The Federal Reserve kept the benchmark Fed Funds rate unchanged at 5.25% - 5.50% at the March FOMC meeting. The statement accompanying the decision was nearly identical to that in January though it included an improved assessment of the labour market, saying that “job gains have remained strong” compared with “job gains have moderated” previously. As before, the Fed stated it wants “greater confidence that inflation is moving sustainably toward 2%” before cutting rates. While recognizing that inflation has slowed, the FOMC noted that it is still elevated, and reaffirmed that it was “strongly committed” to getting inflation back to the 2% target. In the post-meeting press conference, Chairman Powell said that the policy rate was “likely at its peak” and that cuts would be appropriate “at some point this year”. However, he reiterated that the Fed would be willing to maintain rates higher for longer if the data warranted it. On balance sheet reduction, he noted that the Fed will maintain the current pace of reduction in the balance sheet, but that they did discuss slowing the pace of QT “fairly soon”.

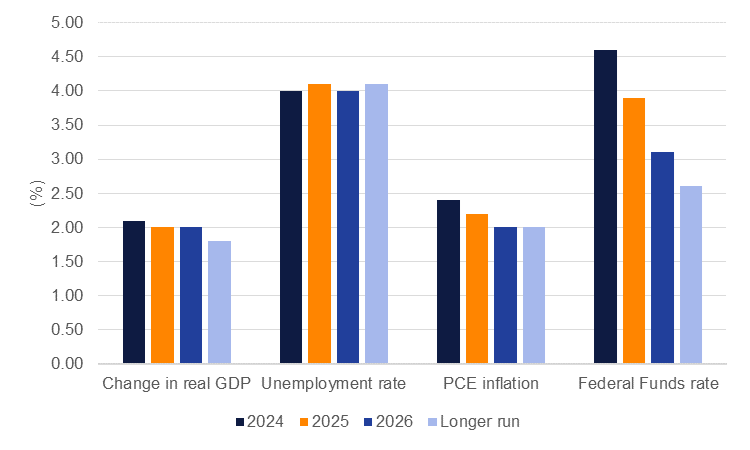

Source: Federal Reserve.

Source: Federal Reserve.

The summary of economic projections showed a sharp upward revision to this year’s GDP growth forecast to 2.1% from 1.4% in December, a modest upward revision to core PCE inflation to 2.6% from 2.4%, and a slight decrease in the forecast unemployment rate to 4.0% from 4.1%. Nevertheless, the dot plot showed 75bps in rate cuts remains the median scenario this year. The forecast for the Fed Funds rate in 2025 is higher however, implying a further 75bps cuts next year, compared with 100bps in the December dot plot. The long-run Fed Funds rate projection was also increased to 2.6% from 2.5% previously, suggesting that policy makers see the “neutral” interest rate for the economy as higher than previously thought. However, Chair Powell stressed that there was a high degree of uncertainty around the neutral rate in the longer term.

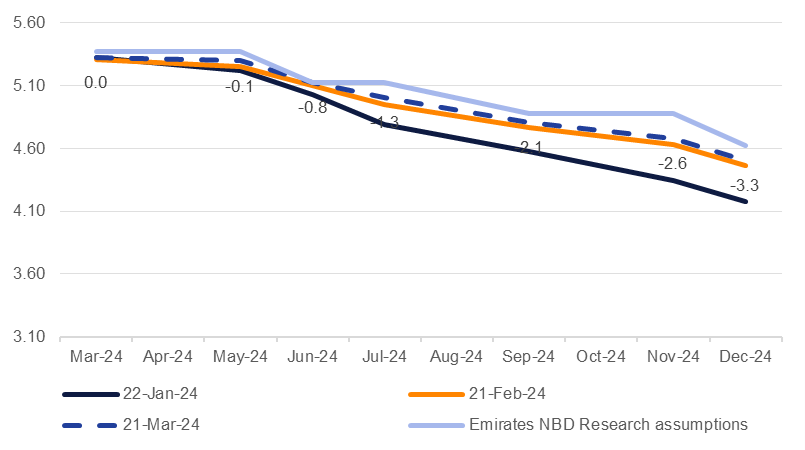

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

We maintain our forecast for the Fed to start cutting rates from the June meeting with a 25bps cut followed by two more spread out over Q3 and Q4 this year (75bps in total). For next year we have 100bps of cuts pencilled in for the Fed Funds rate, ending the year at 3.75% on the upper bound. However, depending on the fiscal stance of the next US government and its potential inflationary impact the risks to the rates outlook for next year could be skewed towards fewer cuts.