Although the 10-year US Treasury yield has fallen back below 3.0% this week, it is still close to its highest level since 2012 and more than double of where it was two years ago. On several other occasions in recent years, the yield had climbed to around 3.0% only to fall back again. However, this time around we think the yields may stay at these elevated levels for few months to come, for several reasons as discussed below.

Large New Supply of Treasuries

The annual US budget deficit is likely to exceed $1 trillion by fiscal 2020, from about $666 billion in 2017 as revenue gets reduced due to the recent tax overhaul and expenditure gets increased to fund the proposed infrastructure spending. In order to fund budget deficits, the US Government debt sales are set to swell.

The US Treasury had earlier released data showing it would need to borrow $955 billion in 2018, and more than $1 trillion in the two subsequent years. Those sums are considerably higher than last year's $516 billion in new debt issued.

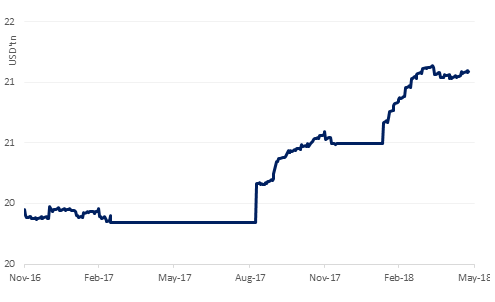

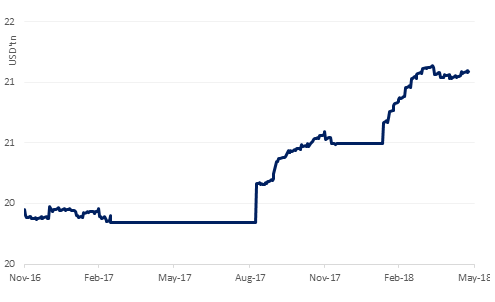

Rising US Public Debt

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Weakening Demand for Treasuries

In contrast, the demand for treasuries is unlikely to keep pace with the supply and in-fact may drop from the current level.

- The Federal Reserve is shrinking its bond holdings, rolling off about $250 billion of treasuries in 2018.

- Also buying by other central banks -- a pillar of support in the previous years – is likely to fade, in part as international-reserve growth stabilizes. This will put the onus on more price-sensitive buyers, such as including households, private-equity firms and trusts for wealthy individuals to fill the gap.

- Demand from regular buyers such as China is expected to ebb somewhat. The bulk of China’s build-up came as it boosted foreign-exchange reserves to help offset a strengthening yuan. But the dollar taking a strengthening path this year will limit China’s need for currency intervention.

- Demand from hedge funds is likely to fall as higher hedging costs in the face of rising USD will diminish their total return.

- A constructive pillar on the demand side maybe the possible increase in demand from pension funds which are trying to avoid penalties related to being underfunded and also possibly the banks that may need to hold more treasuries in order to meet their ‘high-quality liquid assets’ ratio requirements. However the incremental demand from these players is unlikely to be sufficient to counter balance the QE unwinding.

Click here to Download Full article