As anticipated last week, some key equity markets did appear jaded even as macro factors remained supportive. The MSCI World index declined -0.2% mainly on the back of weakness in developed markets. The MSCI G7 index dropped -0.2% 5d.

Volatility was slightly lower with the exception of the V2X index (Europe) which jumped +18.1% 5d. The VIX index (US) and the JP Morgan EM Volatility index dropped -1.8% 5d and -1.0% 5d respectively.

While the factors supporting strength in equity markets remain in place, it does appear that investors are getting slightly concerned about rich valuations and that the next move higher would need some further affirmative data. This makes the upcoming economic data critical. Regionally, the markets are likely to be dictated by broad emerging market flows.

It was a mixed week of trading for MENA equities marked by decline in trading volumes and continued divergence with movement in oil prices. The S&P Pan Arab Composite index declined -0.1% 5d even as ICE Brent futures rallied +8.3% 5d.

The Qatar Exchange (+3.3% 5d) outperformed its peers by a wide margin. It was the seventh consecutive week of gains for Qatari stocks. Last week, gains were mainly on the back of announcement from FTSE that it has relaxed liquidity criteria for inclusion of stocks in the EM index. The index provider also increased the expected number of stocks to 21 from 17 earlier. The results are scheduled to be announced on 31 August 2016 with Phase 1 scheduled in the middle of September 2016 and Phase 2 scheduled for March 2017. The announcement prompted sharp rally in FTSE-related stocks with foreign investors buying stocks worth USD 125mn last week alone.

The Tadawul closed -1.6% 5d lower with the index closing below key technical level of 6,300. The decline in the index despite sharp gains in oil prices can be partly attributed to the adverse developments in the Yemen conflict. Industrial sector stocks were among the worst performers with losses of -5.0% wow.

Continuing with the momentum of capital market reforms, the CMA decided to adopt book building process for pricing the IPOs. Additionally, the regulator also decided to allow QFIs to participate in the IPOs. The decision will come into effect from start of 2017. The IPO rules are in line with previous moves to liberalize the stock market and prepare base for the massive part privatization plans announced earlier in the year.

UAE bourses closed mixed with the ADX index (-0.2% 5d) underperforming the DFM index (+1.4% 5d) for a second consecutive week. Drake & Scull declined -6.2% 5d after reporting weaker than expected Q2 2016 numbers. DP World closed the week with gains of +7.0% after the company reported a 53% y/y increase in H1 2016 net profit. The adjusted EBITDA margin for the company improved to 56.2% from 48.6%. The company kept the capital expenditure guidance for 2016 unchanged and said that it expected H2 2016 throughput performance to be improve and like-for-like financial performance to be similar to H1 2016.

Developed market equities closed lower amid skepticism over the recent rally and rich valuations. Renewed concerns over Italian banks led European equities lower while continued strength in the JPY dragged Japanese stocks lower. The Euro Stoxx 600 index and the Nikkei index declined -1.7% 5d and -2.2% 5d respectively. US equities, on the other hand, simply lacked a catalyst for a move higher with the S&P 500 index closing flat.

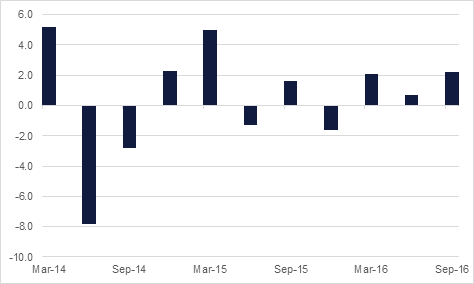

Emerging Markets