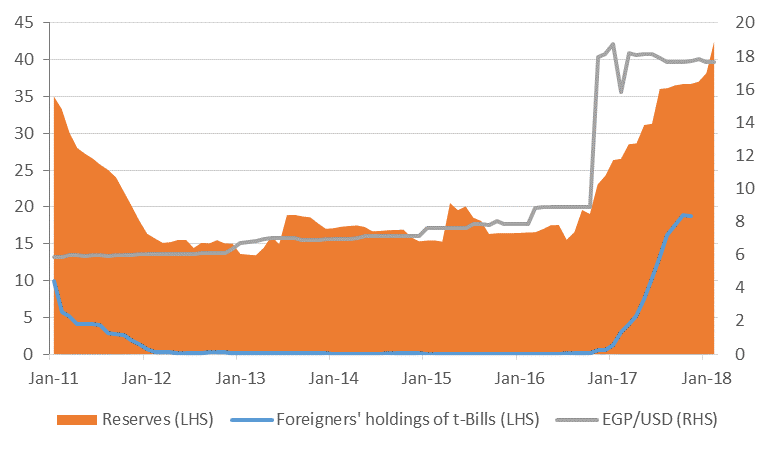

Egyptian international reserves ticked up once again in February, to a new record of USD 42.5bn, from USD 38.2bn the previous month. The issuance of a USD 4bn eurobond last month contributed to the uptick, but Central Bank of Egypt (CBE) sub-governor, Rami Aboul Naga, told Bloomberg that there were other contributing factors to the USD 4.3bn jump. A planned EUR 1.5bn issuance in the coming weeks will further support the country’s net international reserves position.

The strong reserves position will allay fears over the Egyptian pound’s stability as the CBE embarks on a rate-cutting cycle – we expect a further 300bps of cuts to the benchmark interest rates over the remainder of the year, following the initial 100bps cut seen in February. A huge inflow of foreign investment into Egyptian treasury bills has been a contributing factor to the marked recovery in reserves, and concerns have been raised over the negative effect of potential capital flight as rates are cut. However, given the rate cutting will be fairly cautious, meaning that Egypt will remain an attractive investment as compared to other countries, and that reserves are scaling new highs, we do not see any overt threat to the pound. Further, not all of the ‘hot money’ that has flowed into Egypt is represented in that reserves figure. With a further USD 11.9bn of other foreign currency assets at the CBE’s disposal, the bank has significant firepower with which to protect the pound.

Although portfolio inflows have recovered robustly since Egypt embarked on its IMF programme in November 2016, foreign direct investment has been the laggard to date. We expect this to improve over the coming months owing to increased stability and a series of reforms enacted, including new legislation on investment and bankruptcy. There are a number of major developments ongoing in Egypt which we expect to attract foreign capital, including the development of an industrial zone around the DP World-operated port of Ain Sokhna.

Further, it was reported today that Egyptian President Abdel-Fattah El-Sisi and Saudi Arabian Crown Prince Mohammed bin Salman have signed a series of agreements during the crown prince’s three-day visit to Egypt which began on Sunday. One of these agreements concerned setting up a Saudi Egyptian Investment Fund, between the Saudi PIF and the Egyptian Ministry of Investment and International Cooperation. If followed through on, this would help facilitate investment on the Egyptian side of the mega Neom City development in Saudi Arabia. Egypt has reportedly committed more than 1,000 square kilometres to the project.