The US Federal Reserve kept policy rates unchanged on Wednesday, leaving the upper bound at 4.5%. The unanimous decision had been widely anticipated and marked the second hold in a row from the FOMC following the 100bps of cuts implemented through September to December last year. The Fed also made changes to its Quantitative Tightening policy from the beginning of April, with the cap on debt that matures and not be replaced each month declining to USD5bn from USD 25bn.

The press release saw few changes and made reference to ‘somewhat elevated’ inflation and ‘solid’ labour market conditions while reiterating that the ‘Committee is attentive to both sides of its dual mandate.’ With no surprises on the decision, the focus was squarely on the commentary from Fed Chair Jerome Powell and the revised quarterly Summary of Economic Projections (SEP), with both suggesting that the path for rate cuts this year remains clear.

In his statement, Powell acknowledged the changes being implemented by the Trump administration around ‘trade, immigration, fiscal policy, and regulation’ but maintained that ‘uncertainty around the changes and their effects on economic policy is high’ and that the committee is ‘focused on separating the signal from the noise as the outlook evolves.’ As such, he said, the FOMC does ‘not need to be in a hurry to adjust our policy stance, and we are well positioned to wait for greater clarity.’

Source: Federal Reserve, Emirates NBD Research

Source: Federal Reserve, Emirates NBD Research

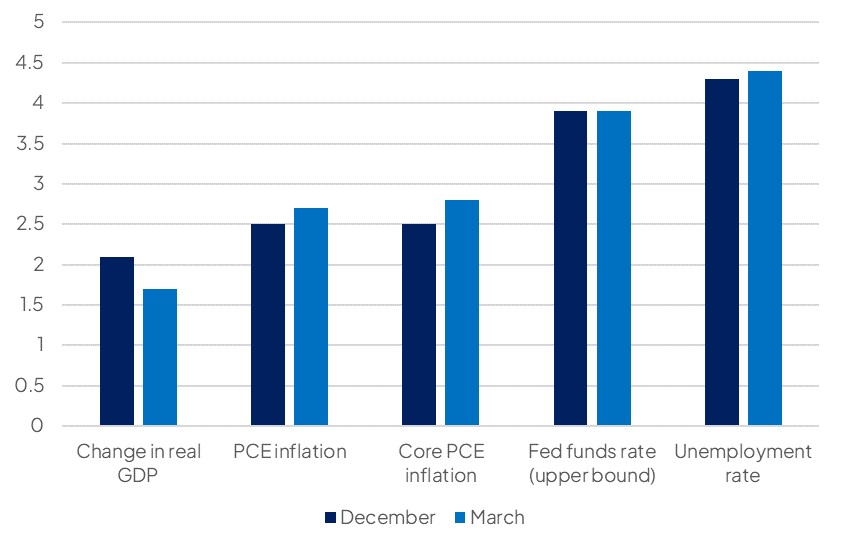

Powell elaborated on the press release in his statement, citing the still low (4.1%) unemployment rate and the resilient job gains which have averaged ‘200 thousand per month over the past three months.’ Labour market data has indeed been robust over the past month, indicative of a slowing economy but not one in freefall. However, the impact of DOGE cuts to government workforce and deteriorating sentiment more broadly are yet to feed through and the SEP forecast for unemployment at the close of 2025 moved up to 4.4%, from 4.3% in December.

On inflation, Powell’s statement highlighted the slowdown in price growth over the past two years, citing estimated core PCE inflation of 2.8% in February. However, he also acknowledged that inflation expectations are moving upwards as both consumers and businesses are increasingly concerned around the potential impact of tariffs on prices, and in his press conference he conceded that progress on bringing down price growth was ‘probably delayed for the time being.’ This was reflected in the revised SEP with officials now seeing core PCE inflation at 2.8% in Q4, up from 2.5% in the previous round of predictions. The 2027 forecast was unchanged at 2.0% with Powell saying that officials expected any inflationary pressure related to tariffs to be one-off and ‘transitory’.

