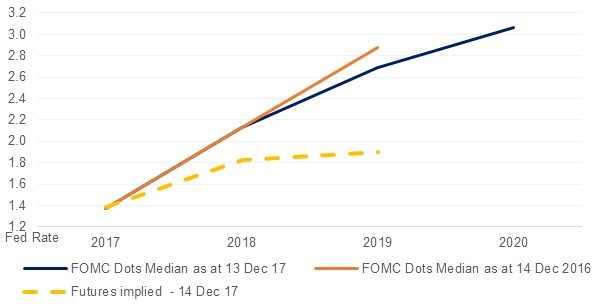

As expected, the US Federal Reserve raised interest rates by 25bps, taking the target rate range to 1.25%-1.50%, at the FOMC meeting yesterday. This represents the first time in recent history that Fed has been able to deliver to its yearly rate hike projections. At yesterday’s meeting the Fed remained convinced of its projection of three rate hikes next year, followed by two in 2019, while reiterating that inflation will remain below target.

GDP growth forecast for 2018 was revised upwards from 2.1% to 2.5% as a result of tax cut stimulus and that for 2019 and 2020 was projected at 2.1% and 2.0% respectively.

Core consumer inflation is expected to increase from an average of 1.7% in 2017 to 1.9% in 2018. However, the Fed Chair, Janet Yellen, admitted that there is imperfect understanding of how inflation will behave. That said, she reiterated that the Fed is prepared to adjust monetary policy as needed to achieve its inflation target of 2% over the medium-term. Keeping inflation in perspective, we note that headline CPI came in at 2.2% with core inflation felling from annualised pace of 1.8% in October to 1.7% in November, thereby creating unexplained conundrum for the policy makers.

Fed officials expect faster economic growth to lead to lower unemployment, with joblessness rate projected to fall to 3.9% by the end of next year, from 4.1% now. While the labor market is expected to stay strong, the pace of payroll gains is likely to moderate over time as the central banks gradually raises interest rates, according to Yellen.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

In reference to the US tax reform bill, although there is plenty of rooms for conflicts and delays, with the House and Senate having now each passed broadly similar bills, it looks highly likely that a fiscal stimulus, worth up to $1.5tn over 10 years, will be in place before the end of the year. Although President Trump continues to argue that his tax cut package will lead to significantly stronger expansion of the economy, Fed officials remain skeptical and only expect the plan to have modest and mostly short term impact.

As is logical, the UST yield curve steepens at the beginning of any rate hike cycle and then flattens over the rest of the rate hike cycle. With five rate hikes done in the current cycle and approximately five more to go before reaching the Fed’s projected long term terminal rate of 2.75%, it is not unreasonable to see the UST curve flattening.

In this cycle, the flattening of the curve is getting exaggerated attention mainly because the longer end of the yield curve has failed to register any increase despite five rate hikes to date. 10yr yields have remained muted and at 2.36% are only 10bps away from where they were before the first rate hike in December 2015.

While the rest of the bond market took the Federal Reserve’s latest interest-rate increase in its stride, Libor is surging. The steady march higher in the LIBOR shows the U.S. central bank’s tightening cycle does have consequences even as measures of overall financial conditions have eased as the Fed hiked rates this year. Libor serves as the basis for trillions of dollars in loans and floating-rate securities and affects borrowing rates for the corporates. Three-month dollar Libor reached 1.59% before yesterday’s Fed rate increase, the highest level since the midst of the global financial crisis in December 2008.

Given the pegged currencies, GCC central banks typically follow U.S. Federal Reserve interest-rate decisions. Kuwait pegs its dinar to a basket of currencies and tends to have some deviation away from the path taken by the Fed.

Following the Fed rate hike yesterday:

While policy rates in the region have generally followed the Fed move, interbank rates have increased at a much slower pace than the increase in the US LIBOR rates mainly as a result of higher oil prices boosting the liquidity in the local banking systems. Although 3m EIBOR rate has increased from 1.38% in February this year to 1.72% now, the current spread between 3m EIBOR and 3m LIBOR at only 14bps is at its lowest since the financial crisis. Thus while the U.S. rate hike in 2018 will likely see further increase in EIBOR rates next year, the spread against LIBOR may continue to compress.