Jerome Powell reiterated that the Fed would remain “patient” in its approach to setting monetary policy. In his testimony to the Senate Banking Committee yesterday, Mr Powell described the current economic conditions as healthy and said that the outlook was favourable, but highlighted uncertainty about government policy (trade issues, Brexit) as well tighter financial conditions and slower global growth as factors that needed to be considered. He maintained that the Fed would take be data driven in its policy decisions.

Data released in the US overnight was largely positive. The conference board’s consumer confidence index rose by more than expected in February, reflecting relief at the end of the government shutdown and the rebound in equity markets since the start of the year. The Richmond Fed’s Manufacturing Index also beat expectations, jumping to a 5-month high. However, the (delayed) housing starts data for December was weaker than expected.

In the UK, PM May agreed to allow parliament to vote on delaying Brexit if the deal negotiated the EU is not approved on 12 March, and if parliament subsequently voted not to leave the EU without a deal. The concession means that several conservative cabinet members who had threatened to resign if a no-deal Brexit wasn’t taken off the table will continue to support the PM. Mrs May is still trying to negotiate with the EU to get a deal that would be approved by parliament on 12 March.

The focus today is likely to be on the second day of Fed Chairman Powell’s testimony to congress, and the meeting between President Trump and Kim Jong Un in Vietnam. Key data to watch are US factory orders and the final durable goods orders for December, as well as pending home sales for January.

Fixed Income

Treasuries closed higher and the curve shifted lower as the Fed Chair Jerome Powell, in his testimony, stayed true to the recent messaging by the Federal Reserve. Yields on the 2y UST, 5y UST and 10y UST closed at 2.48% (-2bps), 2.44% (-3bps) and 2.63% (-3bps) respectively.

Regional bonds continued to drift higher following moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -2bps to 4.28% while credit spreads rose +2bps to 177bps.

Almarai raised USD 500mn through a sukuk which was priced 180bps over midswaps. The company received orders of c. USD 5.3bn and the issue was rated BBB- by S&P.

FX

GBPUSD continued its rally on Tuesday, boosted by market expectations of a “no-deal” Brexit becoming less likely. The resistive 50-week moving average (1.3153) as well as the 38.2% one-year Fibonacci retracement of 1.3181 were both breached and the price ended the day above these key levels. As we go to print GBPUSD is currently trading at 1.3246, close to its five month highs of 1.3263. In the short-term a decline towards 1.32 may be triggered as the Relative Strength Index (RSI) shows that the cross is currently overbought. However, while the price closes above the 38.2% retracement, further gains seem the path of least resistance.

Equities

Developed market equities closed mixed as investors’ locked in some of the recent gains. The S&P 500 index and the Euro Stoxx 600 index closed -0.1% and +0.4% respectively.

Regional equities closed higher as investors’ continued to buy undervalued stocks. The DFM index and the Tadawul added +0.9% and +0.3% respectively. Emaar Properties added +2.7% while Emaar Development gained +6.8%.

Commodities

Oil markets shook off the latest Trump tweet overnight and managed to edge higher. Both Brent and WTI futures are rising this morning with Brent at USD 65.63/b and WTI just over USD 56/b. OPEC is unlikely to heed to president Trump’s call to produce more oil given the US has helped to tighten markets thanks to sanctions on Venezuela and Iran. The API reported a decline in US crude stocks of 4.2m bbl last week with data from the EIA out later this evening.

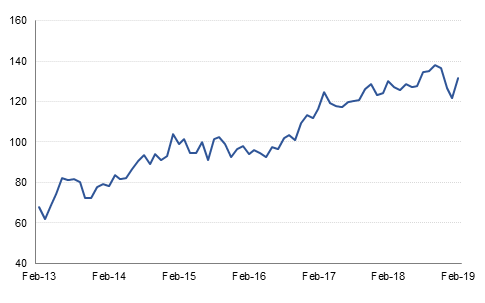

Palladium remains on its meteoric ascent, closing at USD 1,560/troy oz. With the momentum behind the metal, palladium could break higher and push as high as gold’s previous top of nearly USD 1,900/troy oz. Norislk, the largest palladium producer, warned that another deficit for palladium was likely in 2019 given a flat mined supply profile.