Ahead of Fed Chair Powell’s key testimony to Congress later today central bankers around the world are chiming in with their views on monetary policy, illustrating that conversations about policy normalization are very much the theme of the moment. The St Louis Fed President James Bullard said that he believes the current policy rate is ‘broadly appropriate’ but continues to fear the FOMC could raise rates too high and thus risk the policy stance becoming too restrictive. Bullard has taken a more dovish stance over the past year, but he is not a voter currently. Contrasting with Bullard, recently appointed Fed Governor Randal Quarles was more optimistic about the outlook seeing upside risks to growth as fiscal policy is likely to ‘impart considerable momentum to growth over the next couple of years’. On the policy front Quarles stuck to the FOMC's line ‘that further gradual increases in the policy rate will be appropriate to both sustain a healthy labor market and stabilize inflation around 2%’, a mantra that Jay Powell is likely to repeat.

Turning internationally Bank of England Deputy Governor Sir David Ramsden appears to have had a change in heart. Initially he dissented against a rate hike last November, but now he has stated that he ‘sees the case for rate rises somewhat sooner rather than somewhat later’ in interview in the weekend’s Sunday Times. Meanwhile the ECB's President Mario Draghi was typically cautious about the inflation outlook in the Eurozone in a speech to the European parliament saying that inflation has yet to show a sustained uptrend and that the inflation path remains conditional on ECB stimulus. Thus there was no hint that the ECB will commit to an end date for QE at the March ECB meeting which is now looming next week.

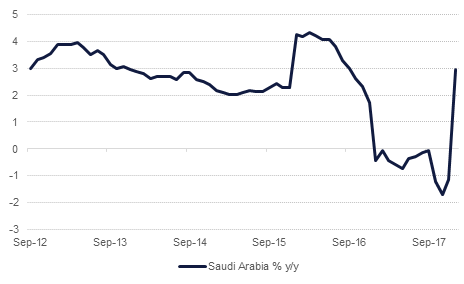

Finally Saudi Arabia’s cost of living index surged in January on the back of fuel subsidy cuts and the introduction of VAT. The headline index rose 4% m/m and 3.0% y/y from an average.

Source: Emirates NBD Research

Source: Emirates NBD Research

US Treasuries closed marginally higher as investors’ remained cautious ahead of Fed Chairman Powell’s testimony to the US Congress. Yields on the 2y UST, 5y UST and 10y UST closed at 2.22% (-2 bps), 2.61% (-1 bps) and 2.86% (flat) respectively.

Regional bonds continued to see some buying activity following stability in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index remained flat at 4.14% and credit spreads unchanged at 156 bps.

First Abu Dhabi Bank raised USD 650mn in a 5-year sukuk which was priced at MS+95 bps. The initial pricing guidance was for MS+110 bps.

NZD is trading softer against the other major currencies after softer than expected trade data. A report from Statistics New Zealand showed that there was a NZD 566mn trade deficit posted in January, accompanied by a narrowing revision of December’s surplus from NZD 640mn to NZD 596mn. As we go to print, NZDUSD is trading 0.33% softer at 0.72783. We see week support at 0.7261, the 61.8% one year Fibonacci retracement which has acted as a support since broken on 12 February 2018 and stronger support at the 50 day moving average (0.7243).

Currently USD is almost unchanged with the Dollar Index virtually flat this morning at 89.82. This evening markets will be eyeing Fed Chairman Powell’s testimony in front of Congress for future guidance of any shift in sentiment and monetary policy.

Developed markets closed higher ahead of Fed Chairman Powell’s testimony to the US Congress amid expectation that he will signal continuity of gradual increases in interest rates. The S&P 500 index and the Euro Stoxx 600 index added +1.2% and +0.5% respectively.

Regional markets remained sluggish with volumes continuing to remain below par. The Tadawul dropped -0.3% while the KWSE index added +0.8%.

Gulf Finance House, accounted for nearly 35% of total volumes on the DFM, gained +6.6% in another dull market.

Oil prices rose slightly to start the week, sending Brent futures up to USD 67.50/b while WTI closed just below USD 64/b. There were few data points for the market to absorb although output from Libya has again been disrupted as oil field guards have forced the closure of the El Feel field. Market structures remain virtually unchanged although the backwardation in Brent is now about half as wide (at USD 0.22/b) as it was at the start of the year.