The Federal Reserve cut the Fed Funds rate by 50bps at the September FOMC meeting, taking the upper bound to 5.0%. The statement accompanying decision noted that the Fed had “gained greater confidence” that inflation would reach its 2% target and that risks to the dual mandates of stable prices and full employment are “roughly in balance.” There was one dissent to the decision with governor Michelle Bowman voting for a 25bps cut.

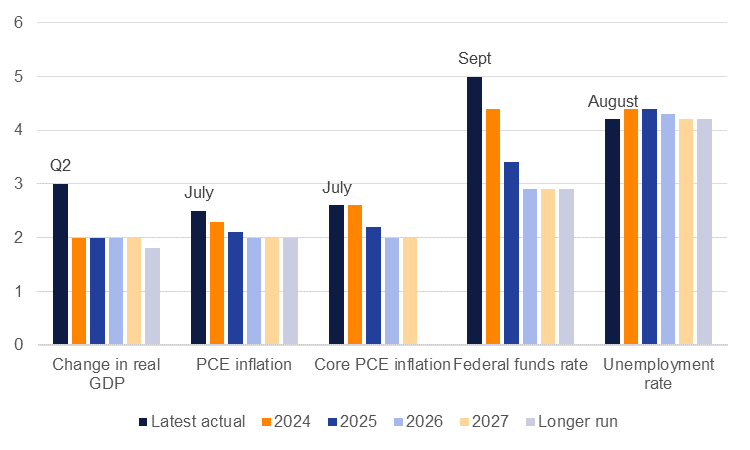

The Fed also released a new summary of economic projections (SEP), tempering their 2024 real GDP forecast expectation for 2024 to 2% from 2.1 % in June but holding their outlook for the next several years at 2%. For unemployment, the Fed had to revise its forecast higher given conditions in the labour market have weakened and it now projects unemployment at the end of 2024 at 4.4% (from 4% previously and not much higher than the 4.2% hit in August) and staying there until the end of 2025. On inflation, the Fed revised its projection for PCE inflation for 2024 downward to 2.3% from 2.6% in June and to 2.1% in 2025 (from 2.3% previously). Inflation is anticipated to hit target levels of 2% by 2026.

Source: FOMC, Bloomberg, Emirates NBD Research.

Source: FOMC, Bloomberg, Emirates NBD Research.

The most notable chance in the SEP was to the dots plot where the median projection for the Fed Funds rate at the end of 2024 is 4.4%, implying an additional 50bps of cuts from the September decision via either an additional 50bps or two 25bps moves. For 2025, another 100bps of cuts are projected though there appears to be a dovish bias with eight policymakers favouring even more cuts.

Powell talks up economy

In his press conference following the decision, Fed Chair Jerome Powell said that the Fed was “not in a rush” to adjust policy lower and that the Fed would keep the flexibility to move faster or slower on cutting rates as appropriate. Chair Powell cautioned that while the Fed started its rate cutting cycle with a 50bps move, it would not be the “new pace.” Powell also stressed that while the Fed can only observe the impacts of the neutral rate of interest, rather than identify it directly, it was probably higher than it had been and thus longer run interest rates would also need to be higher.

Overall, the messaging from the Fed was dovish and while Powell said he didn’t believe the Fed was behind the curve in cutting rates it now appears to want to get ahead of any potential deterioration in the economy, in particular in the labour market. Powell was at pains to say he believed the US economy was in good shape and data suggests that is broadly correct. For every soft data point from the US there seems to be another constructive one: core retail sales for August released this week were a little softer than expected while industrial production for the same month was much stronger.

Where do rates go from here?

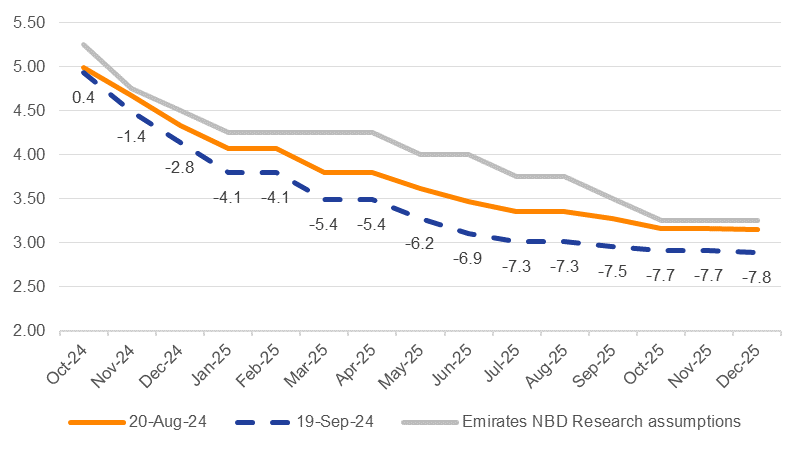

With a dovish tilt now seeming in place at the Fed we are revising our outlook for Fed rates in the rest of 2024 and 2025. For the remainder of this year we will take the Fed’s dot plot as guidance that they will cut another 50bps in total but that it will be spaced out in two 25bps moves at the November and December FOMC meetings.

For next year, the Fed’s dots plot projects another 100bps of cuts which would bring the Fed Funds to 3.5% on the upper bound. On its own, that would bring real rates (midpoint adjusted by the PCE deflator) to just 1.3% assuming inflation progresses in line with the latest SEP, and leave them very close to the range of the New York Fed’s estimate of the neutral interest rate (R*). We expect the Fed will want to maintain the balance of risks between inflation and the labour market and will want rates to be “less restrictive” rather than outright “accommodative” for the economy. Inflation has been on a downward path and the Fed seems to have the confidence that it will get close to target levels by the end of 2025. However, we see upside risks to the inflation outlook from the outcome of the US election—either from extension of tax cuts, expanded tariffs, tighter immigration policies, expansive government spending or, more likely, a combination of all these and other factors.

Our ex-ante forecast to the September FOMC was for 100bps of cuts in 2025 and we are now adjusting that to 125bps for 2025 (five 25bps cuts) as the Fed will try to maintain a precarious balance between inflation and employment. How the data on both progresses over the course of next year will shift the balance between them—if the labour market worsens more than the Fed expects, it will need to cut more though that would be accompanied by weaker economic activity and lower inflation more generally. Hotter than expected inflation would mean they temper the pace of rate cuts to well below market expectations.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Impact for the GCC

The central banks of Saudi Arabia, the UAE and Bahrain have all followed the Fed lower. In the UAE, the central bank cut the overnight deposit rate to 4.9% and in Saudi Arabia the bank cut the reverse repo rate to 5% while Bahrain cut its overnight deposit rate to 5.5%. Qatar moved by a larger 55bps move, taking the repo rate to 5.45% while Kuwait cut its discount rate by 25bps to 4%.

Lower interest rates will be a tailwind to non-oil economies across the region where many have a much lower inflation profile than the US. We had anticipated monetary easing would provide some assistance to the regional economies and thus are leaving our growth targets unchanged at this time.