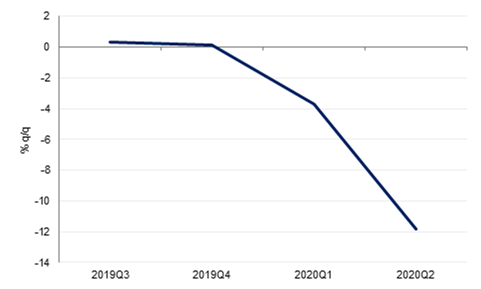

Eurostat said the Eurozone economy declined by -11.8% q/q and -14.7% y/y in Q2. This was less than initial estimates for last quarter but remained the sharpest ever drop, largely due to weaker consumer spending on Covid-19 restrictions. That compared with initial estimates of respectively -12.1% q/q and -15.0% y/y reported at the end of July. In the first three months of this year, the contraction was already -3.7% q/q and -3.2% y/y. Household spending was the biggest drag, shaving -6.6% from growth, followed by gross fixed capital formation at -3.8%. Net trade, government spending and inventory changes also had a negative impact. Eurostat also reported that employment fell by -2.9% in the second quarter, also the sharpest decline after dropping -0.3% in the first three months

Exports from Germany remained far below their pre-crisis levels in July despite increasing 4.7% m/m during the month. This is adding to signs that Germany's economic recovery from the coronavirus will be slow. Imports rose marginally by only 1.1% m/m, taking the seasonally adjusted trade surplus to EUR 18bn. The data showed that exports to the US were -17% y/y lower in July. Exports to China, however, were only -0.1% y/y lower. Overall exports in July were more than -12% lower than in February. The French statistics office Insee said on Tuesday that France’s economic activity had recovered to about 95% of pre-crisis levels in August, while exports grew 9.6% m/m. The statistics office forecast unemployment would rise from 7.1% in the second quarter to 9.5% by the end of the year. The French economy will grow 17% in Q3 to end the year 9% smaller than it started it according to Insee.

Inflation in China slowed in line with expectations to 2.4% y/y in August from 2.7% y/y in July. Core inflation remained low at 0.5% y/y, suggesting that household demand remains soft. Producer prices fell -2.0% y/y in August, slightly more than the market had expected. The slowing inflation provides more room for the PBOC to ease monetary policy further in the coming months, if it is deemed necessary.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Renewed Brexit worries hit the UK gilt market yesterday, as the amplified rhetoric raised fears regarding the prospects of no deal being reached with the EU, driving investors into safe assets. Yields on the two-year gilt fell to a record low of -0.132%, while the yield on the 10-year lost six basis points to 0.188%, the lowest levels in a month. In the US, the risk-off sentiment as equities tumbled saw the 10-year yield lose three basis points to 0.681%.

Within the region, Bloomberg has reported that Bahrain has begun marketing a three-tranche debt issuance, consisting of seven-year Islamic bonds alongside 12- and 30-year conventional debt offerings. We estimate that Bahrain’s budget deficit will widen to 10.4% of GDP this year.

GBP remained on the backfoot and has continued its negative form this morning dropping by -1.55% to trade at fresh monthly lows of 1.2960, its longest losing streak since May. The currency is hovering just above the 50-day moving average of 1.2951 and the sell-off looks to continue. Similarly the NZD also experienced heavy losses, falling by -1.05% to reach 0.6630, which is also close to the currencies' 50-day moving average of 0.6612. The AUD declined by -0.77% and trades at 0.7220.

The USD rallied by 0.84%, partly on the back of the pound's weakness, and stands at 93.490. An initial resistance area of 49.5 will be its first hurdle. The JPY was largely unchanged for the first half of the day but has since recorded a -0.35% loss to trade at 105.90. The EUR experienced a modest decline of -0.31% off the back of renewed coronavirus fears, with France hitting a new peak in infection rates, and trades at 1.1780.

The tech-sector slump continued to weigh on US equity indices in particular, with the NASDAQ losing -4.1%. This means the index is now in correction territory, having lost over -10% since its recent record peak just a week or so ago. The S&P 500 (-2.8%) and the Dow Jones (-2.3%) both closed down also.

The weak sentiment was seen across the world, and while the Shanghai Composite closed 0.7% higher yesterday (despite US talk of ‘decoupling’), this morning it is trading down -2.4%. The news that AstraZeneca has paused its coronavirus vaccine trials to investigate an illness in one of the participants is likely weighing on equity markets this morning as well.

The UK’s FTSE 100 fared relatively well, losing only -0.1%, though this was likely on the back of the pound’s depreciation and its effect on multinationals’ earnings rather than any underlying strength.

Oil markets continued to come under pressure as Brent futures closed down -5.0% yesterday to finish at USD 39.78/b. The benchmark has lost over -10% over the past week and is back to -40% ytd, trading below USD 40/b for the first time since June. WTI is also down -40% ytd, having itself lost 8.0% since Friday’s close (US markets were shut on Monday). The risk-off sentiment hitting the equity markets, the escalation of anti-China rhetoric by US President Donald Trump, and a creeping realisation that there remains significant pandemic-related economic weakness in a number of major oil-importing economies – not least India – are all likely weighing on the oil price. News that Abu Dhabi is following Saudi Arabia’s lead in cutting its October pricing could also weigh on prices over the coming days.