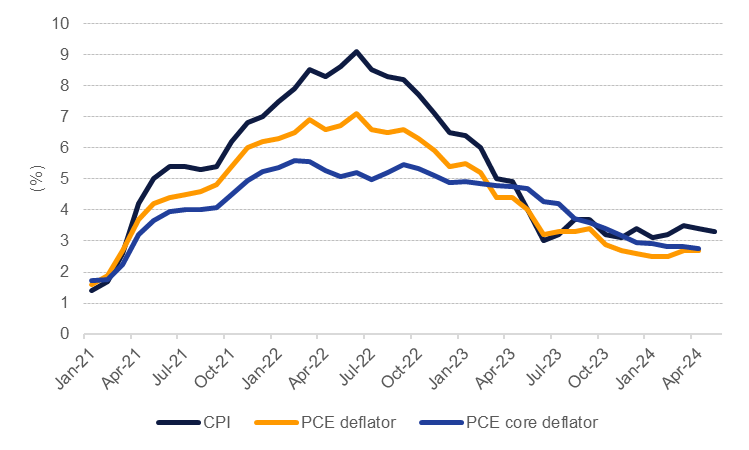

Ahead of the FOMC decision, US CPI for May came in cooler than expected with price growth of 3.3% y/y, slightly slower than the 3.4% print seen in April. On a monthly basis, prices were unchanged for the first time since July 2022. Core inflation was also slower than anticipated at 3.4% in May compared with 3.6% a month earlier. Super core inflation also slowed in May to 4.8%, down from 4.9%. The moderation in inflation was relatively mild but provided some comfort to markets after several hotter than expected prints so far this year. In terms of contribution to inflation, energy helped to flatten the monthly print with prices falling last month. Core services was still the main contributor to inflation with shelter and medical services adding the most.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

The overall message from the Fed was to maintain a hawkish eye over the economy while noting the progress that is being made on inflation. While the median forecast is for rates to be 25bps lower by the end of the year, the possibility of 50bps worth of cuts still remains live, particularly if inflation data follows a similar path to the April-May prints. For now we are holding our expectation for the Fed to cut rates by 25bps twice in the second half of 2024.