The Eurozone economy grew at a faster than expected 0.4% q/q (1.2% y/y) in Q1 2019 according to preliminary estimates. Italy is no longer in recession, registering modest growth of 0.1% q/q, while GDP in France grew 0.3% q/q. Unemployment in the Eurozone also declined to 7.7% in March from 7.8% in February, with German unemployment falling much more than had been forecast.

US data was better than expected with pending home sales rose by 3.8% m/m in March after declining in February. The market had been expected a much more modest 1.5% rise. On an annual basis however, pending home sales were down -3.2%. The Consumer Board Consumer Confidence index rose by more than expected to 129.2 in April, reversing most of the decline in March.

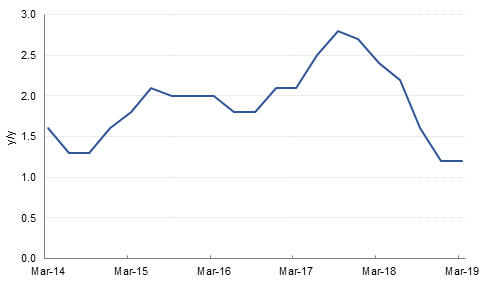

The focus today will be on the Fed as it concludes a 2-day monetary policy meeting. Rates are expected to remain on hold, despite continued pressure from the president for easier monetary policy. Despite stronger than expected Q1 GDP growth and signs that a trade deal between the US and China is close to being finalised, core inflation has softened in recent months and remains well below the 2% the Fed would like to see. We expect the Fed to maintain its “patient” stance.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries held onto gains even as equities continued to drift higher. Comments from the US President that the Fed should cut rates by 100 bps had little impact on the market. Yields on the 2y UST, 5y UST and 10y UST were at 2.26%, 2.27% and 2.50% at the time of this writing.

Regional bonds continue to drift higher. The YTW on the Bloomberg Barclays GCC Credit and High Yield index closed at 3.97% while credit spreads remained flat around 158 bps.

In terms of rating action, Moody’s affirmed KIPCO’s Baa3 ratings with stable outlook.

Currencies generally had a steady day ahead of FOMC meeting today which is expected to reflect no change in interest rates or Fed’s view on the economy. Dollar spot index closed 0.1% up amid little changed Euro at 1.1215. Pound was up a fraction at 1.3042 as there is less time pressure to find a Brexit deal while Kiwi slid 0.3% to 66.53 in response to soft jobs report which augurs for higher possibility of rate cuts by the RBNZ. Yen and Yuan were steady around 111.45 and 6.7391 respectively against the dollar.

Developed market equities closed marginally higher amidst mixed corporate earnings. Investors’ also appeared wary ahead of the US-China trade talks and the Federal Reserve meeting. The S&P 500 index added +0.1% while the Euro Stoxx 50 index gained +0.3%.

Regional markets were largely positive. Flows were dominated by UNB delisting and rebalancing of indices. The Tadawul (+0.3%) closed higher ahead of Phase 2 implementation of inclusion in the FTSE Russell EM index. The rally was sustained by gains in market heavyweights. Elsewhere, GISS added +2.7% after reporting better than expected corporate earnings.

Brent oil futures were down this morning on higher US oil stocks. US crude inventories rose by 6.8mn barrels in the week to 26 April, following a draw-down the week before, according to API data. EIA data on inventories is due later today, with the market expecting a 1.49mn barrel increased.

The inventories data overshadowed earlier comments by Saudi oil minister Khalid Al Falih that OPEC could extend the current cuts through the end of this year as it remains focused on reducing oil global inventories.

Click here to Download Full article