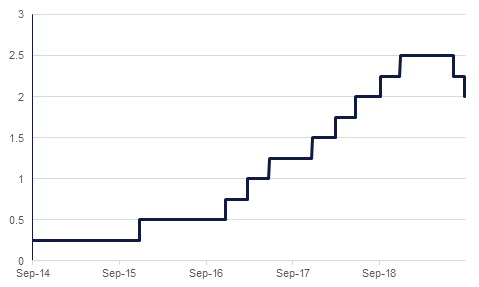

The US Fed cut its benchmark funds rate by 25bps last night in a widely anticipated move. There followed similar 25bps cuts by the UAE and Saudi Arabia central banks. Despite some recent strong consumer data, Chair Jerome Powell kept the focus on sluggish investment and exports, saying that the move was ‘insurance against ongoing risks’, and citing the ‘weakness in global growth and trade policy.’ There were three dissents, with two members wanting to keep rates unchanged, and one looking for a 50bps-cut.

With the result expected, the focus was on the language around its delivery, and the likelihood of further cuts this year which remains fairly uncertain as compared to last night. The market implied probability for a cut at the next meeting is just 41%, and the divide within the FOMC on more easing is greater than that seen yesterday. In other Fed news, it announced it would inject another dose of temporary liquidity following the jump in repo rates earlier this week, offering up to USD 75mn in an overnight repurchase agreement operation. It also cut interest rates on excess reserves by 30bps, and Powell pledged to maintain these operations to get markets back on track.

UK CPI inflation data for August was released yesterday, coming in slower than consensus expectations. While the data were always unlikely to swing the Bank of England rate decision later today in either one direction or another in the midst of ongoing Brexit uncertainty – a hold remains the overwhelmingly most likely outcome – the undershoot of expectations does support the bank’s likely decision to hold, even as a weaker pound and strong wage growth could raise upward price pressures down the line. Inflation was 0.4% m/m, up from 0.0% in July, but missing expectations of 0.5%. On an annualised basis, the headline figure was 1.7% (slower than consensus forecast of 1.9%), while core inflation was 1.5% (compared to 1.8% expectations and 1.9% in July).

Meanwhile, the European parliament’s Brexit debate, including speeches by European Commission president Jean-Claude Juncker and chief Brexit negotiator, saw speakers take pains to attribute the responsibility of finding a way through the impasse on the UK, while continuing to make positive noises about a potential resolution.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The Federal Reserve cut rates by 25 bps in line with expectations. However, the outlook for the rest of the year was more mixed. The Fed Chair Jerome Powell insisted that the Fed would remain data dependent and would not hesitate to ease monetary policy further should economic activity slow down. He reaffirmed that the US economy remains on solid footing and that most risks are external in nature.

Treasuries closed lower with yields on the 2y UST, 5y UST and 10y UST closing at 1.76% (+4 bps), 1.67% (+2 bps) and 1.80% (flat) respectively.

Following the Fed decision, central banks in the UAE and Saudi Arabia lowered key rates by 25 bps while Kuwait left it unchanged.

Regional bonds closed largely unchanged as investors awaited the Fed decision. The YTW on Bloomberg Barclays GCC Credit and High Yield index was flat at 3.24% and credit spreads hovered around 147 bps.

FX

There was little reaction to the Fed’s rate decision with the USD rallying modestly, as the market questioned how many more rate cuts might happen in the coming year. With three dissenters from the decision, the absence of a firm consensus about when the Fed might cut again saw the USD gain ground against both major currencies and emerging market ones before stabilizing after Chairman Powell said the Fed could resume organic balance sheet growth earlier than expected.

Developed market equities closed flat as the Fed cut rates by 25 bps and reiterated views that it would remain proactive in easing should the economy slow down. The S&P 500 index and the Euro Stoxx 600 index closed flat.

Regional equities closed mixed. The DFM index dropped -0.9% while the Tadawul added +0.7%. Market heavyweights led the gains on the Tadawul as tensions eased. Al Rajhi Bank and Sabic added +1.8% and +0.2% respectively.

Commodities

Oil prices continued to edge lower overnight as the market grew less anxious over the scale of disruption to supplies from Saudi Arabia. Brent futures fell nearly 1.5% to settle at USD 63.66/b while WTI closed at USD 58.22/b, down 2.1%. The IEA released a statement saying that it saw no need for a release of emergency reserves in response to the attacks.

Markets will continue to closely watch how quickly Saudi Arabia is able to restore production with the pace of repair likely evident in distortions to physical crude prices. The premium for Russian crude headed to Asia soared to over USD 7/b in response to the attacks as importers reorient supply routes.

EIA data was mixed overnight with a limited build in total crude stocks (1m bbl), mixed performance across productions and a dip in exports to 3.17m b/d (down 120k b/d w/w). Total inventories edged up slightly last week.