The uncertainty related to tariffs was also likely behind the downgrade in GDP growth expectations in the SEP with growth this year now expected to slow to 1.7%, from the previous forecast of 2.1% growth (and down from 2.8% in 2024), while the 2026 forecast was revised down to 1.8%, from 2.0% previously. Powell’s statement highlighted the ‘moderation in consumer spending’ and this is starting to manifest in hard data now as well as deteriorating confidence indices. Retail sales in February fell well short of expectations with 0.2% m/m growth compared to the predicted 0.6%, with spending at food services and drinking places falling 0.2%.

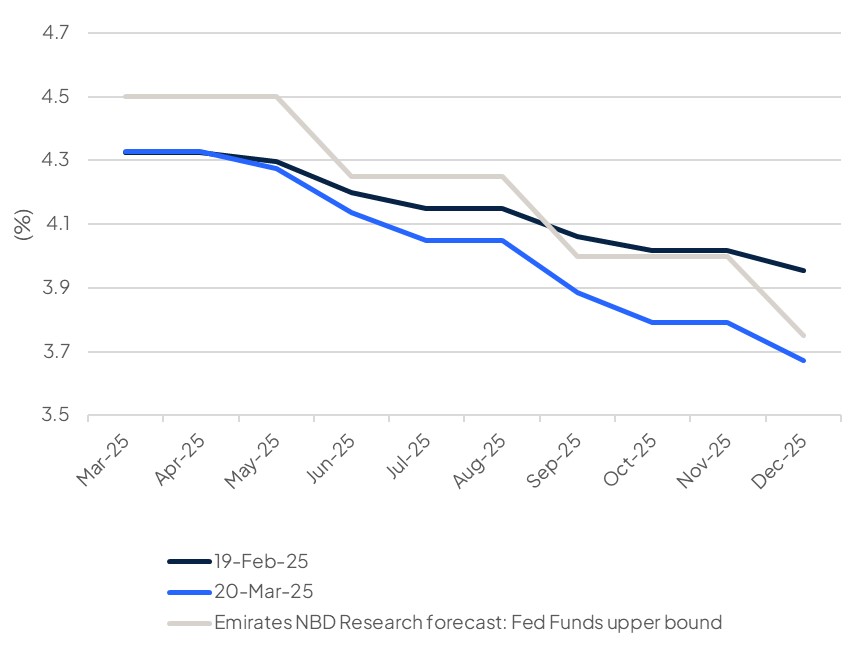

Despite the higher inflation expectations, the committee’s expectations for rate cuts, or the dot plot, remained broadly unchanged with the median expectation still that there is scope for 50bps worth of cuts to the policy rate this year. We anticipate that there may be slightly more, with a 25bps rate cut from the Fed at the June meeting, followed by one per quarter in Q3 and Q4 2025. As it stands it seems clear that the FOMC is prepared to look through the mounting noise around tariffs and other government policy changes for now and remain data dependent, and to date there has not been a material deterioration in the key indicators. As such, the Fed will likely maintain its aim of making policy less restrictive. There will be several more months’ worth of key labour market and inflation data indicators to parse prior to the June meeting when any impact of government policies will likely be easier to read.

Market reaction

The Fed decision was interpreted as a dovish hold by markets, especially given the no change to the dot plot, with the median of committee members still expecting two 25bps rate cuts this year. Equities gained with the Dow Jones up 0.9%, the S&P 500 1.1%, and the NASDAQ 1.4%. The dollar index closed up 0.2% against its basket of peers though it did pare the gains it had made in the run-up to the decision, having been up 0.6% shortly earlier. Yields on USTs meanwhile fell sharply, with the 2yr falling 11bps from its level just prior to the meeting to 3.9723% at the close. Markets are now pricing 66bps of cuts by December, compared with just 55bps just before the meeting.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research