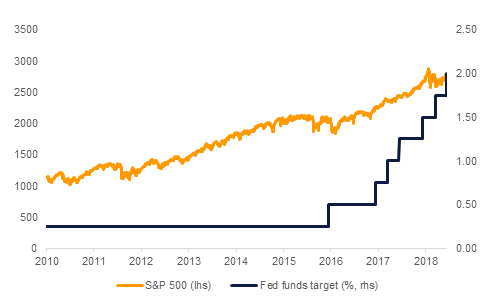

The Federal Reserve raised rates again overnight, taking the Fed funds target rate up 25bps to between 1.75% and 2%. The rate hike was largely anticipated by the market and more attention was focused on the Fed’s language about the outlook for the US economy as well as the trajectory for further rate rises in 2018. As far as the economy is concerned, the Fed is moving away from financial crisis-era language and described economic activity as solid and cut its pledge to keep rates low ‘for some time’ as well as signaling it could accept above-target inflation if it meant the economy continued to perform well. The FOMC also updated its projections for interest rates this year, expecting two more 25bps moves compared with just one more at its March meeting and held its projections for 2019 at three hikes. Central banks in the GCC have begun to respond to the Fed hikes with both Saudi Arabia and Bahrain raising policy rates by 25bps while Kuwait held its discount rate at 3%.

Inflation in the UK came in lower than expected at 2.4% y/y for May, steady on the April figure. The Bank of England had warned that inflation could accelerate over the coming months thanks to high oil prices but that it would eventually converge on its target of 2%. The softer than expected inflation data and mixed employment figures a day earlier has put the probability of an August hike at around 50%.

Industrial production in the Eurozone fell by 0.9% m/m in April, affirming a general slowdown in growth in the currency bloc. Output fell in all of the bloc’s five largest economy but part of the decline was relate to lower energy output after a surge related to cold weather in February-March. However, there was some positive employment data out from the Eurozone where employment rose by 0.4% in Q1 compared with Q4.

The UAE has adopted new visa rules for workers that are meant to lessen the burden placed on employers for sponsoring foreign workers. The government estimates that as much as AED 14bn could be reinjected back into the economy as fixed worker guarantee payments are replaced with annual fees of AED 60 per worker.

Treasuries dropped after the Federal Reserve hiked interest rates by 25 bps. Importantly, the Fed also upgraded its median dot plot projection by one additional hike than previously projected for 2018 and 2019. The Fed Chair Jerome Powell also confirmed that he will be holding press conference after every meeting from 2019 onwards. Yields on the 2y UST, 5y UST and 10y UST closed at 2.56% (+3 bps), 2.83% (+3 bps) and 2.96% (+1 bp) respectively.

Regional bonds drifted lower with the YTW on the Bloomberg Barclays GCC Credit and High Yield index rising 1 bp to 4.65% and credit spreads tightening by 1 bp to 187 bps. Most regional central banks followed the Fed in raising rate by 25 bps.

Despite falling to a one week low of 1.1742 in the immediate aftermath of the Fed’s 25 bps hike, EURUSD rebounded from these losses with the price finishing the day just shy of the 1.18 candle. Despite monetary policy makers in the US adopting a more hawkish tone, investors turned their focus towards the Eurozone where the ECB meets to set monetary policy this afternoon. The markets will be looking for insights and clues from Governor Mario Draghi on the central bank’s exit plan from the existing lose monetary policy and asset purchase programs.

In addition to the ECB meeting, EURUSD may also be influenced by US retail sales data, expected for release this afternoon. Following the FOMC’s tilt on Wednesday, investors will be looking for evidence supporting that the US economy remains firm enough to sustain a faster pace of monetary policy tightening.

Developed market equities closer mixed as a hawkish tone from the US Federal Reserve dragged US equities lower. The S&P 500 index dropped -0.4% while the Euro Stoxx 600 index added +0.2%.

Regional equities closed mixed as investors lower as investors locked in gains of Eid holidays. The DFM index and the ADX index lost -0.9% and -2.1% respectively

Oil prices gained overnight thanks to a surprisingly large draw in US crude stocks and warnings from the IEA about declining spare capacity. Brent futures were up more than 1% while WTI gained about 0.4%. Crude stocks in the US fell by 4.1m bbl last week and there were draws across nearly all the rest of the barrel. Production move higher though and is now within 100k b/d of hitting 11m b/d.