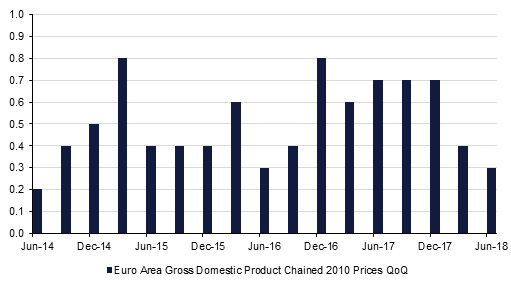

Eurozone GDP growth slowed to 0.3% q/q in Q2 from 0.4% q/q rate in Q1, with the annual rate falling back to 2.1% y/y from 2.5% y/y. This was weaker than expected but not a complete surprise after the lower than anticipated national data from France, Spain and Austria. Draghi had already acknowledged that some of the weakness from the first quarter spilled over into the second, but looking ahead confidence numbers continue to point to a slight slowing in growth momentum. Eurozone unemployment stood at 8.3% in June, unchanged from May, which was revised down from 8.4% reported previously.

The outcome of the two-day FOMC policy meeting will be in focus today, although the decision will probably be a relative non-event with no formal changes expected. The Fed has already hiked the Fed funds rate by 25bp twice this year, and has guided market expectations for two further 25bp hikes, one in probably in September and another in December. No press conference is scheduled today and only minor changes are likely compared to the Fed's June policy statement. The stage looks set, however, for the Reserve Bank of India to follow up its June rate hike with further tightening today, a 25bp rise in both the repo and reverse repo rates expected, to 6.50% and 6.25% respectively.

Turkish central bank governor, Murat Cetinkaya, issued the TCMB’s quarterly inflation report yesterday, raising the 2018 inflation forecast to 13.4%, from the 8.4% predicted in April. Inflation has spiked on the back of a sharp depreciation in the lira. Crucially, any investors looking for indications that monetary policy will tighten in order to help stem the currency’s fall were disappointed as the report now projects price growth of 6.7% at end-2019, meaning that the bank expects inflation to remain above its 5.0% target level over the next three years. The surprise hold at the last MPC meeting was explained by Cetinkaya as a result of rebalancing in the growth drivers in Turkey, as external demand ‘maintains its strength’ while ‘signs of deceleration in domestic demand became more visible.’

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

U.S. Treasuries have continued to decline in the build-up to the FOMC meeting. With trade tensions between the US and China easing, U.S. 10 year yields are rising with the 3% psychological level within reach. As we go to print 2 year yields sit at 2.67%, while 5 year yields and 10 year yields sit at 2.85% and 2.97% respectively.

USDJPY has continued to firm in the aftermath of the Bank of Japan meeting yesterday, with profit-taking the main factor responsible for the JPY’s softness, even though more volatile bond yields could cause the JPY to strengthen ultimately. Elsewhere the USD is broadly steady awaiting the outcome of the FOMC meeting, at which two more rate hikes this year are likely to be endorsed. Threats of increased US tariffs on China harmed the AUD, which was also hurt by soft Australian economic data including the manufacturing PMI and home prices.

Developed global equity markets closed in the green yesterday after posting gains. In the U.S., the S&P500 posted a gain of 0.49%, while the Dow Jones rose 0.43% and Nasdaq rose 0.55%. European markets fared almost as well with the Euro Stoxx 50 rising by 0.38% and the Dax rose by 0.06%. Regional markets were mixed with the DFM and Tadawul closing 0.30% and 0.22% lower respectively, while the ADX gained 0.31%.

This morning, Asian equity markets are having mixed performances and the Nikkei is currently trading 0.69% higher while the while the Shanghai composite is 0.32% lower.

Brent futures closed down 1.0% at USD74.25/b overnight, while WTI declined 2.0% to USD68.76/b as US inventories surprised to the upside in data released yesterday. According to the American Petroleum Institute, US stockpiles of crude climbed 5.6mn b last week, compared to Bloomberg analyst survey expectations of a decline.

Click here to Download Full article