Ernst & Young (EY) have released an economic impact assessment indicating that Expo 2020 would generate AED 122.6bn in gross value added (GVA) for the UAE, or around 0.5% of estimated national GDP per year from 2013 to 2031. The three phases of the project are expected to support 49,700 full time jobs per year. The economic impact assessment published in 2013 for the bid had estimated AED 88bn would be added to Dubai’s economy from 2014-2021. The new EY report estimates a smaller GVA of AED 60.4bn over that period. This includes direct spending, the indirect impact through the supply chain and induced benefits (increased spending by employees).

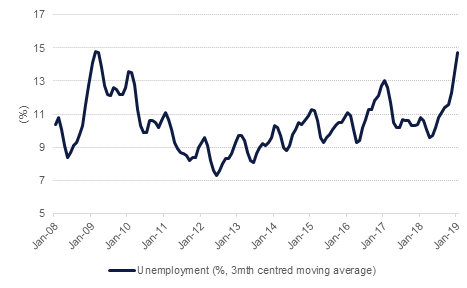

Turkish unemployment rose to 14.7% in the three months ending February, from 13.5% the previous period. Broadly in line with expectations of 14.6%, this was the weakest reading since Q1 2009, and is indicative of an economy under increasing pressure following a currency sell-off in 2018. Youth unemployment stood at 26.7%, and with the economy having entered its first recession in a decade in late 2018, job creation will likely be sluggish over the rest of the year.

Wholesale prices in India accelerated in March, rising by 3.18% y/y. The gains were roughly in line with market expectations and compared with 2.9% growth a month earlier. Consumer prices had also accelerated in March (up to 2.86%) but the pace of price growth remains at levels consistent with the RBI keeping rates on hold or adopting a more dovish stance.

The EU has approved a plan to begin trade talks with the US. The European Commission plan is to tackle talks on industrial goods tariffs and also ensuring goods meet EU and US standards. The EU-US trade standoff is threatening movement of cars, where Germany is particularly keen to prevent any imposition of tariffs. Agriculture, a target of the US, will not be up for discussion according to the EU’s plan. The chair of the US’ Senate Finance Committee, Chuck Grassley, said that any plan that didn’t include agriculture wasn’t likely to be approved by the US.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries drifted higher amid lack of catalysts. Yields on the 2y UST, 5y UST and 10y UST closed at 2.39% (flat), 2.37% (-1 bp) and 2.55% (-1 bp) respectively. The Chicago Fed President Charles Evans said that the Fed may need to cut rates if US inflation falls. He, however, also added that he does not see that scenario playing out and instead expects rates to remain on hold until the fall of 2020.

According to Treasury Department data, China’s holdings of Treasury securities rose for a third month by USD 4.2bn to USD 1.12bn in February 2019.

AUD is this mornings softest performing G-10 currency in the aftermath of the release of the RBA minutes. The minutes revealed that policy makers had discussed the potential of cutting interest rates further from their current record low of 1.50%. While the central bank began 2019 with a tightening bias, Governor Lowe shifted to a neutral stance in February.

Following the latest minutes, the market is now considering that the central bank will lower interest rates as soon as their August, with the OIS pricing in a 55.1% chance of a cut by then. As we go to print, AUDUSD is trading 0.37% lower at 0.71474. A break below the 100-day moving average (0.7138) will make the price vulnerable to further declines towards the 0.71 handle in the short term.

Developed market equities started the week on a cautious note amid mixed corporate earnings from market heavyweights and weakness in oil prices. The S&P 500 index and the Euro Stoxx 50 index closed flat.

Regional markets continued to remain largely positive with gains on the DFM index (+0.6%) and the Tadawul (+0.4%). Apart from some strength in banking sector stocks, Dubai Investments saw investor interest. The stock rallied +5.3% as investors built positions ahead of dividend announcement next week.

Oil futures closed lower overnight as an expectation that OPEC+ may look to actually increase production catches on in the market. Brent fell 0.5% to USD 71.18/b while WTI closed at USD 63.40/b, down 0.77%. Both benchmarks have continued to soften this morning.

The EIA expects output from US shale basins to reach 8.46m b/d in May, up 80k b/d m/m and 1.4 m b/d y/y, with Texas and the Permian basin providing the bulk of output. The annual pace of supply gains has slowed as the US drilling rig count has levelled off and productivity gains in the large basins appear to have plateaued. The pickup in prices since the start of the year, however, may see a turnaround in drilling activity over the coming months.