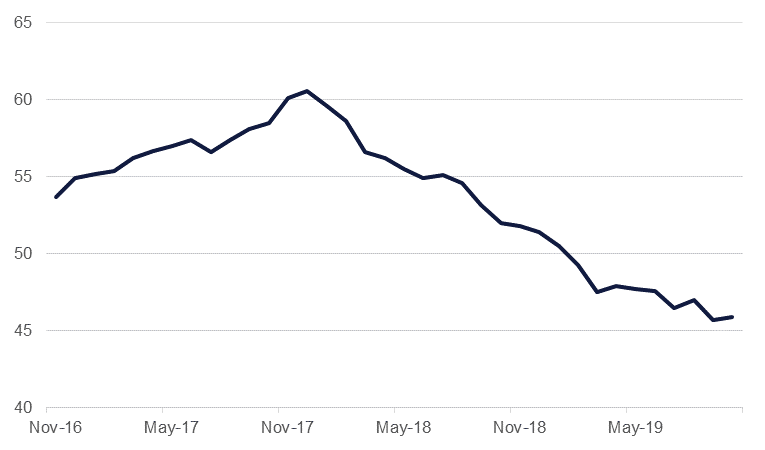

The Manufacturing PMI Index for the Eurozone continues to feel the negative impact of the US-China trade war on global trade and lack of clarity over Brexit. IHS Markit’s final manufacturing PMI stood at 45.9 in October, barely moving above the previous month’s 45.7, and remaining firmly in contraction territory below the 50 mark for the 9th month running. The index as a whole remains around seven year lows. Germany, Europe’s largest economy is seeing its manufacturing sector remain contraction mode, at 42.1 from 41.7 in September marking the 13th month of contraction for the sector as a whole, and factories in Germany are shedding jobs at the fastest pace in 10 years. Even stronger performers like France, Greece and the Netherlands barely saw their manufacturing sector brake away from the 50 PMI mark.

US Factory order data for September fell 0.6% after dipping by 0.1% in August according from data by the US Commerce Department. The sector which accounts for 11% of the US economy continues to stymied by the 16 month long trade ware between the US and China. Business spending has also dropped as evident by shipments of core goods which are used to calculate business equipment spending as part of the gross domestic product, that component declined 0.7% in September. US and Chinese trade negotiators are trying to finalize a “phase one” agreement before Dec 15, when new US tariffs on Chinese imports such as electronics, laptops and toys kick in.

Turkish CPI inflation dipped to 8.6% y/y in October, from 9.3% the previous month, in line with consensus expectations. Core inflation fell to 6.7%. The central bank has been given significant space to cut interest rates on the back of the strong disinflation seen this year, slashing the one-week repo by a cumulative 1,000bps over the past three meetings. However, despite strong government support for lower rates, the pace of this adjustment is likely to stall hereafter as base effects related to currency moves pass through, meaning the inflation slowdown will likely bottom out over the coming months.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower as risk appetite remained high on the back of continued positive progress on trade front. Yields on the 2y UST, 5y UST and 10y UST closed at 1.58% (+3 bps), 1.59% (+5 bps) and 1.77% (+6 bps) respectively.

Regional bonds drifted lower even as it continued to remain in a reasonably tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +1bp to 3.28% and credit spreads tightened 4 bps to 156 bps.

The Dollar was broadly steady on Monday, with slightly softer than expected U.S. factory orders having little impact. The dollar maintained a bid tone, with last week's stronger jobs report, and an FOMC that is on hold putting a floor under it. USDJPY rallied after the Financial Times said U.S. officials were considering scrapping some levies on USD112 billion of Chinese imports that were implemented on September. 1. The RBA left interest rates unchanged at 0.75% in line with expectations, but giving the AUD a boost even though the central bank indicated it was prepared to ease further if necessary.

Developed market equities closed higher on the back of encouraging developments on the trade front. The S&P 500 index and the Euro Stoxx 600 index rose +0.4% and +1.0% respectively.

Regional markets closed mixed in what was a subdued day of trading. There was little development in terms of single stocks.

Oil prices gained to start the week on optimism that a trade deal between the US and China could be reached. Prices are holding roughly steady this morning with Brent at USD 62.17/b and WTI at USD 56.52/b.

The Supreme Petroleum Council in Abu Dhabi has approved plans from Adnoc for a Murban crude oil futures contract. The contract had been mooted over the past several months and should allow importers and traders to price crude from the UAE, and wider Middle East, more accurately rather than relying on differentials to the North Sea Brent market. Liquidity will be key to the survival of the new contract and traders, importers and financial institutions will need to back the new contract. Adnoc crudes are currently priced on a retroactive basis; moving toward forward pricing will provide more clarity for importers. Abu Dhabi also raised its reserve estimate by 7bn bbl to 105bn bbl, pushing it above Kuwait in total reserves. At production of around 3m b/d the UAE’s reserve to production ratio now stands at around 95 years.