Last month, the UST yield curve shifted upwards as economic data remained strong and the US Federal Reserve appeared committed to follow through on its projection of three rate hikes this year. Yields on 2yr, 5yr and 10yr US treasuries closed the month at 2.16% (+27bps), 2.54% (+32bps) and 2.72% (+32bps). With such material movements in the benchmark yield curve, it is no surprise that bond portfolios generally had a month of negative returns.

Total return on Emirates NBD iBoxx Markit USD Sukuk index for the month was a loss of 0.27%. Excluding the benefit of coupon collection, the capital loss on the index would have been 0.60%.

Looking ahead, we expect return on sukuk investments this year to be constrained by the continuing increase in US rates, although some respite may come from tightening of credit spreads. Oil has now spent more than a quarter at the above $60/b mark and likely to hold ground during the year. There are little doubts about global growth being synchronised across the developed and emerging markets. Also rating agencies are reporting more positive outlook changes than negatives ones and expect default rates to remain low. In this environment, appetite for credit risk remains well anchored and may support some tightening of credit spreads.

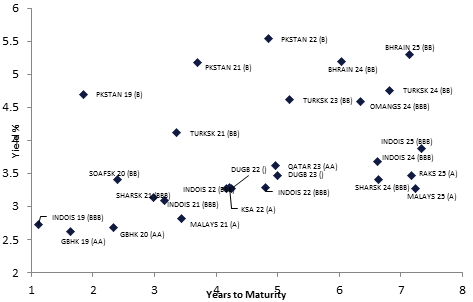

Looking at current yields we make following relative value observations:

Source: Markit, Emirates NBD Research

Source: Markit, Emirates NBD Research

Click here to Download Full article