The US Federal Reserve cut interest rates by a further quarter of one percentage point overnight as the markets had expected, taking the policy band to 1.50-1.75%. This was the third successive quarter point reduction, but it appears that the Fed is also seeking to draw the line under further easing for the time being. The statement removed its pledge to “act as appropriate to sustain the expansion,” while adding a promise to monitor data as it “assesses the appropriate path of the target range for the federal funds rate.” Fed Chair Powell also said that ‘”We believe monetary policy is in a good place…..and see the current stance of monetary policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook”. He also noted that the risks associated with trade tensions and Brexit were showing some signs of improving. Meanwhile there were two dissenters who wanted an unchanged stance.

Corroborating the Fed’s optimism about the economy, U.S. GDP growth slowed to just 1.9% in Q3, stronger than expected, after slipping to a 2.0% in Q2 and from 3.1% in Q1. Consumption was up 2.9%, also stronger than expected, while fixed investment dropped -1.3%.Government consumption was up 2.0%, while inventories and net trade subtracted from growth. The price deflator slipped to 1.7% y/y from 2.4%, while the core rate rose to 2.2% from 1.9%. Separately the ADP private sector jobs reports showed jobs rose by 125k in October, a good result considering ongoing strike activity at GM. Overall the stronger than expected data add to the argument in favour of the Fed pausing for now, also adding to the sense of it being a ‘hawkish’ easing. However, we would not rule out the Fed cutting rates again if the economy does start to weaken again, and retain one further cut in our forecasts for 2020.

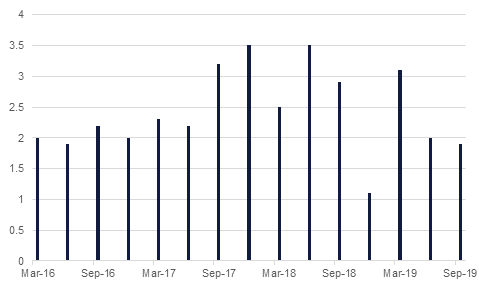

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

US treasury yields dipped lower again yesterday, with yields on benchmark 10yr USTs falling just shy of 7bps, and the 2yr UST yield falling 4bps. Despite the positive noises from Jerome Powell around trade wars and some better-than-expected GDP data from the US, the market anticipates another cut in 2020.

GCC sovereign five-year CDS were largely unchanged, but Lebanon’s continues to move sharply upwards, rising 245bps yesterday to new highs of 1,588.

The USD firmed a little after the ADP jobs report and a better than expected Q3 U.S. GDP report released yesterday. It also traded slightly higher after the Fed cut interest rates by 25 basis points, as was widely expected. Overall though, reaction to the Fed was relatively muted, and it subsequently unwound these initial gains as Powell indicated the Fed could cut again if conditions warrant.

The AUD and NZD are this morning’s best performing major currencies as a result of benefiting from increased risk appetite. As we go to print, AUDUSD is trading 0.33% higher at 0.6924 while NZDUSD is trading 0.68% higher at 0.6426. The JPY firmed slightly after the BOJ left its policy balance rate unchanged at -0.1%.

The S&P 500 hit a fresh high in the wake of the message from Jerome Powell that there would be no hike in rates barring a significant uptick in inflation in the US, helping the index gain 0.3%. The FTSE enjoyed similar gains, while the DAX lost 0.2%.

In the region, the DFM closed up 0.6%, while the Tadawul gained 1.3%. Building materials firm Al Kathiri Holding Company is scheduled to debut on the Saudi index on Sunday.

Oil markets sank in response to a build in US crude inventories. Brent futures, which expire today, fell by 1.6% and were trading close to USD 60.50/b in early trading this morning while WTI was off by 0.9% and has moved below USD 55/b. An interest rate cut from the Fed appears to have had limited impact on supporting oil prices.

US crude stocks gained by 5.7m bbl last week, far bigger than the market had been expecting. Production held steady at 12.6m b/d.

Brazil’s president, speaking at an investment event in Saudi Arabia, hinted that his country could potentially join OPEC. Brazil would be a significant new addition but joining at a time when significant upstream investment is underway and Brazil has plans to raise output would be at odds with OPEC’s current production restraint strategy. Saudi Arabia’s energy minister, Abdulaziz bin Salman, told the Future Investment Initiative that Aramco’s IPO was ‘coming soon’ and would hit markets at the ‘right time.’ Most of the minister’s comments addressed factors beyond the Aramco issue and OPEC, instead focusing on efforts to restrain oil demand growth in Saudi Arabia.