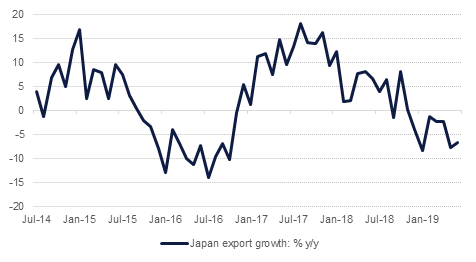

Trade data out of Japan weakened in June as exports fell by 6.7% from year-ago levels, a sharper fall than market expectations. Imports fell much more than expected—down 5.2% compared with expectations of a 0.4% drop. Japan is currently embroiled in a trade dispute with South Korea over the export of materials for chip and phone manufacturing while at the same time it is pursuing a comprehensive deal with the US. Japan’s trade surplus with the US expanded by 13.5% in June as imports from the country fell. We would not rule out the US administration trying to tackle multiple trade conflicts at the same time even as the headline dominating UIS-China trade war remains unresolved.

Inflation in the Eurozone accelerated marginally in June to 1.3% y/y, up from 1.2% in the previous month’s print. The June figure came in slightly higher than expected with core inflation also beating market expectations. Inflation has slowed considerably in 2019 after it exceeded ECB targets of close to 2% in H2 2018. More unconventional policy from the ECB is likely to hit markets as policymakers have said the bank would step in to support growth and inflation targets while the regional economy lingers. Meanwhile, UK inflation came in largely at expected at 2% for headline CPI and 1.8% for core goods.

US housing starts declined for a second month running in June, declining by 0.9% m/m. the dip in housing construction appears linked to shortages of both land and labour even as rates that influence mortgage costs have fallen in recent months. The Fed’s Beige Book of anecdotal business conditions said the economy was expanding modestly but pointed out residential construction in particular for being flat.

The IMF heaped more downward pressure on the USD in its latest External Sector Report, saying the greenback was overvalued by 6-12% in light of the short-term performance of the US economy. The IMF pointed to external surpluses in the Eurozone or Chinese economy as keeping their currencies fairly valued while the US runs a persistent current account deficit. The Fund’s chief economist warned against policies that specifically “distort trade”, effectively singling out the US for the current administration’s use of tariffs to influence trading relationships.

Source: Eikon, Emirates NBD Research

Source: Eikon, Emirates NBD Research

Treasuries closed higher amid a wider risk-off move. The curve shifted lower with yields on the 2y UST, 5y UST and 10y UST closing at 1.81%, 1.82% and 2.04% respectively.

Regional bonds continue to track moves in benchmark yields. The YTW on Bloomberg Barclays GCC credit and High yield index closed at 3.45% while credit spreads widened slightly to 151 bps.

The AUD is trading firmer this morning following stronger than expected economic data. A business survey conducted by NAB has shown that business confidence rose to 6 in Q2 2019 compared with 0 the previous quarter, beating market expectations for a decline to -1. In addition, the unemployment rate in June remained at 5.2% with 21,100 full time jobs being created, up from 3,100 the previous month. As we go to print, AUDUSD is trading at 0.7028, above the 100-day moving average (0.7018). The cross needs to realize a close above this level in order for these gains to be sustained.

Developed market equities closed lower amid weak corporate earnings. The S&P 500 index and the Euro Stoxx 50 index lost -0.7% and -0.6% respectively.

Trading in regional markets were dominated by earnings announcement by UAE’s major banks. Emirates NBD, Dubai Islamic Bank and First Abu Dhabi Bank all reported earnings that topped analysts estimates. Along with earnings, First Abu Dhabi Bank also said that it is proposing to remove the foreign ownership cap in the stock which is currently set at 40%. However, the move would require approvals and rule changes.

Oil prices extended their losses for a third day overnight, dropping by 1.46% in WTI to USD 56.78/b while Brent fell to USD 63.66/b, a drop of 1.1%. Inventory data from the US came in less supportive than expected with total crude stocks fall by 3.1m bbl but offset by significant builds in gasoline and middle of the barrel fuels. Total product and crude stocks actually rose by almost 12m bbl last week.