The US Federal Reserve meets this week facing the steady challenge of how to argue in favour of keeping policy extraordinarily accommodative when inflation is hitting multi-year highs. The Fed has maintained its line that the forces pushing CPI in the US up to as much as 5% in May are transitory and are a consequence of the reopening of the economy from the disruption to activity caused by the Covid-19 pandemic.

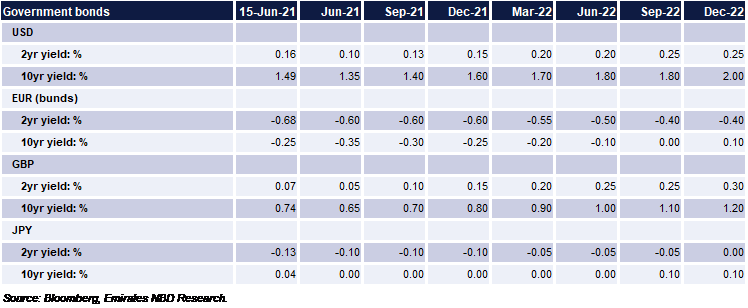

For now, markets appear to have at least accepted that the Fed will tolerate high price growth and keep policy easy even if market participants don’t necessarily agree with the economic logic. Yields on 10yr US Treasuries have fallen 25bps from their year-to-date peak close of 1.74% at the end of March to around the 1.45-1.50% level presently, not far off our own target for yields at 1.35% by the end of Q2. And that acceptance of Fed policy, if not necessarily agreeing with it, seems to be getting stronger. The April CPI print exceeded expectations by 60bps (4.2% y/y vs 3.6% median estimate) and yields jumped around 7bps on the day but the May print exceeded expectations by around 30bps (5% y/y vs 4.7% median estimate) and yields sank nearly 6bps.

.png)

Source: Bloomberg, Emirates NBD Research. Note: Over/under is actual versus median estimate; reaction is 1 day change in 10yr UST yield in bps.

We don’t believe the Fed has necessarily brought the market to heel but there seems to have been some accounting for the exuberant sell-off of USTs in Q1, bringing yields closer in line to where the mixed data should support them. In an inverse of the first few months of the year where labour data outperformed expectations and CPI was in line with targets, the labour market now appears muddled. Several months of misses on the non-farm payrolls and continuing jobless claims staying sticky at well above pre-pandemic levels suggests there is still work to go on improving employment conditions in the US. The expiry of Federal jobless benefits by the end of June in some states could help bring workers back to fill the apparent labour shortage firms are encountering—job openings in the US hit a record high for April at 9.3m—or just as equally could push an enormous amount of households into further financial distress.

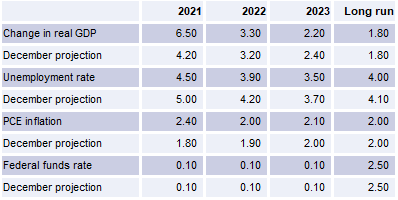

The drop in yields may then have run its course for now. That doesn’t mean that we see a sudden surge back to levels of 1.70% given we doubt the Fed will shift so abruptly in its messaging to a hawkish or substantially less accommodative tone. The FOMC this week will no doubt provide the next catalyst for a movement higher or lower in yields and we believe the risks to be asymmetrically skewed. Given that the Fed has so consistently spread its message about transitory inflation and not pulling back on asset purchases or rates too early, a cautious but optimistic statement from the Fed or even a moderate revision higher to its economic projections could cement yields around current levels or allow for a continued drift lower.

Source: Federal Reserve.

Source: Federal Reserve.

But were the Fed to highlight any internal debate about the pace or length of asset purchases (currently at USD 120bn/month) or revise its inflation or growth projections substantially higher then there is a risk of a sharp snap higher, potentially rising to the 1.60% level over a brief time frame.

We are holding our view for a moderate rise in 10yr yields throughout the rest of the year in line with a general recovery in the economy—buffered and buffeted by improving labour and high inflation. We would highlight upside risks to our views as the Fed starts to communicate how it will bring an end to asset purchases, potentially as early as this week’s FOMC but more likely in more in depth discussion at the Jackson Hole symposium toward the end of the summer.