.jpg?h=457&w=800&la=en&hash=FB35BF5B37BED495431E29DA738124F4)

Economic data out of Japan in the last 24 hours was better than expected, contributing to a further appreciation in the yen. The flash manufacturing PMI rose to 54.4 in January up from 54.0 in December, while the All Activity Index released by the Ministry of Economy rose 1.0% m/m in November against a forecast of 0.8% and up from 0.3% in October.

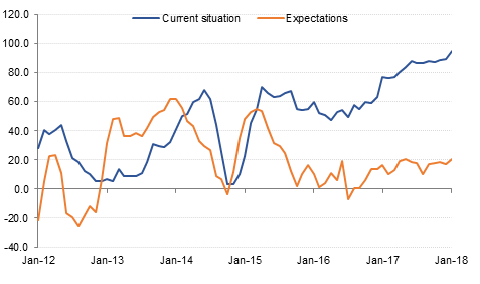

In Europe, the German ZEW survey was much better than expected with both the current situation index (95.2) and the expectations index (20.4) rising by more than forecast in January. Investors in Germany are seemingly unperturbed by the recent strengthening of the euro or the time that it is taking to form a new government. Formal coalition talks between the CDU and the Social Democrats have yet to begin. Eurozone consumer confidence also rose sharply in January, with the index reaching 1.3 from 0.5 in December and much higher than the 0.6 forecast.

In the GCC, Oman is reportedly considering raising a USD 2bn loan, although discussions are preliminary. Oman successfully raised USD 6.5bn in bonds earlier this month to help finance its budget deficit this year, which we estimate will be USD 9.2bn. Meanwhile, Saudi Arabia has approved a new water strategy that involves constructing nine new desalination plants at a cost of SAR 2bn (USD 533mn) over the next 18 months.

The key data releases today are the flash January PMIs for the Eurozone and the US, as well as unemployment and wage data in the UK (for November). In the US, we also get existing home sales data.

Source: Emirates NBD Research

Source: Emirates NBD Research

US Treasuries closed higher as strong demand in the 2y UST auction boosted sentiment across the curve. Short covering also provided additional boost. Yields on the 2y UST, 5y UST and 10y UST closed at 2.04% (- 2 bps), 2.41% (-3 bps) and 2.61% (- 4 bps) respectively.

Regional bonds closed flat amid drop in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index closed at 3.86% while credit spreads widened by 2 bps to 148 bps. There was no impact in the prices of DEWA and DIFC bonds following the decision of the S&P to change the outlook to negative. DEWA 20 gains USD 0.50 to close at USD 111.64 while DIFCAE 24s closed flat at USD 103.35.

In Saudi Arabia, Ministry of Finance closed its fifth domestic issuance raising SAR 5.85bn. The issuance was in three tranches maturing in 2023, 2025 and 2028.

Dollar weakness was again evident across the board overnight, with the greenback losing ground against all the other major currencies. Following an improved January PMI (see macro) but a narrower trade surplus in December, USDJPY has fallen 0.33% to trade at 109.95. USDJPY has set a new 2018 low of 109.88 earlier in the session and we expect the next level of support to come in at 109.25, the 23.6% one year Fibonacci retracement.

Sterling continues to be the 2018’s top performing currency as optimism on a “soft Brexit” deal continues. As we go to print, GBPUSD trades 0.31% higher at 1.4044, the first time the pair is trading above 1.40 since the Brexit vote in June 2016.

Developed market equities drifted higher as earnings season continued to see strong corporate results. The S&P 500 index and the Euro Stoxx 600 index added +0.2% each.

Regional equity markets were largely positive with the exception of the DFM index (-0.7%). The drop in the DFM index was mainly on account of Emaar Properties going ex-dividend. In terms of stocks, Saudi Kayan dropped -2.1% after the company reported earnings that missed estimates.

Oil prices kept moving higher overnight despite a report out from the API showing a build in crude and petrol stocks in the US. Brent futures closed up 1.35% at USD 69.96/b and WTI ended the day at USD 64.47/b. The API reported a build in crude stocks of 4.8m bbl last week and an increase in gasoline inventories of 4.1m bbl. Meanwhile refining margins in Asia continue to weaken which, as we warned in our latest Monthly Insights, could cause an erosion of marginal demand.