Emerging market currency and bond markets may be running out of road now that the Federal Reserve has brought forward its projections for rate hikes to 2023. A combination of higher market yields, elevated commodity prices and economies still very much recovering from the Covid-19 pandemic will weigh on the outlook for currencies and bonds. While some central banks in emerging markets have begun to raise rates to try and head off inflation at the pass, underlying economic conditions could amplify volatility and risk investors pulling funds out of emerging markets on a larger scale.

The Fed kept policy rates at 0.25% at the upper bound and asset purchases at USD 120bn/month at its June FOMC meeting, unchanged on previous policy. In the Fed’s new economic projections, however, it raised its forecast for real GDP growth in 2021 to 7% from 6.5% previously and its expectation for PCE inflation up to 3.4% from 2.4% previously. Expectations for 2022 and beyond were relatively unchanged.

Most notably the FOMC also brought forward its expectation for rate hikes with a majority of members now expecting to see two rate increases in 2023. The dispersion for where rates will be is wide, ranging from a mid-range level of 0.625% up to 1.625% but the expectation that the Fed will now move faster on rates than expected—even if some market participants believe it is still behind the curve—will reinvigorate short positions on US Treasuries and drive benchmark yields upward.

While the dot plot only represents the views of FOMC members based on current economic conditions, an upward pull in yields and the dollar represent additional risks for the performance of emerging market currencies and bonds.

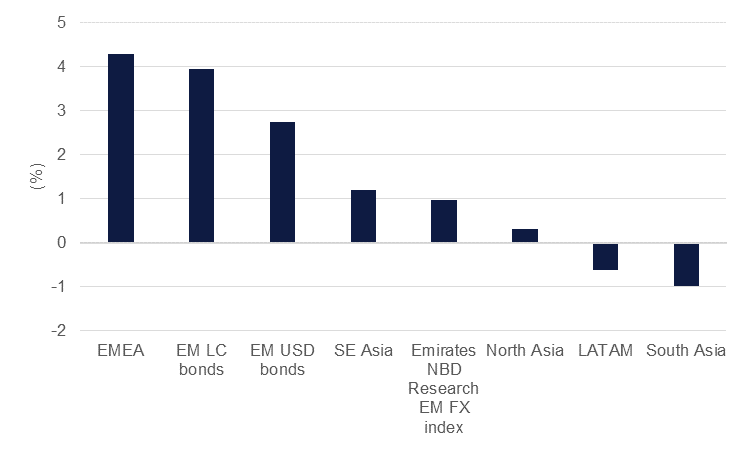

Emerging market assets had a decent performance over Q2, abetted by the drop in UST yields, a softer dollar and general optimism around the outlook the global economy to recover out of the Covid-19 pandemic. Local currency emerging market bonds have gained almost 4% since the start of Q2 while US-denominated EM bonds rallied 2.8%. Our measure of emerging market currencies showed around a 1% gain against the dollar in Q2 so far although performance was varied: the EMEA sub-index gained more than 4% in Q2 while Latin American and South Asian currencies underperformed.

Source: Bloomberg, Emirates NBD Research. Note: bond performance are Bloomberg Barclays bond indices.

Source: Bloomberg, Emirates NBD Research. Note: bond performance are Bloomberg Barclays bond indices.

However, emerging markets now face the prospect of market yields moving higher amid a still relatively modest roll-out of Covid-19 vaccines that would allow economic activity to return to pre-pandemic trends. On average, key emerging markets (representing around 98% of total nominal GDP of a broad emerging market universe) have managed to provide at least one dose of a Covid-19 vaccine to 34% of their population. Some markets have run extremely successful vaccine programmes such as Israel at 123% or Singapore and China at 76% and 66% respectively. However, large economies like Russia, India, Indonesia, South Africa and Egypt have all underperformed their emerging market peers so far.

That’s not to say that vaccine rollouts won’t accelerate in the coming months and allow more emerging markets to move closer to hitting a herd immunity threshold. But while some developed markets are increasingly talking about Covid-19 in the past tense, emerging economies are still grappling with a public health crisis that will act as a substantial drag on growth as restrictions on internal mobility can be announced quickly and international travel remains a shade of its pre-pandemic level.

Emerging markets will also be coming to grips with the enormous surge in commodity prices. Oil markets are displaying considerable tightness with Brent futures at their highest level since 2018 and threatening to push higher. Policy from OPEC+ appears to favour allowing the oil market to remain tight, keeping oil prices high in H2 2021 and into next year—our expectation is for Brent futures to record an average of around USD 70/b for the rest of this year and to remain near those levels in H1 2022.

But it’s not only energy prices that have risen. Food prices have had an enormously strong first half of the year with basic stables rising sharply. Corn futures have rallied more than 37% since the start of the year while soybeans have gained 10% and wheat prices are up nearly 4%.

.png) Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

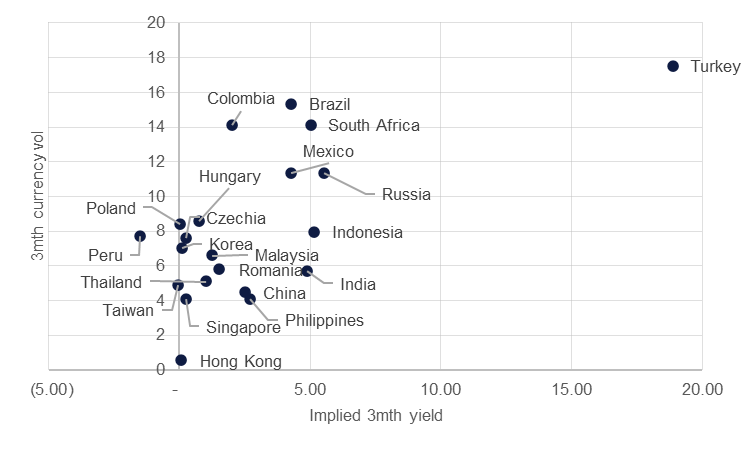

The rise in input costs has pushed several central banks in emerging markets to begin raising interest rates and signal that more hikes are on the way. Since the start of the year, emerging market central banks have raised rates by a net 450bps while the risk of monetary policy uncertainty in some key markets such as Turkey represent considerable downside risks for currency and bond performance.

Emerging market bonds have opened on a softer footing following the June FOMC with yields rising in South Africa, Indonesia, India and Malaysia. We still expect some divergence in performance with the carry-to-vol of emerging market currencies seemingly favouring several EMEA and North Asian markets.

Source: Bloomberg, Emirates NBD Research