While markets yesterday eventually took heart from Trump’s mixed messages about trade, in one comment threatening more tariffs on China and in the next saying that he expects to ‘make a great deal with China’, other news unfolded that maintained the broader gloom about the global economy.

Eurozone Q3 GDP growth was weaker than expected at just 0.2% q/q, with stagnation in the Italian economy dragging the overall growth rate down from 0.3% q/q despite the expected recovery in French growth to 0.4% q/q from 0.2% q/q. The Eurozone’s annual growth rate fell back to 1.7% from 2.2% in Q2. The French recovery was supported by the end of strikes that held back expansion in the second quarter, but with Italy flat and the German auto sector under pressure, this was not enough to boost overall Eurozone growth.

ECB President Draghi highlighted last week that part of this slowing is actually a normalization in growth momentum amid high levels of capacity utilization with the room for further expansion limited. However, it is also clear that headwinds from geopolitical trade tensions are also mounting. The Eurozone ESI economic confidence index also fell to 109.8 in October, from 110.9 in September, showing waning confidence across all sectors.

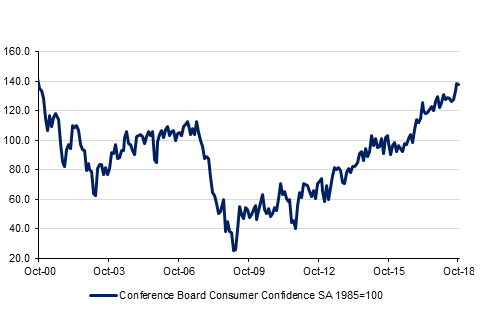

China’s PMI reading also fell to 50.2 from 50.8 in terms of manufacturing, with the composite index falling down to 53.1 from 54.1, perhaps increasing the pressure on the Chinese leadership to reach a trade deal with the US. In the UK too the CBI Distributive Trades Survey in October was also soft, suggesting that official retail sales data will also remain weak. In contrast to all of this U.S. October Consumer Confidence rose to 137.9, an 18-year high, from 135.3 in September. The expectations component rose to 114.6 in October from 112.5 in September, while current conditions rose to 172.8 in October, from 169.4. The contrasting economic performance globally is continuing to underpin the USD at the expense of most other major currencies.

Treasuries closed lower following a rebound in US equities. Yields on the 2y UST, 5y UST and 10y UST closed at 2.85%, 2.95% and 3.12% respectively.

Regional bonds continued to trade in a tight range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index closed at 4.62% while credit spreads tightened marginally to 170 bps.

During Wednesday’s Asian session, AUD has pared half of yesterday’s gains in the aftermath of a slowdown in Chinese PMIs (see macro). As we go to print, AUDUSD is trading 0.32% lower at 0.7086 with the currently daily downtrend firmly intact. We maintain our view that while the price remains below the 50-day moving average (0.7169), further losses are likely. A break and daily close below the 2018 low of 0.7021 could catalyse further losses towards 0.6850.

It was a volatile session of trading for developed market equities. The S&P 500 index added +1.6% while the Euro Stoxx 50 index lost -0.3%. The mid-session rally was helped by corporate earnings and bottom fishing by investors.

Regional equities traded mixed. The DFM index added +1.1% while the Tadawul dropped -0.2%. Tasnee dropped -3.2% after the company reported an operational delay for a titanium smelter plant. Elsewhere, Emaar added +2.1% and Emirates NBD jumped +2.2%.

Oil markets fell overnight as anxiety over a surplus developing next year becomes more widespread. Brent futures closed down nearly 1.9% and were below USD 76/b at the close of trading while WTI closed the day at USD 66.18/b, a decline of 1.3%. Private sector data from the API reported another build in US crude inventories, of 5.7m bbl, large than the market had been expecting. If confirmed later today by the EIA data it would be six consecutive weeks of builds, the longest stretch since early 2017 (and would mean that the US has actually added crude inventories this year rather than drawn).

The weak performance in spot prices is weighing on forward curves and has brought a very mild contango into the Brent curve. There is potential for a snap back next week once US sanctions on Iran’s oil trade come into place but for now a softening demand narrative is firmly shaping the trajectory for oil.

Click here to Download Full article