As expected the Federal Reserve confirmed that the benchmark federal funds rate would remain lower for longer as a result of its new approach to inflation targeting. While the Fed’s economic projections indicate that the US economy will contract by less than it had earlier expected (Q4 GDP is now forecast at -3.7% y/y vs -6.5% previously), the statement said that the pandemic would continue to weigh on activity, inflation and employment in the near term, and pose considerable risks to the economic outlook over the medium term. On interest rates, the statement said they would remain near zero until the labour market was at “maximum employment” and “inflation has risen to 2% and is on track to moderately exceed 2% for some time”. The Fed’s own forecast shows core PCE under 2% through 2022, this would imply interest rates remain unchanged until 2023-2024. Indeed the dot plot shows most FOMC members expect the Fed Funds rate to remain where it is until end-2023. However, the Fed’s statement did not indicate an change to its asset purchase strategy, instead saying the Fed would continue to purchase treasury securities and agency-backed securities “at least” at the current pace.

Meanwhile retail sales in the US in August came in below forecasts at 0.6% m/m. Retail spending slowed from July following the expiration of federal unemployment benefits, but remains around 2% above pre-pandemic levels.

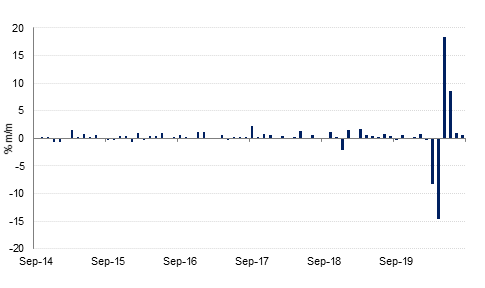

In the UK, CPI inflation fell -0.4% m/m in August, largely driven by the effects of lower VAT for tourism & hospitality and the “eat out to help out” scheme which resulted in a drop of -2.8% y/y on prices in the restaurant & hotels sector. Headline CPI fell to 0.2% y/y from 1.0% in July, but was slightly higher than the market had expected. The Bank of England’s MPC is not expected to make any changes to monetary policy at today’s meeting, but will likely expand its QE programme in the coming months.

The Bank of Japan kept rates on hold this morning as expected, and upgraded its outlook for the economy, saying activity is resuming gradually but that the rate of improvement was likely to be only moderate.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The long-end of the curve steepened yesterday, as the US 10-year added two basis points to 0.6969% and the 30-year 3bps to 1.4590% following the outcome of the FOMC meeting, and Fed Chair Jerome Powell’s statements on the economic outlook. The expectation that rates would remain low through 2023 at least, questions over the recovery, and the door left open for greater asset purchases, saw shorter-dated bond yields dip with the two-year falling from 0.1390% to 0.1370%.

It is a busy day close to the week for central banks, with the BoJ having announced that it was keeping rates on hold this morning, while keeping its asset purchase programme intact. A similar move is anticipated from the BoE later today, and we also have a number of EM central bank decisions including Indonesia, Taiwan and South Africa.

The USD advanced on Wednesday evening and has continued to do so early this morning after statements from Jerome Powell improved upgrading the economic outlook for the US. The DXY index rose by 0.43% and trades at 93.450. The JPY has maintained a position around the 105 handle after briefly dropping to 104.81 in the evening, its lowest point since late July.

The EUR was amongst the biggest movers of the day, dropping by -0.85% to reach 1.1745, just above the 50-day moving average of 1.1744. GBP rebounded from highs of 1.3007 and trades at 1.2910, which still represents some modest gains. All eyes will be on the British Parliament as they have their say on the controversial Brexit bill. Both the AUD and NZD declined by -0.51% and -0.45% to trade at 0.7265 and 0.6685 respectively. The latter snapped a four-day winning streak after the RBNZ released results of a stress test on lenders..

The lack of any new support measures announced by the FOMC, and Jerome Powell’s stress that ‘the path ahead remains highly uncertain’ – especially given that renewed fiscal support appears ever less likely for the time being – weighed on equities yesterday. The S&P 500 and the NASDAQ closed down 0.5% and 1.3% respectively, with the Dow inching up by 0.1%. European markets, which closed prior to the FOMC announcement, fared a little better, with the CAC (0.1%) and the DAX (0.3%) both gaining, although a stronger pound weighed on the FTSE 100 which lost 1.3% on the day.

Oil markets enjoyed strong gains yesterday, as WTI futures climbed 4.9% to close at USD 40.2/b – its first close above USD 40.0/b in two weeks – and Brent added 4.0% to USD 42.22/b. Prices were boosted by EIA data showing that US oil reserves had fallen by 4.4mn bbl last week to 496mn bbl – the lowest levels since April. Signals from the UAE that it would cut output, following its having missed its production curb targets earlier over the summer – also likely induced some upward price pressure.