Global equities lost some of its recent momentum as discussion about stretched valuations gathered pace. We also saw strong economic data from the US which dampened bets of a faster easing cycle in the US. Overall, the MSCI World index added +0.5% 5d to close the month of August with gains of +6.2%. Emerging market equities continue to underperform developed market equities with the MSCI EM index losing -0.4% 5d. A large part of the weakness in emerging market equities comes from Chinese equities as the Shanghai Composite index lost -1.1% 5d to end the month of August with losses of -2.8%.

The focus of investors will shift completely to the economic data ahead of the Federal Reserve meeting later this month. The non-farm payrolls data will be keenly watched. It must be remembered that the weak non-farm payrolls data last month caused significant volatility in the first half of August.

In the first eight months of the year, the MSCI World index has rallied +15.5% on the back of +16.2% gains in the MSCI G7 index. The MSCI EM index has rallied +7.4% while the MSCI GCC index has lost -0.4% over the same period.

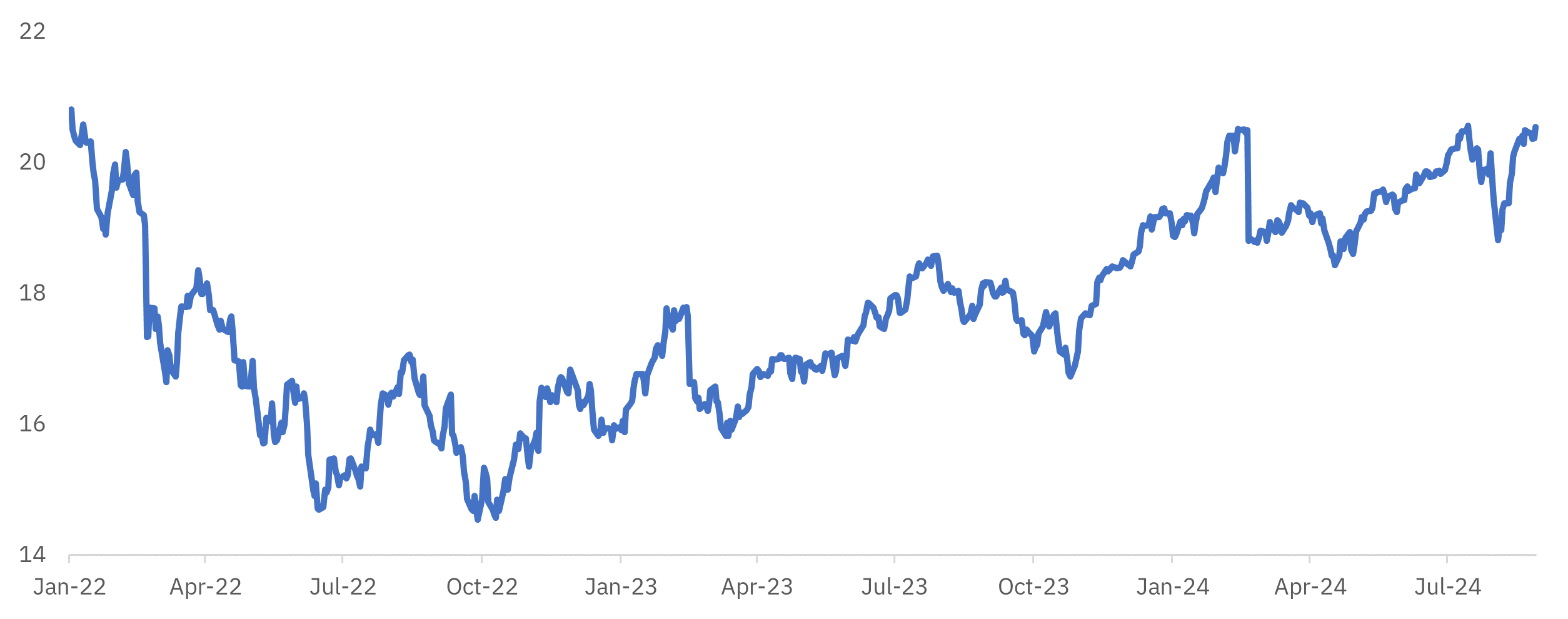

The MSCI World index is currently trading at 1y forward BEst PE of 19.3, close to the multiple last seen at the start of 2022. In terms of regional indices, the MSCI G7, the MSCI EM index and the MSCI GCC index are trading at 1y forward BEst PE of 19.7x, 12.2x, and 14.4x respectively.

Regional equities closed mixed with the Qatar Exchange and the DFM index adding +1.2% 5d and +0.8% 5d respectively, while the ADX index and the Tadawul lost -1.0% 5d and -0.6% 5d respectively.

TECOM had its best week since March 2024 with gains of +5.1% 5d. The stock currently trades at a 2024 BEst PE multiple of 13.4x with a 2024E dividend yield of 5.1%. Over the past month, the stock has outperformed the broader real estate sector stocks (+0.7% 1m) on the DFM with gains of +10.2% 1m.

Source: Bloomberg

Source: Bloomberg